FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

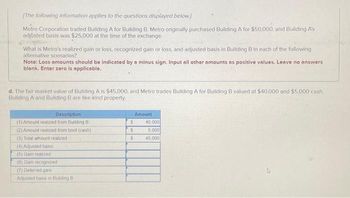

Transcribed Image Text:[The following information applies to the questions displayed below.)

Metro Corporation traded Building A for Building B. Metro originally purchased Building A for $50,000, and Building A's

adjusted basis was $25,000 at the time of the exchange.

What is Metro's realized gain or loss, recognized gain or loss, and adjusted basis in Building B in each of the following

alternative scenarios?

Note: Loss amounts should be indicated by a minus sign. Input all other amounts as positive values. Leave no answers

blank. Enter zero is applicable.

d. The fair market value of Building A is $45,000, and Metro trades Building A for Building B valued at $40,000 and $5,000 cash.

Building A and Building B are like kind property.

Description

(1) Amount realized from Building B

(2) Amount realized from boot (cash).

(3) Total amount realized

(4) Adjusted basis

(5) Gain realized

(6) Gain recognized

(7) Deferred gain

Adjusted basis in Building Br

Amount

S

$

$

40,000

5,000

45.000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- China Inn and Midwest Chicken exchanged assets. Midwest Chicken received restaurant equipment and gave delivery equipment. The fair value and book value of the delivery equipment given were $28,600 and $31,400 (original cost of $35,400 less accumulated depreciation of $4,000), respectively. To equalize market values of the exchanged assets, Midwest Chicken received $8,600 in cash from China Inn. Record the gain or loss for Midwest Chicken on the exchange of the equipment. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet 1 Record the gain or loss for Midwest Chicken on the exchange of the equipment. Note: Enter debits before credits. Transaction 1 General Journal Debit Creditarrow_forwardConsider each of the following independent situations: a. GYT Co. exchanges a machine that cost $4,000 and has accumulated amortization of $2,560 for a similar machine. GYT also receives $25 in the exchange. The fair market value of the old asset is $750. The fair market value of the new asset is $725. There is no commercial substance to the transaction. b. FST Co. exchanges a machine that cost $4,000 and has accumulated amortization of $3,560 for a similar machine. FST also receives $25 in the exchange. The fair market value of the old asset is $750. The fair market value of the new asset is $725. There is no commercial substance to the transaction. c. LKC Co. pays $250 and exchanges a machine that cost $3,000 and has accumulated amortization of $1,900 for a similar machine. The fair market value of the old asset is undeterminable. The fair market value of the new asset is $690. The transaction has commercial substance. d. HRT Co. pays $250 and exchanges a…arrow_forwardOCD exchanged old realty for new like-kind realty. OCD’s adjusted basis in the old realty was $31,700 ($60,000 initial cost − $28,300 accumulated depreciation), and its FMV was $48,000. Because the new realty was worth only $45,000, OCD received $3,000 cash in addition to the new realty. Required: a-1. Compute OCD's realized gain. a-2. Determine the amount and character of any recognized gain. b. Compute OCD’s basis in its new realty.arrow_forward

- China Inn and Midwest Chicken exchanged assets. Midwest Chicken received restaurant equipment and gave delivery equipment. The fair value and book value of the delivery equipment given were $25,000 and $28,000 (original cost of $33,000 less accumulated depreciation of $5,000), respectively. To equalize market values of the exchanged assets, Midwest Chicken received $8,000 in cash from China Inn. Record the gain or loss for Midwest Chicken on the exchange of the equipment. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.)arrow_forwardChina Inn and Midwest Chicken exchanged assets. China Inn received delivery equipment and gave restaurant equipment. The fair value and book value of the restaurant equipment were $21,500 and $11,800 (original cost of $44,000 less accumulated depreciation of $32,200), respectively. To equalize market values of the exchanged assets, China Inn paid $8,900 in cash to Midwest Chicken. Record the gain or loss for China Inn on the exchange of the equipment. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.)arrow_forward[The following information applies to the questions displayed below.] DLW Corporation acquired and placed in service the following assets during the year: Asset Computer equipment Furniture Commercial building Assuming DLW does not elect §179 expensing and elects not to use bonus depreciation, answer the following questions: (Use MACRS Table 1, Table 2, Table 3, Table 4 and Table 5.) (Do not round intermediate calculations. Round your final answers to the nearest whole dollar amount.) a. What is DLW's year 1 cost recovery for each asset? Asset Date Acquired 2/26 2/26 12/20 Computer equipment Furniture Commercial building Total Year 1 Cost Recovery $ Cost Basis $ 19,500 $ 18,000 $ 341,000 3,900 2,572 9,050 15,522arrow_forward

- Required information [The following information applies to the questions displayed below.] Case A. Kapono Farms exchanged an old tractor for a newer model. The old tractor had a book value of $15,000 (original cost of $34,000 less accumulated depreciation of $19,000) and a fair value of $9,600. Kapono paid $26,000 cash to complete the exchange. The exchange has commercial substance. Case B. Kapono Farms exchanged 100 acres of farmland for similar land. The farmland given had a book value of $530,000 and a fair value of $760,000. Kapono paid $56,000 cash to complete the exchange. The exchange has commercial substance. 1. What is the amount of gain or loss that Kapono would recognize on the exchange of the land? 2. Assume the fair value of the farmland given is $424,000 instead of $760,000. What is the amount of gain or loss that Kapono would recognize on the exchange? What is the initial value of the new land? 3. Assume the same facts as Requirement 1 and that the exchange lacked…arrow_forwardGive me correct answer with explanation.arrow_forwardMetro Corporation traded Building A for Building B. Metro originally purchased Building A for $50,000, and Building A's adjusted basis was $25,000 at the time of the exchange. What is Metro's realized gain or loss, recognized gain or loss, and adjusted basis in Building B in each of the following alternative scenarios? (Loss amounts should be indicated by a minus sign. Input all other amounts as positive values. Leave no answer blank. Enter zero is applicable.) c. The fair market value of Building A is $35,000, and Building B is valued at $40,000. Metro exchanges Building A and $5,000 cash for Building B. Building A and Building B are like-kind property. Description Amount (1) Amount realized from Building B (2) Amount realized from boot (cash) (3) Total amount realized $ (4) Adjusted basis (7) Deferred gain Adjusted basis in Building Barrow_forward

- Foxtrot Co. exchanged equipment and $17,100 cash for similar equipment. The book value and the fair value of the old equipment were $81,000 and $91,700, respectively. Assuming that the exchange lacks commercial substance, Foxtrot would record a gain/(loss) on exchange of assets in the amount of: Multiple Choice $(10,700). $0. $10,700. $27,800.arrow_forwardCase B. Kapono Farms exchanged 100 acres of farmland for similar land. The farmland given had a book value of $520,000 and a fair value of $740,000. Kapono paid $54,000 cash to complete the exchange. The exchange has commercial substance. Required: What is the amount of gain or loss that Kapono would recognize on the exchange? What is the initial value of the new land? Assume the fair value of the farmland given is $416,000 instead of $740,000. What is the amount of gain or loss that Kapono would recognize on the exchange? What is the initial value of the new land? Assume the same facts as Requirement 1 and that the exchange lacked commercial substance. What is the amount of gain or loss that Kapono would recognize on the exchange? What is the initial value of the new land? Assume the same facts as Requirement 2 and that the exchange lacked commercial substance. Assume the fair value of the farmland given is $416,000 instead of $740,000. What is the amount of gain or loss that…arrow_forwardRakesharrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education