FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

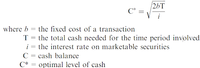

The following formula is used in determining its optimal level of cash. Assume that the fixed cost of selling marketable securities is P10 per transaction and the interest rate on marketable securities is 6% per year. The company estimates that it will make cash payments of P12,000 over a 1-month period. What is the average cash balance (rounded to the nearest peso)?

(check the attached photo)

choose the letter of the correct answer

a. P1,732.00

b. P3,464.00

c. P6,928.00

d. P8,660.00

e. P15,588.00

Transcribed Image Text:26T

C* =

!

where b = the fixed cost of a transaction

T = the total cash needed for the time period involved

i = the interest rate on marketable securities

C = cash balance

C* = optimal level of cash

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Assume that a firm issues $500,000,000 of U.S. commercial papers (and therefore uses a 360-day year for CP calculations) with a 30-day maturity at a discount of 0.5%. The annualized dealer fee is 0.175% and the cost of a backup line of credit is 0.25%. a. What is the amount of usable funds? b. What is the amount of dealer fee? c. What is the amount of backup line of credit? d. What is the annualized cost of the paper?arrow_forwardMeriton Ltd expects cash flows of $13 000, $11 500, $12 750, and $9635 over the next 4 years. What is the present value of these cash flows if the appropriate discount rate is 8 per cent? A. $49990.81B. $2700.81C. $49099.81D. $39099.81arrow_forwardProvide correct solutionarrow_forward

- The table below gives the expected cash inflows of a firm for a period of 9 years. Time 3 6 9 Cash inflow (£) 45000 90000 120000 Assume the present value of the cash outflows is £87000, and the applicable cost of capital is 13%. Calculate the (a) Future value of the cash inflows (b) Modified internal rate of return (MIRR)arrow_forwardSkysong, Inc. is using a discounted cash flow model. Scenario 1: Cash flows are fairly certain $180/year for 5 years Risk-adjusted discount rate is 6% Risk-free discount rate is 4% Identify which model Skysong might use to estimate the discounted fair value under each scenario, and calculate the fair value. (For calculation purposes, use 5 decimal places as displayed in the factor table provided. Round final answers to 2 decimal places, e.g. 5,275.25.) Click here to view the factor table PRESENT VALUE OF 1 Click here to view the factor table PRESENT VALUE OF AN ANNUITY OF 1. Scenario 1. Skysong might use Fair Value Scenario 2: Skysong might use Fair Value $ Scenario 2: Cash flows are uncertain 75% probability that cash flows will be $180 in 5 years 25% probability that cash flows will be $95 in 5 years Risk-adjusted discount rate is 6% Risk-free discount rate is 4% $ traditional approach ✓ model. expected cash flow model.arrow_forwardSuppose that LilyMac Photography has annual sales of $233,000, cost of goods sold of $168,000, average inventories of $4,800, average accounts receivable of $25,600, and an average accounts payable balance of $7,300.Assuming that all of LilyMac’s sales are on credit, what will be the firm’s cash cycle? (Use 365 days a year. Do not round intermediate calculations. Round your final answer to 2 decimal places.)arrow_forward

- Can you please confirm my calculations: discount rate is 6%; end of year cash flows are as follows: Year 0: -20,000; year 1 through 5 are each 5,000; is the net present value of all cash flows 1061.82? and how do you calculate "at what discount rate is the net present value "0"?arrow_forwardWhat is the future value at the end of year 3 of the following set of cash flows if the interest rate is 8%? (the cash flows occur at the end of each period) (round answer to nearest penny and enter in the following format 12345.67) Year 0 cash flow = 2000 Year 1 cash flow = 1700 Year 2 cash flow = 700 Year 3 cash flow = 900 Answer: کےarrow_forwardIf average daily remittances are $1 million, and extended disbursement float adds 12 days to the disbursement schedule, how much should the firm be willing to pay for a cash management system if the firm earns 15% on excess funds?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education