FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

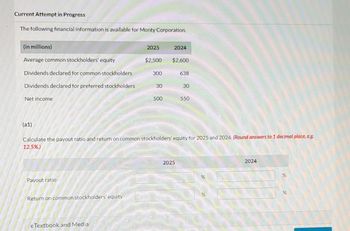

Transcribed Image Text:Current Attempt in Progress

The following financial information is available for Monty Corporation.

(in millions)

Average common stockholders' equity

Dividends declared for common stockholders

Dividends declared for preferred stockholders

Net income

(a1)

Payout ratio

Return on common stockholders' equity

2025

e Textbook and Media

$2,500

300

30

500

2024

$2,600

Calculate the payout ratio and return on common stockholders' equity for 2025 and 2024. (Round answers to 1 decimal place, e.g.

12.5%)

638

2025

30

550

%

%

2024

%

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- need help with requirement 1arrow_forwardSome recent financlal statements for Smolira Golf, Inc., follow. SMOLIRA GOLF, INC. Balance Sheets as of December 31, 2018 and 2019 2018 2019 2018 2019 Assets Llabilitles and Owners' Equlty Current assets Current liabilitles Cash $ 3,271 $ 3,457 Accounts payable $ 2,138 $ 2,570 5,811 Notes payable Other Accounts recelvable 4,782 12,418 1,735 2,086 Inventory 13,812 87 104 Total $ 20,471 $23.080 Total $ 3,960 $ 4760 $ 13,700 $16,460 Long-term debt Owners' equity Common stock 36,500 and pald-in surplus $36.500 S Accumulated retalned 38,893 Fixed assets 15,639 earnings Net plant and 75,393 $49,328 $73,533 Total $ 52,139 $ equipment Total llabilitles and owners' Total assets $69,799 $ 96,613 $ 69,799 $96,613 equity SMOLIRA GOLF, INC. 2019 Income Statement 186,770 Sales 125,903 Cost of goods sold Depreclation 5,363 EBIT $55,504 1,460 Interest pald Taxable Income $ 54,044 Таxes 18,915 Net Income $ 35,129 $ 11,875 23,254 Dividends Retalned earningsarrow_forwardThe following financial information is available for Blue Spruce Corporation. (in millions) Average common stockholders' equity Dividends declared for common stockholders Dividends declared for preferred stockholders Net income Payout ratio 2022 Return on common stockholders' equity $3,000 276 38 500 2021 2022 $3,200 616 Calculate the payout ratio and return on common stockholders' equity for 2022 and 2021. (Round answers to 1 decimal place, e.g. 12.5%) 38 550 % % 2021 % %arrow_forward

- For the year ended December 31, 2020, Blossom Company reported the following: Net income Preferred dividends declared Common dividend declared Unrealized holding loss, net of tax Retained earnings, beginning balance Common stock Accumulated Other Comprehensive Income, Beginning Balance $300400 $643100 $843100 O $601900 49300 9900 5200 401900 200000 25000 What would Blossom report as total stockholders' equity?arrow_forwardPlease do not give solution in image format thankuarrow_forward! Required information [The following information applies to the questions displayed below.] Financial information for Forever 18 includes the following selected data (in millions): ($ in millions) Net income 2017 2018 Preferred stock dividends Average shares outstanding (in millions) Stock price $ ($ in millions) Earnings per Share LA LA 2018 120 30 250 $ 11.47 $ $ LA LA $ 2017 Required: 1-a. Calculate earnings per share in 2017 and 2018. (Enter your answer in millions (i.e. 5,500,000 should be entered as 5.5).) 210 21 500 10.42arrow_forward

- On the basis of this information, calculate as many liquidity, activity, leverage, profitzit and common stock measures as you can. (Note: Assume the current market price of the common stock is $75 per share.arrow_forwardRequired information [The following information applies to the questions displayed below.] Financial information for Forever 18 includes the following selected data: ($ in millions) Net income Dividends on preferred stock Average shares outstanding Stock price Required: 1-a. Calculate earnings per share in 2023 and 2024. 1-b. Did earnings per share increase in 2024? 2024 $156 $23 300 $11.87 2023 $188 $18 400 $10.82arrow_forwardBelow is the history of the dividend payments for the HMST firm. What is your best estimate for the firm's cost of equity on December 3, 2021, if on that day the stock sells for $40? Date Paid 12/1/2017 12/1/2018 12/1/2019 12/1/2020 12/1/2021 $3.68 Dividend $3.5 $3.95 $4.29 $5.32 31.00% 19.73% 18.70% 23.11% 26.07%arrow_forward

- Please do not give solution in image format thankuarrow_forwardUse the following information to find dividends paid to common stockholders during 2021. (Enter your answers in millions of dollars.) (in millions of dollars) Balance of retained earnings, December 31, 2020$496 Plus: Net income for 2021 50 Less: Cash dividends paid Preferred stock$2 Common stock Total cash dividends paid Balance of retained earnings, December 31, 2021 $526arrow_forwardDarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education