ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

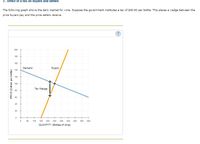

Transcribed Image Text:3. Effect of a tax on buyers and sellers

The following graph shows the daily market for wine. Suppose the government institutes a tax of $40.60 per bottle. This places a wedge between the

price buyers pay and the price sellers receive.

200

180

160

Demand

Supply

140

120

100

Tax Wedge

80

60

40

20

50

100

150

200

250 300

350

400

450

500

QUANTITY (Bottles of wine)

PRICE (Dollars per bottle)

Transcribed Image Text:Fill in the following table with the quantity sold, the price buyers pay, and the price sellers receive before and after the tax.

Quantity

Price Buyers Pay

Price Sellers Receive

(Bottles of wine)

(Dollars per bottle)

(Dollars per bottle)

Before Tax

After Tax

Using the data you entered in the previous table, calculate the tax burden that falls on buyers and on sellers, respectively, and calculate the price

elasticity of demand and supply over the relevant ranges using the midpoint method. Enter your results in the following table.

Tax Burden

(Dollars per bottle)

Elasticity

Buyers

Sellers

The burden of the tax falls more heavily on the v elastic side of the market.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- USE TABLE #1: The supply curve intersects with the price axis at $_____. (Remember to use a comma, if a comma is needed and to include the decimal point and two numbers to the right of the decimal point).arrow_forwardEconomists in Champaign have been studying the local market for pizza. The market is described in the graph below: What is the price elasticity of demand(in absolute value) when the price changes from $7 to $5?(Round your answer to include 2 decimal places.)arrow_forwardPrice of Gasoline P3 P₂ P₁ 0 9₂ 9₂ 52 D S₁ Price Ceiling Quantity of Gasoline Refer to the figure above. With a price ceiling present in this market, what will happen when the supply curve for gasoline shifts from S₁ to S₂? The market price will stay at P₁ due to the price ceiling. A shortage will occur at the price ceiling of P2. The price will increase to P3. A surplus will occur at the new market price of P₂.arrow_forward

- In 2020 the UK government introduced a sales tax on all products bought online from overseas. Please note this is not a tariff – it is a tax. The tax will be 2% of the value of the products sold in the UK. This tax is collected from online sellers such as Amazon or ebay. Source: BBC (2019). See link: https://www.bbc.com/news/business-50656106 Consider the market for online products. The initial market equilibrium is at 10 million products sold per year at an average price of $500 each. Then, the UK government imposes a tax on the market, collected from sellers (for example Amazon and ebay). The tax is 2% per item (each item has an average price of $500). Show the effect of this on the market for online products. Show the effect on consumers of online products, on the online sellers and on the government. Does the UK economy gain or lose as a result of the tax? Explain why. Use a diagram to support your answer.arrow_forwardPrice (dollars per gallon of ice cream) 20 18 16 14 12 10 50 100 150 200 250 300 350 Quantity (thousands of gallons of ice cream) The above figure shows the market for gourmet ice cream. In effort to reduce obesity, government places a $2 tax per gallon on suppliers in this market, shifting the supply curve from So to S1. The quantity of ice cream consumed before the tax is gallons and the quantity consumed after the tax is . gallons. A) 200,000; 250,000 B) 200,000; 300,000 C) 250,000; 200,000arrow_forwardThe figure below represents the market for Gasoline, where initially the equilibrium price was $5.60. The picture shows the effect of a $1.50 tax on gasoline. Using the information from the figure, what is the price elasticity of supply(Using the Midpoint method) when moving from equilibrium to the new supply after the tax?(round your answer to 2 decimal places)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education