FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

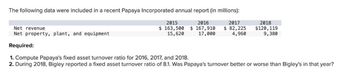

Transcribed Image Text:The following data were included in a recent Papaya Incorporated annual report (in millions):

Net revenue

Net property, plant, and equipment

2015

$ 163,500

15,620

2016

$167,910

17,000

2017

$ 82,225

2018

4,960

$120,119

9,380

Required:

1. Compute Papaya's fixed asset turnover ratio for 2016, 2017, and 2018.

2. During 2018, Bigley reported a fixed asset turnover ratio of 8.1. Was Papaya's turnover better or worse than Bigley's in that year?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The Oscar Meyer Corporation earned $33 million in 2019 on sales of $450.5 million. The company's balance sheet also listed current assets of $27 million, and fixed assets of $378 million. What is the firms Return on Assets (ROA)? a. 0.211 b. 0.201 O c. -0.029 d. -0.049 e. 0.081arrow_forwardThe comparative balance sheets for 2016 and 2015 and the statement of income for 2016 are given below for Wright Company. Additional information from Wright's accounting records is provided also. WRIGHT COMPANYComparative Balance SheetsDecember 31, 2016 and 2015($ in 000s) 2016 2015 Assets Cash $ 125 $ 110 Accounts receivable 151 155 Short-term investment 56 20 Inventory 155 150 Land 114 140 Buildings and equipment 740 560 Less: Accumulated depreciation (211) (155) $ 1,130 $ 980 Liabilities Accounts payable $ 46 $ 51 Salaries payable 4 7 Interest payable 5 4 Income tax payable 9 13 Notes payable 0 36 Bonds payable 332 260 Shareholders' Equity Common stock 435 360 Paid-in capital—excess of par 200 180 Retained earnings 99…arrow_forwardArco Steel, Inc. generated total sales of $45,565,200 during fiscal 2010. Depreciation and amortization for the year totaled $2,278,260, and cost of goods sold was $27,339,120. Interest expense for the year was $9,641,300 and selling, general, and administrative expenses totaled $4,556,520 for the year. What is Arco’s EBIT for 2010? A) $9,641,300 B) $11,391,300 C) $13,275,030 D) $18,490,000arrow_forward

- Flubber Products has current assets of $60,000 and total assets of $340,000. The firm’ssales are $700,000. Flubber’s interest expense is $25,000. All assets are classified asbeing either current assets or fixed assets. Flubber’s fixed asset turnover is?arrow_forwardExtracts from the balance sheet of Atlantis Inc. are as follows: 2018 Assets Current Assets: Cash and Cash Equivalents 30,000 Accounts Receivable, Net 65,000 Merchandise Inventory 50,000 Total Current Assets 145,000 Long-Term Investments 150,000 Property, Plant, and Equipment, Net 250,000 Total Assets 545,000 Total Current Liabilities 150,000 Compute the acid test ratio.arrow_forwardIn 2021, Noble Tech Inc. reported that the company's Return on Assets (ROA) was 10%, and its net profit margin was 6%. Calculate the company's total asset turnover (round your answer to two decimal places).arrow_forward

- Samuel Corp. has provided the following information for the year ended December 31, 2018. Samuel Corp Comparative Balance Sheet December 31, 2018 and 2017 2018 2017 Inc/(dec) Current Assets: Cash $33,000 $13,000 $20,000 Accounts Receiveable 29,000 36,000 (7,000) Inventory 56,000 29,000 27,000 Plant Assets, net 126,000 92,000 34,000 Total Assets $244,000 $170,000 $74,000 Accounts Payable $9,000 $13,000 $(4,000) Accrued Liabilities 7,000 3,000 4,000 Long-Term Notes Payable 70,000 79,000 (9,000) Total Liabilities 86,000 95,000 (9,000) Common Stock $55,000 $3,000 $52,000 Retained Earnings 115,000 78,000 37,000 Treasury Stock (12,000) (6,000) (6,000) Total Stockholders' Equity $158,000 $75,000 $83,000 Total Liabilities and Stockholders Equity $244,000 $170,000 $74,000 Samuel Corp Income…arrow_forwardFind the firm's asset turnover ratio & ROA.arrow_forwardPlease provide answer in text (Without image)arrow_forward

- Baldwin, Inc. had net sales of $52,200,000 for the year ended May 31, 2024. Its beginning and ending total assets were $55,200,000 and $88,800,000, respectively. Determine Baldwin's asset turnover ratio for year ended May 31, 2024. (Round the asset turnover ratio to two decimal places, X.XX.) Asset turnover ratio Carrow_forwardNelson Ltd reported a total asset of $600,000, and a net profit of $90,000, while their current liabilities stood at $320,000 for 2021 financial period. If current assets are 40% of the total assets, what is the current ratio for Nelson Ltd? 0.75 1.88 0.53 1.33arrow_forwardCurrent Attempt in Progress Presented below are a number of balance sheet items for Culver, Inc. for the current year, 2017. Goodwill $ 211,800 Accumulated depreciation-equipment $ 467,100 Payroll taxes payable 67,100 Inventory 400,400 Bonds payable 501,800 Rent payable (short-term) 41,800 Discount on bonds payable 35,100 Income tax payable 112,600 Cash 62,800 Rent payable (long-term) 81,800 Land 352,800 Common stock, $1 par value 251,800 Notes receivable 162,300 Preferred stock, $25 par value 1,251,800 Notes payable (to banks) 266,700 Prepaid expenses 70,560 Accounts payable 348,800 Equipment 1,387,800 Retained earnings ? Equity investments (trading) 376,800 Income taxes receivable 47,400 Accumulated depreciation-buildings 361,300 Unsecured notes payable (long-term) 1,301,800 Buildings 2,801,800 Prepare a classified…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education