FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

![[The following information applies to the questions displayed below.]

The following data were selected from the records of Sykes Company for the year ended December 31, Current Year.

Balances January 1, Current Year

Accounts receivable (various.

customers)

Allowance for doubtful accounts

$120,000

7,000

In the following order, except for cash sales, the company sold merchandise and made collections on credit terms 3/10,

n/30 (assume a unit sales price of $800 in all transactions).

Transactions during current year

a. Sold merchandise for cash, $272,000.

b. Sold merchandise to R. Smith; invoice price, $11,500.

c. Sold merchandise to K. Miller; invoice price, $48,000.

d. Two days after purchase date, R. Smith returned one of the units purchased in (b) and received account credit.

e. Sold merchandise to B. Sears; invoice price, $30,000.

f. R. Smith paid his account in full within the discount period.

g. Collected $91,000 cash from customer sales on credit in prior year, all within the discount periods.

h. K. Miller paid the invoice in (c) within the discount period.

i. Sold merchandise to R. Roy; invoice price, $23,500.

j. Three days after paying the account in full, K. Miller returned seven defective units and received a cash refund.

k. After the discount period, collected $6,000 cash on an account receivable on sales in a prior year.

1. Wrote off a prior year account of $4,000 after deciding that the amount would never be collected.

m. The estimated bad debt rate used by the company was 3.5 percent of credit sales net of returns.

Required:

1. Prepare the journal entries for these transactions, including the write-off of the uncollectible account and the adjusting entry for

estimated bad debts. Do not record cost of goods sold.

Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your final

answers to nearest whole dollar amount.](https://content.bartleby.com/qna-images/question/7093ecba-b133-4717-8763-cf52fea08762/287ab38f-1dc6-4337-ba3b-f809f6f9d75f/00hiusy_thumbnail.png)

Transcribed Image Text:[The following information applies to the questions displayed below.]

The following data were selected from the records of Sykes Company for the year ended December 31, Current Year.

Balances January 1, Current Year

Accounts receivable (various.

customers)

Allowance for doubtful accounts

$120,000

7,000

In the following order, except for cash sales, the company sold merchandise and made collections on credit terms 3/10,

n/30 (assume a unit sales price of $800 in all transactions).

Transactions during current year

a. Sold merchandise for cash, $272,000.

b. Sold merchandise to R. Smith; invoice price, $11,500.

c. Sold merchandise to K. Miller; invoice price, $48,000.

d. Two days after purchase date, R. Smith returned one of the units purchased in (b) and received account credit.

e. Sold merchandise to B. Sears; invoice price, $30,000.

f. R. Smith paid his account in full within the discount period.

g. Collected $91,000 cash from customer sales on credit in prior year, all within the discount periods.

h. K. Miller paid the invoice in (c) within the discount period.

i. Sold merchandise to R. Roy; invoice price, $23,500.

j. Three days after paying the account in full, K. Miller returned seven defective units and received a cash refund.

k. After the discount period, collected $6,000 cash on an account receivable on sales in a prior year.

1. Wrote off a prior year account of $4,000 after deciding that the amount would never be collected.

m. The estimated bad debt rate used by the company was 3.5 percent of credit sales net of returns.

Required:

1. Prepare the journal entries for these transactions, including the write-off of the uncollectible account and the adjusting entry for

estimated bad debts. Do not record cost of goods sold.

Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your final

answers to nearest whole dollar amount.

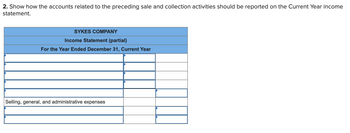

Transcribed Image Text:2. Show how the accounts related to the preceding sale and collection activities should be reported on the Current Year income

statement.

SYKES COMPANY

Income Statement (partial)

For the Year Ended December 31, Current Year

Selling, general, and administrative expenses

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following information is available for Market, Incorporated and Supply, Incorporated at December 31. Accounts Accounts receivable Allowance for doubtful accounts Sales revenue Required Market, Incorporated Supply, Incorporated $56,800 $80,200 3,048 666,960 2,456 887,100 a. What is the accounts receivable turnover for each of the companies? b. What is the average days to collect the receivables? c. Assuming both companies use the percent of receivables allowance method, what is the estimated percentage of uncollectible accounts for each company? Complete this question by entering your answers in the tabs below. Required A Required B Required C What is the average days to collect the receivables? (Use 365 days in a year. Do not round intermediate calculations. Round your answers to the nearest whole number.) Company Market Supply Average Collection Period days daysarrow_forwardAlpesharrow_forwardPlease help mearrow_forward

- Below are amounts (in millions) from three companies' annual reports. Beginning Ending Accounts Accounts Receivable Receivable Net Sales $1,715 5,666 529 WalCo TarMart CostGet Required: 1. Calculate the receivables turnover ratio and the average collection period for WalCo, TarMart and CostGet $2,662 $312,427 6,194 57,878 565 58,963arrow_forwardUsing the following data for the current year, determine the accounts receivable turnover. Net sales on account during the year $ 457,065 Cost of merchandise sold during the year 461,280 Accounts receivable, beginning of year 75,290 Accounts receivable, end of year 26,280 Inventory, beginning of year 185,000 Inventory, end of year 169,570 a.7 b.8 c.10 d.9arrow_forwardAnswer provide Pleasearrow_forward

- Judon Corp. provides the following information from its annual report. Assume all revenues are credit sales. The cost of revenues can be used as an approximation of the company's purchases for the year. Revenues $ 546,190 Cost of revenues $ 340,275 Inventories as of 31 January 2022 $44,064 Inventories as of 31 January 2021 $41,020 Accounts payable as at 31 January 2022 $58,600 Accounts payable as at 31 January 2021 $51,800 Accounts receivable as at 31 January 2022 $7,482 Accounts receivable as at 31 January 2021 $5,434 Compute the following financial ratios for Judon Corp for 2022 1. Account Receivable Turnover Ratio (Times)? 2. Collection Interval (DSO) / Days? 3. Inventory Turnover Ratio (Times) ? 4. Holding Interval (Days) ? 5. Account Payable Turnover Ratio (Times)? 6.Payment Interval (Days)? 7. Does Judon Corp need short-term financing?arrow_forwardanswer in text form please (without image)arrow_forward8arrow_forward

- Elon Co.'s September balance sheet contains the following information: $ 73,500 (dr 252,000 (dr 4,800 (cr 33,250 (dr) Cash Accounts receivable. Allowance for doubtful accounts Merchandise inventory hs Management has designated $71,000 as the firm's minimum monthly cash balance. Other information about the firm and its operations is as follows: a. Sales revenues of $710,000, $840,000, and $622,500 are expected for October, November, and December, respectively. All goods are sold on account. b. The collection pattern for accounts receivable is 60% in the month of sale, 39% in the month following the month of sale, and 1% uncollectible, which is set up as an allowance. c. Cost of goods sold is 60% of sales revenues. d. Management's target ending balance of merchandise inventory is 10% of the current month's budgeted cost of goods sold. e. All accounts payable for inventory are paid in the month of purchase. f. Other monthly expenses are $94,250, which includes $6,500 of depreciation and…arrow_forwardThe financial statements of the Sunland Company report net sales of $384000 and accounts receivable of $50400 and $33600 at the beginning of the year and the end of the year, respectively. What is the average collection period for accounts receivable in days?arrow_forwardBlossom Company has a balance in its Accounts Receivable control account of $11,300 on January 1, 2022. The subsidiary ledger contains three accounts: Bixler Company, balance $4,200: Cuddyer Company, balance $2,200, and Freeze Company. During January the following receivable-related transactions occurred. Bixler Company Cuddyer Company Freeze Company (a) Credit Sales Collections $9,000 $7,900 2.600 8.800 7.100 8.500 Returns $0 3.000 Balance in the Freeze Company subsidiary account S 0 What is the January 1 balance in the Freeze Company subsidiary account?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education