FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

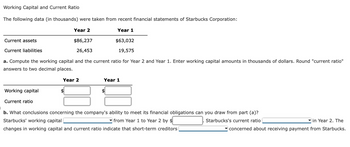

Transcribed Image Text:Working Capital and Current Ratio

The following data (in thousands) were taken from recent financial statements of Starbucks Corporation:

Year 2

Year 1

$86,237

$63,032

26,453

19,575

a. Compute the working capital and the current ratio for Year 2 and Year 1. Enter working capital amounts in thousands of dollars. Round "current ratio"

answers to two decimal places.

Current assets

Current liabilities

Working capital

Current ratio

Year 2

Year 1

b. What conclusions concerning the company's ability to meet its financial obligations can you draw from part (a)?

Starbucks' working capital

from Year 1 to Year 2 by $

Starbucks's current ratio

changes in working capital and current ratio indicate that short-term creditors

in Year 2. The

concerned about receiving payment from Starbucks.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Need help with this Questionarrow_forwardWhat is the current assets for each company? What are the short term investments for each company? What is the average account receivable for each company? What is the average inventory for each company?arrow_forwardPrepare multi-step income statement Prepare single step income statement Income Statement Saghir Company's 2014 information Administrative Expenses Officers salaries 6,860 Depreciation of office furniture and equipment 5,544 Cost of Goods Sold 84,798 Net Sales 135,100 Rental Revenue 24,122 Selling Expense Transportation Out 3,766 Sales Commissions 1,172 Depreciation of Sales Equipment 9,072 Income Tax 12,698 Interest Expense 2,604 Common Shares Outstanding 40,550 Instructions Prepare a multi-step income statement for 2014 Prepare a single step income statement for 2014arrow_forward

- 3. Measuring Performance. Here are simplified financial statements for Watervan Corporation: INCOME STATEMENT (Figures in $ millions) Net sales 881 Cost of goods sold Depreciation Earnings before interest and taxes (EBIT) 741 31 109 Interest expense 12 Income before tax 97 Taxes 34 Net income 63 BALANCE SHEET (Figures in $ millions) End of Year Start of Year Assets Current assets 369 312 Long-term assets 258 222 Total assets 627 534 Liabilities and shareholders' equity Current liabilities 194 157 121 Long-term debt Shareholders' equity Total liabilities and shareholders' equity 108 325 256 627 534 The company's cost of capital is 8.5%. (LO4-2) a. Calculate Watervan's economic value added (EVA). D. What is the company's return on capital? (Use start-of-year rather than average capital.) C. What is its return on equity? (Use start-of-year rather than average equity.)arrow_forwardIncome statements illustrate what revenues the firm collects, the expenses required to support revenues, and the firm's profitability over a specified period of time. While balance sheets are a "snapshot" of the firm's status on a specific date, income statements reflect performance over a period of time. Publicly held companies generate income statements every quarter (three months) and for their annual report. INCOME STATEMENT (Thousands of dollars) Net revenues - Cost of goods sold - Operating expenses - Research & development expense Operating costs excluding depreciation - Depreciation and amortization expense Operating income (EBIT) - Interest expense Taxable income - Taxes Net income - Preferred dividends Net income available to common shareholders Dividends Addition to retained earnings The gross margin for this fictional company is: O 14.7% O 9.2% 18.2% 60.3% O 33.3% $ $ On the income statement, interest expense is $ Wages are considered a(n) $ $ In this example, the firm pays…arrow_forwardGive solutionarrow_forward

- farrow_forwardThe following information of Red Oak Manufacturing is available for the current year: Net income $844,200 Net sales 6,809,000 Average total assets 5,911,000 Average stockholders' equity 2,575,000 The total leverage as per the DuPont analysis computation isarrow_forwardTrend Analysis Critelli Company has provided the following comparative information: Year 5 Year 4 Year 3 Year 2 Year 1 Net income $940,300 $810,600 $681,200 $582,200 $493,400 Interest expense 319,700 291,800 252,000 192,100 153,000 Income tax expense 300,896 226,968 190,736 151,372 118,416 Average total assets 5,779,817 5,103,704 4,360,748 3,704,785 3,153,171 Average stockholders' equity 1,975,420 1,769,869 1,548,182 1,373,113 1,203,415 You have been asked to evaluate the historical performance of the company over the last five years. Selected industry ratios have remained relatively steady at the following levels for the last five years: Industry Ratios Return on total assets 21.5 % Return on stockholders’ equity 44.4 % Times interest earned 4.6 Instructions: Calculate three ratios for Year 1 through Year 5. Round to one decimal place. a. Return on total assets: Year 5…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education