FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

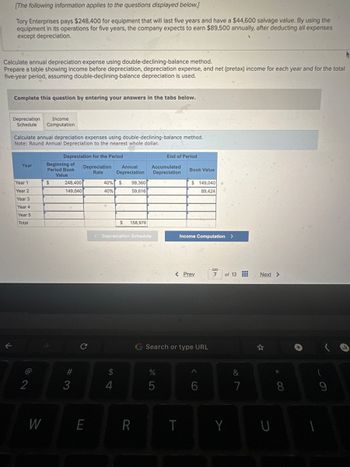

Transcribed Image Text:**Tory Enterprises Depreciation Analysis**

Tory Enterprises acquired equipment for $248,400, which is expected to last five years with a salvage value of $44,600. The company anticipates earning $89,500 annually over this period, excluding depreciation. The task is to calculate annual depreciation using the double-declining-balance method and outline income before depreciation, depreciation expense, and pretax income over five years.

**Depreciation Schedule**

This section includes a table showing the calculation of depreciation using the double-declining-balance method. The table outlines:

- **Year:** The time period (Year 1 to Year 5).

- **Beginning of Period Book Value:** Starting asset value before depreciation.

- **Depreciation Rate:** Constant rate used (40%).

- **Annual Depreciation:** Depreciation expense for the year.

- **Accumulated Depreciation:** Total depreciation to date.

- **Book Value:** Remaining value of the asset at the end of each year.

**Table Entries:**

1. **Year 1:**

- Beginning Book Value: $248,400

- Depreciation Rate: 40%

- Annual Depreciation: $99,360

- Accumulated Depreciation: $99,360

- Book Value: $149,040

2. **Year 2:**

- Beginning Book Value: $149,040

- Depreciation Rate: 40%

- Annual Depreciation: $59,616

- Accumulated Depreciation: $158,976

- Book Value: $89,424

*Years 3 to 5 are yet to be completed.*

**Conclusion:**

The total of $158,976 accumulated depreciation after Year 2 illustrates the amount deducted from the asset's original cost over two years. Continued calculations would apply the same principles for the remaining years. This method helps in understanding asset value reduction over its useful life, impacting financial statements and tax obligations.

Expert Solution

arrow_forward

Step 1: Meaning of depreciation :

Depreciation meaning:- Because of the usage, deterioration, or obsolescence, an asset's monetary value falls with time. Depreciation is basically used to measure this decline. Depreciation is the gradual lowering of a fixed asset's recorded cost over the time, until the asset's value is insignificant, according to accounting terminology.

Accounting method wherein the cost of a tangible asset is spread over the asset's useful life. Depreciation usually denotes how much of the asset's value has been used up and is usually considered an operating expense. Depreciation occurs through normal wear and tear, obsolescence, accidents, etc.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- i need the answer quicklyarrow_forwardAlfredo Company purchased a new 3-D printer for $90,000. This printer is expected to last for ten years, at which time, Alfredo believes it will be able to sell the printer for $15,000. Calculate yearly depreciation using the double-declining-balance method. PLEASE NOTE: All whole dollar amounts will be with "$" and commas as needed (i.e. $12,345). Year 1 Depreciation: ____________________ Year 2 Depreciation: ____________________ Year 3 Depreciation: ____________________ Year 4 Depreciation: ____________________ Year 5 Depreciation: ____________________ Year 6 Depreciation: ____________________ Year 7 Depreciation: ____________________ Year 8 Depreciation: ____________________ Year 9 Depreciation: ____________________ Year 10 Depreciation: ___________________arrow_forwardAlfredo Company purchased a new 3-D printer for $90,000. This printer is expected to last for ten years, at which time, Alfredo believes it will be able to sell the printer for $15,000. Calculate yearly depreciation using the double-declining-balance method. PLEASE NOTE: All whole dollar amounts will be with "$" and commas as needed (i.e. $12,345). Year 1 Depreciation: _________________ Year 2 Depreciation: _________________ Year 3 Depreciation: _________________ Year 4 Depreciation: _________________ Year 5 Depreciation: _________________ Year 6 Depreciation: _________________ Year 7 Depreciation: _________________ Year 8 Depreciation: _________________ Year 9 Depreciation: _________________ Year 10 Depreciation: _________________arrow_forward

- Required information [The following information applies to the questions displayed below] NewTech purchases computer equipment for $261,000 to use in operating activities for the next four years. It estimates the equipment's salvage value at $30,000. Prepare a table showing depreciation and book value for each of the four years assuming double-declining-balance depreciation. (Enter all amounts as positive values.) Year Year 1 Year 2 Year 3 Year 4 Total Depreciation for the Period Beginning-Year Depreciation Book Value Rate Annual Depreciation End of Period Accumulated Depreciation Year-End Book Value MUABAKANarrow_forwardWhite Mountain Supply Company purchases warehouse shelving for $18,400. Shipping charges were $370, and assembly and setup amounted to $375. The shelves are expected to last for 8 years and have a scrap value of $700: Use the straight-line method of depreciation to answer the questions. (Round your answers to the nearest cent.) (a) What is the annual depreciation expense (in $) of the shelving)arrow_forwardNewTech purchases computer equipment for $267,000 to use in operating activities for the next four years. It estimates the equipment’s salvage value at $25,000. Prepare a table showing depreciation and book value for each of the four years assuming double-declining-balance depreciation.arrow_forward

- Kenartha Oil recently paid $477,900 for equipment that will last five years and have a residual value of $110,000. By using the machine in its operations for five years, the company expects to earn $176,000 annually, after deducting all expenses except depreciation. Complete the schedule below assuming each of (a) straight-line depreciation and (b) double-declining-balance depreciation. (Do not round intermediate calculations. Enter loss amounts with a minus sign.) (a) Straight-Line Depreciation: Profit before depreciation Depreciation expenses Profit (loss) (b) Double-Declining-Balance Depreciation: Profit before depreciation Depreciation expenses Profit (loss) Year 1 Year 1 Year 2 Year 2 Year 3 Year 3 Year 4 Year 4 Year 5 Year 5 5-Year Totals 5-Year Totalsarrow_forwardQuantum Electronic Services paid P = $40,000 for its networked computer system. Both tax and book depreciation accounts are maintained. The annual tax depreciation rate is based on the previous year’s book value (BV), while the book depreciation rate is based on the original first cost (P). Use the rates listed to plot annual depreciation and book values for each method. Develop the graphs using hand calculations or a spreadsheet, as directed by your instructor.arrow_forwardYou are evaluating two different devices. Equipment A costs $215,000 and is used for a period of three years, with a pre-tax operating cost of $32,000 per year. Equipment B costs $355,000 and is used for six years, with a pre-tax operating cost of $42,000 per year. Both units were depreciated to book value of 0 over the life of the unit using the linear old method of depreciation, assuming a residual value of $20,000. If your tax rate is 35%, the discount rate is 9%. Calculate the average cost of the two machines for the year. Which machine do you prefer?Why?arrow_forward

- Tory Enterprises pays $254,400 for equipment that will last five years and have a $45,200 salvage value. By using the equipment in its operations for five years, the company expects to earn $90,100 annually, after deducting all expenses except depreciation. Prepare a table showing income before depreciation, depreciation expense, and net (pretax) income for each year and for the total five-year period, assuming straight-line depreciation is used.arrow_forwardNOS Corp. purchased equipment for $180,000. They sold the equipment at the end of three years for $147,000. If the expected useful life of the equipment was ten years with a residual value of $30,000, and they use straight-line depreciation, which of the following is true regarding the journal entry to record the sale of the equipment? Select one: a. Credit Gain on Sale for $23,000 b. Credit Gain on Sale for $6,000 c. Credit Gain on Sale for $9,000 d. Credit Gain on Sale for $3,000 e. Credit Gain on Sale for $12,000arrow_forwardColquhoun International purchases a warehouse for $300,000. The best estimate of the salvage value at the time of purchase was $15,000, and it is expected to be used for twenty-five years. Colquhoun uses the straight-line depreciation method for all warehouse buildings. After four years of recording depreciation, Colquhoun determines that the warehouse will be useful for only another fifteen years. Calculate: At time of purchase, annual depreciation was ___ Calculate annual depreciation expense for the first four years. Determine the depreciation expense for the final fifteen years of the asset’s life: Original cost Depreciation previously taken Book value at beginning of year five Salvage value Revised remaining depreciable cost Revised remaining useful life 15 years Revised annual depreciation Create the depreciation expense journal entry for year five: DR CRarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education