FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

thumb_up100%

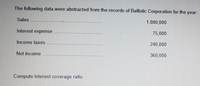

Transcribed Image Text:The following data were abstracted from the records of Ballistic Corporation for the year:

Sales

1,080,000

Interest expense

75,000

Income taxes

240,000

Net income

360,000

Compute interest coverage ratio.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Following information are taken from financial statements of a company. What is the interest coverage ratio? Sales Revenue $1,000,000 Tax Rate 20% Net Income $200,000 Operating Income $280,000arrow_forwardConsider the following given information below: Total Income P1,321,000 Total Distribution Cost 268,900 Total Administrative Cost 250,200 Other Expenses 8,000 Interest Expense 9,000 Total Expenses 536,100 Income Tax Expense 235,500 What is the amount of income before tax to be reflected in the income statement?arrow_forwardThe following data applies to the GCI Company: Sales $1,000,000. Receivables- S260,000. Payables S600,000. Purchases S800,000. COGS - S800,000. • Inventory- S400,000. Net Income $50,000. Total Assets $800,000. • Debu Equity - 200%. What is the average collection period, the average inventory processing period, and the payables payment period for GCI Company? Paymentsarrow_forward

- The following information appeared in the annual financial statements of Hitashi Projects Limited:Statement of Comprehensive Income for the year ended 31 December 2019 R Revenue 1 250 000Direct costs (786 000) Gross profit 464 000 Operating expenses (124 000) Operating profit 340 000 Interest expense (15 000) Profit before tax 325 000 Income tax (97 500) Profit after tax 227 500 Statement of Financial Position as at 31 December 2019Assets R Non-current assets 314 000 Current assets 386 000 Total assets 700 000 Equity and liabilities Shareholders’ equity 350 000 Non-current liabilities 205 000 Current liabilities 145 000 Total equity and liabilities 700 000 Note • Current assets (R386 000) include accounts receivable of R160 000, inventories of R80 000 and cash of R146 000. • Inventories as at 31 December 2018 amounted to R130 000. • Current liabilities comprise accounts payable only. • All direct costs and revenues are on credit.Required: Calculate the following ratios using the…arrow_forwardGoldfinger Corporation had account balances at the end of the currentyear as follows: sales revenue, $29,000; cost of goods sold, $12,000;operating expenses, $6,200; and income tax expense, $4,320. Assumeshareholders owned 4,000 shares of Gold finger's common stock duringthe year. Prepare Goldfinger's income statement for the current year.arrow_forwardThe Tarboro Corporation data for the current year and prior year is as follows: Current year $75,600 $59,400 $51,200 Account Current assets A/R Mdse. Inventory Current liabilities $76,500 $31,000 $47,460 $31,240 $607,700 $469,700 $138,000 $49,080 $88,920 $20,520 $68,400 Long-term liabilities. Common stock (5,000 shares) Retained earnings Net sales revenue COGS Gross Profit Selling/General expenses Net income before taxes Income tax expense Net Income What would a horizontal analysis report with respect to long-term liabilities? OA. Long-term liabilities increased by $28,500. B. Long-term liabilities decreased by $16,500. OC. Long-term liabilities decreased by 27.5%. D. Long-term liabilities increased by 91.94%. Prior year $60,000 $44,000 $40,000 $60,000 $2,500 $42,000 $17,000 $515,000 $385,000 $130,000 $52,000 $78,000 $18,000 $60,000arrow_forward

- A company reports the following:Income before income tax $4,000,000Interest expense 400,000Determine the times interest earned ratio. Round to one decimal place.arrow_forwardThe Lancaster Corporation’s income statement is given below. LANCASTER CORPORATION Sales $ 265,000 Cost of goods sold 137,000 Gross profit $ 128,000 Fixed charges (other than interest) 25,100 Income before interest and taxes $ 102,900 Interest 19,100 Income before taxes $ 83,800 Taxes (35%) 29,330 Income after taxes $ 54,470 a. What is the times-interest-earned ratio? (Round your answer to 2 decimal places.)arrow_forward9 )arrow_forward

- Hsu Company reported the following on its income statement: Income before income taxes $330,740 Income tax expense 99,222 Net income $231,518 Interest expense was $72,287. Hsu Company's times interest earned ratio (rounded to two decimal places) is a.3.2 times b.2.2 times c.5.58 times d.4.58 timesarrow_forwardThe income statement and comparative Statement of Financial Positions of MacTavish Ltd. are shown below.Income Statement for the year ended December 31, 20x4Sales $ 1,420,000Cost of goods sold (1,110,000)Depreciation expense (55,000)Interest expense (22,000)Operating expenses (178,000)Gain on sale of capital assets 10,000Income tax expense (19,000)Net income $ 46,000Statement of Financial Position as at December 31 20x420x4 20x3Cash $ 71,000 $ 80,000 Accounts receivable 191,000 169,000 Inventory 303,000 324,000 Prepaid expenses 18,000 26,000Capital assets 640,000 612,000 Accumulated depreciation (301,000) (253,000) $922,000 $958,000Accounts payable $ 149,000 $ 243,400 Interest payable 41,000 36,000 Income taxes payable 8,000 12,000 Deferred revenue 25,000 17,000Bonds payable – net 226,000 229,600Common shares 317,000 300,000 Retained earnings 156,000 120,000 $922,000 $958,000 Additional information1. The bonds payable have a face value of…arrow_forwardWhat is included in the income tax expense for each year (25%)? And what is the net income for each yeararrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education