FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Having an issue with this problem.

Thank you

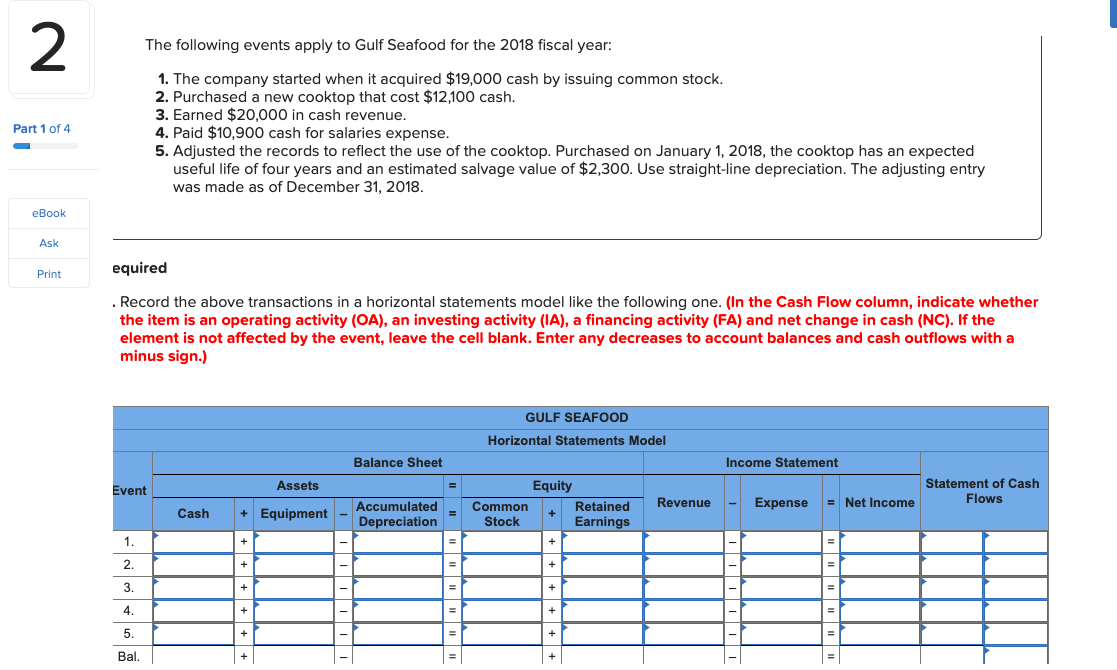

Transcribed Image Text:The following events apply to Gulf Seafood for the 2018 fiscal year:

1. The company started when it acquired $19,000 cash by issuing common stock.

2. Purchased a new cooktop that cost $12,100 cash.

3. Earned $20,000 in cash revenue.

4. Paid $10,900 cash for salaries expense.

5. Adjusted the records to reflect the use of the cooktop. Purchased on January 1, 2018, the cooktop has an expected

useful life of four years and an estimated salvage value of $2,300. Use straight-line depreciation. The adjusting entry

was made as of December 31, 2018.

Part 1 of 4

eBook

Ask

equired

Print

Record the above transactions in a horizontal statements model like the following one. (In the Cash Flow column, indicate whether

the item is an operating activity (OA), an investing activity (IA), a financing activity (FA) and net change in cash (NC). If the

element is not affected by the event, leave the cell blank. Enter any decreases to account balances and cash outflows with a

minus sign.)

GULF SEAFOOD

Horizontal Statements Model

Balance Sheet

Income Statement

Event

Assets

Equity

Statement of Cash

Revenue

Expense

= Net Income

Flows

Common

Stock

Retained

Earnings

Accumulated

Cash

+ Equipment

Depreciation

1.

2.

3.

%3D

4.

5.

Bal.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A Framework for decision making: a. can help reduce the unexpected consequences of our actions. b. is not needed if the activity is legal. c. helps identify who gains the most from a decision.arrow_forwardM. What is meant by perspective getting? How does note-taking improve perspective-getting?arrow_forwardAre you concerned about high deficits? Why are why not?arrow_forward

- do you not see the solution you provided is the exact one i submitted, it says it's wrong..arrow_forwardWhat are the strengths and weaknesses that you see in the system and ways that you would improve any weaknesses identified.arrow_forwardIt says they answers are wrong from your example.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education