Economics:

10th Edition

ISBN: 9781285859460

Author: BOYES, William

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

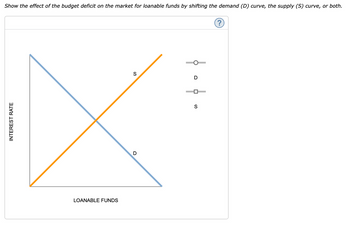

The following graph shows the loanable funds market in the United States. It plots both the demand (D) for loanable funds and the supply (S) of loanable funds. At the current equilibrium, the government is operating with a balanced budget. Assume now that the financial industry is close to bankruptcy and the U.S. government decides to implement a bailout plan of several billion dollars without increasing taxes, causing a budget deficit.

Show the effect of the budget deficit on the market for loanable funds by shifting the demand (D) curve, the supply (S) curve, or both.

Based on this model, the budget deficit leads to (an increase/a decrease) in the level of investment and (an increase/a decrease) in the interest rate.

Which of the following arguments might a supporter of a balanced budget make in defense of their position? Check all that apply.

-An individual's share of the government debt represents only a small portion of his or her lifetime earnings.

-A decrease in spending today, such as funding cuts in education, may hurt future generations more.

-Budget deficits decrease national saving.

-Budget deficits place a burden on future taxpayers.

Supporters of a balanced budget claim that the government's budget deficit cannot grow forever, but critics believe that this is not necessarily true. They argue that what matters is the size of debt relative to national income .

Transcribed Image Text:Show the effect of the budget deficit on the market for loanable funds by shifting the demand (D) curve, the supply (S) curve, or both.

INTEREST RATE

LOANABLE FUNDS

S

D

D

☐

S

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- What must take place for the government to run deficits without any crowding out?arrow_forwardUnder Crowding Out, when the federal government runs a deficit and finances it with debt: The demand for loanable funds declines. The supply for loanable funds increases. The supply for loanable funds decreases. The supply for loanable funds remains unchanged.arrow_forward27) What is the most likely impact of an increase in the government budget deficit on the market for loanable funds? a) Overall demand for loanable funds decreases. b) Overall supply of loanable funds increases. c) Real interest rates fall. d) Private investment spending decreases.arrow_forward

- Which graph shows the effect of a government budget deficit on the loanable funds market? Real Interest rate Real Interest rate Supply Increased demand Old demand Quantity of loanable funds Decreased supply Old supply C DELL 910arrow_forwardThe current market rate of interest is 10 percent. At that rate of interest, businesses borrow $300 billion per year for investment and consumers borrow $50 billion per year to finance purchases. The government is currently borrowing $150 billion per year to cover its budget deficit. a. Derive the market demand for loanable funds, and show how investors and consumers will be affected if the budget deficit increases to $250 billion per year. b. Assuming taxpayers do not anticipate an increase in the future market rate of interest due to the increase in budget deficit, show the impact of the increase in the budget deficit on the market for loanable funds. c. How would your conclusion differ if taxpayers fully anticipate future tax increases to offset the increase in the budget deficit? d. Do you think the Ricardian Equivalence is realistic?arrow_forwardHow does the government budget deficit impact interest rates, investment, and economic growth? Explain your answer.arrow_forward

- A government surplus can decrease investment through the crowding-out effect because the surplus decreases the quantity supplied of loanable funds." Is this statement correct? Explain with words + graph(s)arrow_forwardUsing a graph representing the market for loanable funds, show and explain what happens tointerest rates and investment if a government goes from a deficit to a surplus.arrow_forwardThe current market rate of interest is 10 percent. At that rate of interest, businesses borrow $300 billion per year for investment and consumers borrow $50 billion per year to finance purchases. The government is currently borrowing $150 billion per year to cover its budget deficit. a. Derive the market demand for loanable funds, and show how investors and consumers will be affected if the budget deficit increases to $250 billion per year. Draw a graph to show your conclusion. b. Assuming taxpayers do not anticipate an increase in the future market rate of interest due to the increase in budget deficit, show the impact of the increase in the budget deficit on the market for loanable funds.arrow_forward

- Please answer fastarrow_forwardhow should i shift the supply and demand curve?arrow_forwardIs it possible to assume there is crowding out as well with a formula? If there was crowding out of $100 billion how would that be calculated. What are the long run implications of the macroeconomy and the market for loanable funds?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Economics (MindTap Course List)EconomicsISBN:9781337617383Author:Roger A. ArnoldPublisher:Cengage Learning

Economics (MindTap Course List)EconomicsISBN:9781337617383Author:Roger A. ArnoldPublisher:Cengage Learning

Exploring EconomicsEconomicsISBN:9781544336329Author:Robert L. SextonPublisher:SAGE Publications, Inc

Exploring EconomicsEconomicsISBN:9781544336329Author:Robert L. SextonPublisher:SAGE Publications, Inc Principles of Economics 2eEconomicsISBN:9781947172364Author:Steven A. Greenlaw; David ShapiroPublisher:OpenStax

Principles of Economics 2eEconomicsISBN:9781947172364Author:Steven A. Greenlaw; David ShapiroPublisher:OpenStax

Economics (MindTap Course List)

Economics

ISBN:9781337617383

Author:Roger A. Arnold

Publisher:Cengage Learning

Exploring Economics

Economics

ISBN:9781544336329

Author:Robert L. Sexton

Publisher:SAGE Publications, Inc

Principles of Economics 2e

Economics

ISBN:9781947172364

Author:Steven A. Greenlaw; David Shapiro

Publisher:OpenStax