FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

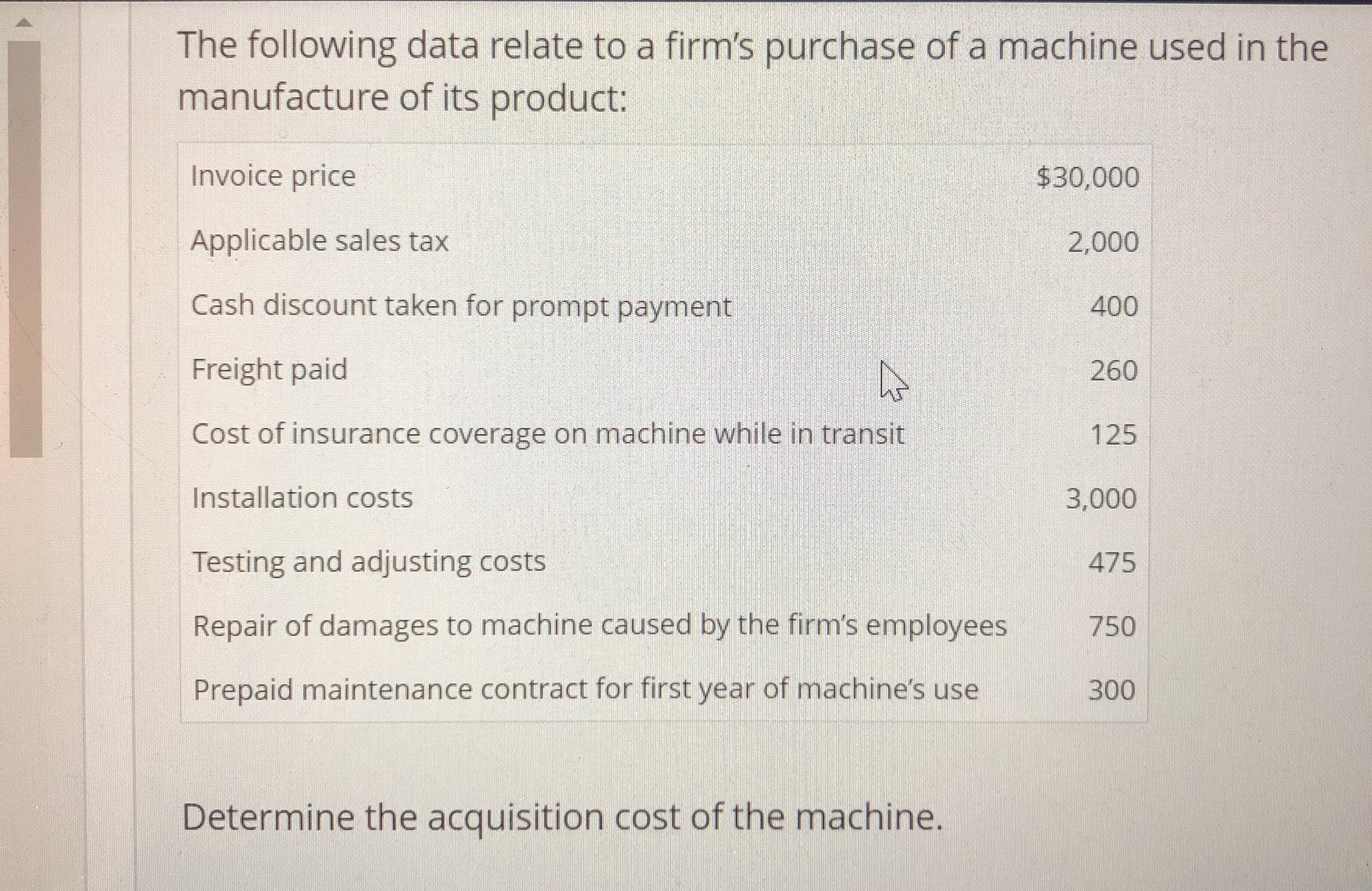

Transcribed Image Text:The following data relate to a firm's purchase of a machine used in the

manufacture of its product:

Invoice price

Applicable sales tax

Cash discount taken for prompt payment

Freight paid

Cost of insurance coverage on machine while in transit

Installation costs

Testing and adjusting costs

Repair of damages to machine caused by the firm's employees750

Prepaid maintenance contract for first year of machine's use

$30,000

2,000

400

260

125

3,000

475

300

Determine the acquisition cost of the machine.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Similar questions

- Rahularrow_forwardUSE THE FOLLOWING INFORMATION: The following information regarding the exchange is available: Motown Corporation trades in a delivery vehicle for a new delivery vehicle. Assume the transaction has commercial substance. Cost of Motown's vehicle (old) $ 59,000 Accumulated Depreciation - Motown's vehicle (old) $ 2,200 Fair value Motown's vehicle (old) $ 39,000 List price of new vehicle (new) $ 61,000 Trade in allowance for Motown's vehicle (old) $ 38,000 26.) Compute the basis of the new vehicle to be recorded on Motown's books.arrow_forwardSouthwest Inc. would like to exchange an old piece of equipment for a new one. Which of the following are relevant to the decision? The cost of the old piece of equipment The book value of the old piece of equipment The repair costs incurred on the old piece of equipment The cost of the new equipmentarrow_forward

- Allocation of Package Purchase Price Tamarack Company purchased a plant from one of its suppliers. The $1,000,000 purchase price included the land, a building, and factory machinery. Tamarack also paid $6,000 in legal fees to negotiate the purchase of the plant. An appraisal showed the following values for the items purchased: Property Assessed Value Land $126,000 Building 456,000 Machinery 318,000 Total $900,000 Using the assessed value as a guide, allocate the total purchase price of the plant to the land, building, and machinery accounts in Tamarack Company’s records. Do not round until your final answers. Round answers to the nearest dollar. Asset Allocation ofPurchase Price Land Answer Building Answer Mark 0.00 out of 1.00 Machinery Answer Total Answerarrow_forwardRecording Asset Acquisition, Depreciation, and Disposal On January 2, 2016, Verdi Company acquired a machine for $75,000. In addition to the purchase price, Verdi spent $2,100 for shipping and installation, and $2,600 to calibrate the machine prior to use. The company estimates that the machine has a useful life of 5 years and a residual value of $11,000. Required a. Prepare journal entries to record the acquisition costs. Description Debit + → b. Calculate the annual depreciation expense using straight-line depreciation and prepare a journal entry to record depreciation expense for 2016. Description Credit Cash ◆ ◆ Accumulated depreciation c. On December 31, 2019, Verdi sold the machine to another company for $14,000. Prepare the necessary journal entry to record the sale. Credit Description Debit Credit Debit ◆ ♦arrow_forwardA fixed asset with a cost of $24,737 and accumulated depreciation of $22,263 is traded for a similar asset priced at $60,057 (fair market value) in a transaction with a commercial substance. Assuming a trade-in allowance of $4,264, at what cost will the new equipment be recorded in the books? a.$4,264 b.$1,790 c.$60,057 d.$20,473arrow_forward

- Acquisition of Equipment - A machine cost $1,200,000, has annual depreciation of $200,000, and has accumulated depreciation of $850,000 on December 31, 2017. On April 1, 2018, when the machine has a fair value of $275,000, it is exchanged for a machine with a fair value of $1,350,000 and the proper amount of cash is paid. The exchange had commercial substance. Required: Prepare the entry to record the acquisition of the new equipment.arrow_forwardi need help with this question pleasearrow_forwardSituation II During 2022, Pearl SA constructed and manufactured certain assets and incurred the following borrowing costs in connecti with those activities. Warehouse constructed for Pearl's own use Special-order machine for sale to unrelated customer, produced according to customer's specifications Inventories routinely manufactured, produced on a repetitive basis Borrowing Costs Incurred The total amount of borrowing cost to be capitalized R$ R$28,200 8,460 7,520 All of these assets required an extended period of time for completion. Assuming the effect of borrowing cost capitalization is material, what is the total amount of borrowing cost to be capitalized?arrow_forward

- Acquisition Cost of Long-Lived Asset The following data relate to a firm’s purchase of a machine used in the manufacture of its product: Invoice price $34,000 Applicable sales tax 2,000 Cash discount taken for prompt payment 400 Freight paid 260 Cost of insurance coverage on machine while in transit 125 Installation costs 2,000 Testing and adjusting costs 475 Repair of damages to machine caused by the firm’s employees 750 Prepaid maintenance contract for first year of machine’s use 400 Determine the acquisition cost of the machine.arrow_forwardAcquisition and retirements Capital lease Goodwill Net income Ownership Property tax Repairs and maintenance Retirement work order Revenue Subsidiary ledger Working papersarrow_forwardRecording Asset Exchanges Minneapolis Inc. has equipment with an original cost of $52,500 and accumulated depreciation of $30,000. This equipment was traded in for new equipment with a list price of $60,000. The new machine can be purchased without a trade-in for $56,250 cash. The difference between the fair value of the new asset and the market value of the old asset will be paid in cash. Prepare the entry to record acquisition of the new machine under each of the following separate cases. a. The new machine is purchased for cash with no trade-in. b. The transaction has commercial substance. The old equipment is traded in, and $37,500 cash is paid. c. The same as in part b except that the transaction lacks commercial substance. a. Account Name Dr. Cr. Answer Answer b. Account Name Dr. Cr. Answer Answer Answer Answer Answer Answer Answer Answer C. Account Name Dr. Cr. Answer…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education