FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

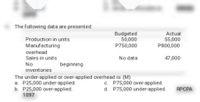

Transcribed Image Text:The following data are presented:

Budgeted

50,000

P750,000

Actual

Production in units

55,000

P800,000

Manufacturing

overhead

Sales in units

No data

47,000

No

beginning

inventories

The under-applied or over-applied overhead is: (M)

a P25,000 under-applied.

b. P25,000 over-applied.

1097

C. P75,000 over-applied.

d. P75,000 under-applied.

RPCPA

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 6arrow_forwardQ1. Prepare a Flexible budget for overheads on the basis of the following data. Ascertain the overhead rates at 70% and 80% capacity. Variable Overheads (60% capacity) Indirect Material = Rs. 6,000 Labour Rs. 18,000 Semi-variable overheads: Electricity (40% fixed) = Rs. 40,000 Repairs (80% fixed) = Rs. 2,400 Fixed Overheads: Depreciation Rs. 16,500 Insurance Rs. 4,500 Salaries= Rs. 20,000 Estimated Labour Hours 15,000 hrs H =arrow_forwardAnswerarrow_forward

- Hansabenarrow_forwardParagraph Styles Question 1: WPC Company's Budget and actual costs per unit are provided below for the most recent period. During this period, 700 units were actually produced. Product Product Standard Cost Actual Cost Materials Unit Price Per Metre $2.00 $2.20 Metres Standard $10.00 Actual 5.2 $11.44 Direct labour Hours Hourly Rate $50 $5.50 Standard 3. $15.00 Actual 3.2 $17.60 Variable overhead Hours Hourly Rate Standard 4 $3.00 $12.00 $3.10 $13.02 Actual 4.2 Total unit cost $37.00 $42.06 Required: Given the information above, compute the following variances. Also indicate if the variances are favorable or unfavorable.arrow_forwardPlease do not give solution in image format thankuarrow_forward

- Sh1 Please help me. Thankyou.arrow_forward--/1 Question 22 View Policies Current Attempt in Progress The predetermined overhead rate for Coronado Industries is $5, comprised of a variable overhead rate of $3 and a fixed rate of $2. The amount of budgeted overhead costs at normal capacity of $150000 was divided by normal capacity of 30000 direct labor hours, to arrive at the predetermined overhead rate of $5. Actual overhead for June was $12680 variable and $8040 fixed, and standard hours allowed for the product produced in June was 4000 port hours. The total overhead variance is O $720 F. O $4040 F. O $4040 U. O $720 U. hp ins f12 f11 f10 prt sc f9 144 f8 f7 f6 f5 4+ 8 %3D C 60 To 96arrow_forwardSales (7,000 units x $400 per unit) Costs Direct materials Direct labor Indirect materials Supervisor salary Sales commissions Shipping Administrative salaries Depreciation-office equipment Insurance Office rent Income 1. Compute total variable cost per unit. 2 Compute total fixed costs. $ 2,800,000 280,000 490,000 175,000 65,000 140,000 154,000 210,000 35,000 20,000 36,000 1,195,000 3. Prepare a flexible budget at activity levels of 6,000 units and 8,000 units. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Prepare a flexible budget at activity levels of 6,000 units and 8,000 units. Sales Variable costs Direct materials Direct labor Sales commissions Indirect materials Shipping Total variable costs Contribution margin Fixed costs Supervisor salary Administration salaries Depreciation-Office equipment Insurance Office rent Income TEMPO COMPANY Flexible Budget Variable Amount Total Fixed per Unit Cost S 400.00 Flexible Budget for.…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education