FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

nku.7

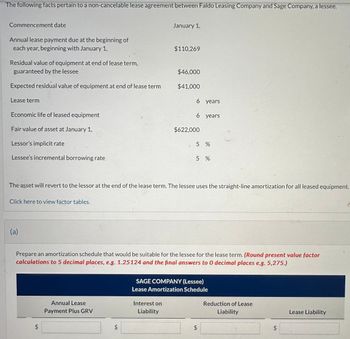

Transcribed Image Text:The following facts pertain to a non-cancelable lease agreement between Faldo Leasing Company and Sage Company, a lessee.

Commencement date

Annual lease payment due at the beginning of

each year, beginning with January 1,

Residual value of equipment at end of lease term,

guaranteed by the lessee

Expected residual value of equipment at end of lease term

Lease term

Economic life of leased equipment

Fair value of asset at January 1,

Lessor's implicit rate

Lessee's incremental borrowing rate

Click here to view factor tables.

(a)

LA

$

Annual Lease

Payment Plus GRV

January 1,

$

$110,269

$46,000

$41,000

The asset will revert to the lessor at the end of the lease term. The lessee uses the straight-line amortization for all leased equipment.

Interest on

Liability

6 years

6

$622,000

Prepare an amortization schedule that would be suitable for the lessee for the lease term. (Round present value factor

calculations to 5 decimal places, e.g. 1.25124 and the final answers to 0 decimal places e.g. 5,275.)

years

5 %

5 %

SAGE COMPANY (Lessee)

Lease Amortization Schedule

$

Reduction of Lease

Liability

$

Lease Liability

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- What is busd What is xrp How they worksarrow_forwardWhat is the importance of a Form 8-K? What is the importance of a proxy statement?arrow_forwardPiper Specialty Store Ltd. completed the following merchandising transactions in the month of May 2021. At the beginning of May, Piper's ledger showed Cash $7,000; Accounts Receivable $1,900; Inventory $3,500; Common Shares $7,800; and Retained Earnings $4,600. Piper Specialty has experienced a return rate of 2% of sales and uses a perpetual inventory system. Purchased merchandise on account from Depot Wholesale Supply Ltd. for $5,340, terms 1/10, n/30, FOB shipping point. May 3 Freight charges of $137 were paid by the appropriate party on the merchandise purchased on May 1. Sold merchandise on account to Yip Company for $3,500, terms n/30, FOB destination. The cost of the merchandise was $2,400. 7 Freight charges of $86 were paid by the appropriate party on the May 4 sale. 8. Received a $140 credit from Depot Wholesale Supply when merchandise was returned. Paid Depot Wholesale Supply in full. 11 Purchased supplies for $390 cash. 14 Received payment in full from Yip Company for…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education