FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

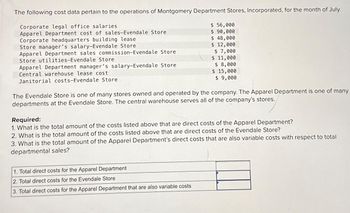

Transcribed Image Text:The following cost data pertain to the operations of Montgomery Department Stores, Incorporated, for the month of July.

Corporate legal office salaries

Apparel Department cost of sales-Evendale Store

Corporate headquarters building lease

Store manager's salary-Evendale Store

Apparel Department sales commission-Evendale Store

Store utilities-Evendale Store

Apparel Department manager's salary-Evendale Store

Central warehouse lease cost

Janitorial costs-Evendale Store

$ 56,000

$ 90,000

$ 48,000

$ 12,000

$ 7,000

$ 11,000

$ 8,000

$ 15,000

$ 9,000

The Evendale Store is one of many stores owned and operated by the company. The Apparel Department is one of many

departments at the Evendale Store. The central warehouse serves all of the company's stores.

Required:

1. What is the total amount of the costs listed above that are direct costs of the Apparel Department?

2. What is the total amount of the costs listed above that are direct costs of the Evendale Store?

3. What is the total amount of the Apparel Department's direct costs that are also variable costs with respect to total

departmental sales?

1. Total direct costs for the Apparel Department

2. Total direct costs for the Evendale Store

3. Total direct costs for the Apparel Department that are also variable costs

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Refer to the interview in Exercise 4.17 (especially to Question 4 and 7). The general ledger reveals the following annual costs: Supervisor’s salary $ 64, 600 Clerical salaries 210,000 Computers, desks, and printers 32,000 Computer supplies 7,200 Telephone expenses 4,000 ATM $ 1,250,000 All non labor resources, other than the ATM, are spread evenly among the eight credit department employees (in terms of assignment and usage). Credit department employees have no contact with ATMs. Printers and desks are used in the same ratio as computers by the various activities. Required: Determine…arrow_forwardVinubhaiarrow_forwardThe Wonder Drug Company's total overhead costs at various levels of activity are presented below: Month September October November December Assume that the overhead costs above consist of indirect labor, scheduling salaries, and maintenance. The breakdown of these costs for the month of November is as follows: Indirect labor (V) Maintenance (M) Scheduling Salaries (F) a. Direct Labor Hours 15,000 12,000 18,000 21,000 Total Overhead Direct Labor Hours High Required: (a.) Using the high-low method, determine the cost formula for maintenance. (b.) Express the company's total overhead costs in linear equation form. $ 21,000 $ 219,600 197,400 125,000 542,000 Low 12,000 Total Overhead $ 472,000 409,400 542,000 604,700 Differencearrow_forward

- Interdepartment Services: Step Method O'Brian's Department Stores allocates the costs of the Personnel and Payroll departments to three retail sales departments, Housewares, Clothing, and Furniture. In addition to providing services to the operating departments, Personnel and Payroll provide services to each other. O'Brian's allocates Personnel Department costs on the basis of the number of employees and Payroll Department costs on the basis of gross payroll. Cost and allocation information for June is as follows: Direct department cost Number of employees Gross payroll Personnel Payroll Housewares Clothing Furniture $7,300 $3,800 $12,300 $20,000 $15,650 5 Total costs $ 2 $6,100 $2,800 Payroll 0 (a) Determine the percentage of total Personnel Department services that was provided to the Payroll Department. (Round your answer to one decimal place.) 12.5 X% (b) Determine the percentage of total Payroll Department services that was provided to the Personnel Department. (Round your answer…arrow_forwardThe following is a manufacturing cost report of Marching Ants Inc. Evaluate and correct this report.arrow_forwardThe following selected data were taken from the accounting records of Metcalf Manufacturing. The company uses direct-labor hours as its cost driver for overhead costs. Month January February March April May June Direct-Labor Hours 37,000 39,000 52,000 40,000 44,000 42,000 March's costs consisted of machine supplies ($296,400), depreciation ($32,500), and plant maintenance ($570,100). These costs exhibit the following respective behavior: variable, fixed, and semivariable. Manufacturing Overhead $701,000 740,000 899,000 754, 250 805,500 802,500 The manufacturing overhead figures presented in the preceding table do not include Metcalf's supervisory labor cost, which is step- fixed in nature. For volume levels of less than 15,000 hours, supervisory labor amounts to $77,500. The cost is $155,000 from 15,000- 29,999 hours and $232,500 when activity reaches 30,000 hours or more. Required: 4. 1. Determine the machine supplies cost and depreciation for January. 2. Using the high-low method,…arrow_forward

- Cordner Corporation has two production departments, P1 and P2, and two service departments, S1 and S2. Direct costs for each department and the proportion of service costs used by the various departments for the month of July are as follows: Proportion of Services Used by: Department Direct costs S1 S2 P1 P2 S1 $ 72,000 0.70 0.10 0.20 S2 $ 157,000 0.20 0.30 0.50 P1 $ 214,000 P2 $ 179,000 Under the step method of allocation, the total amount of service costs allocated to producing departments would be: Multiple Choice $174,000. $178,600. $74,000. $229,000.arrow_forwardMalone Company has the following balances for the current month: Indirect materials used $1320 Direct labor 5469 Sales salaries 11588 Indirect labor 1508 Production manager's salary 10170 Marketing costs 4286 Factory rent Direct materials used What are the total period costs? 11814 2021arrow_forwardHartley Uniforms produces uniforms. The company allocates manufacturing overhead based on the machine hours each job uses. Hartley Uniforms reports the following cost data for the past year: Budget Actual 7,600 hours 6,100 hours Direct labor hours Machine hours 7,200 hours 6,300 hours Depreciation on salespeople's autos $23,000 $23,000 Indirect materials $48,500 $50,500 Depreciation on trucks used to deliver uniforms to customers solla $13,000 $70,000 $40,000 $11,000 Depreciation on plant and equipment Indirect manufacturing labor $72,500 $42,000 Customer service hotline $19,000 $21,000 Plant utilities $35,900 $38,400 Direct labor cost $72,500 $85,500 Requirements 1odel tba 1. Compute the predetermined manufacturing overhead rate. 2. Calculate the allocated manufacturing overhead for the past year. 3. Compute the underallocated or overallocated manufacturing overhead. How will this underallocated or overallocated manufacturing overhead be disposed of? 4. How can managers usA accoarrow_forward

- Acme Consulting uses job order costing to determine the cost of services provided to clients. For a particular year, Acme has budgeted the following amounts: Office rent and utilities $100,000 Support staff $70,000 Advertising $25,000 Supplies $5,000 Direct labor (based on 2.000 hours) $120,000 The firm has completed job 101 for a client. Job 101 involved 25 hours of direct labor. Acme assigns indirect costs based on direct labor hours. What is the cost of job 101? ANSWER $2,500 $4,000 $1,500 $5,000 I DON'T KNOW YETarrow_forwardThe accounting department of a large limousine company is analyzing the costs of its services. The cost data and level of activity for the past 16 months follow. Month Special Analyses CustomerAccounts PaychecksProcessed AccountingService Costs 1 2 325 1,029 $ 63,800 2 4 310 993 68,900 3 2 302 1,268 64,000 4 1 213 1,028 61,300 5 2 222 984 61,600 6 0 214 712 50,800 7 1 131 762 51,020 8 1 123 739 54,300 9 0 115 708 50,500 10 2 296 1,232 64,800 11 2 213 978 58,000 12 1 222 929 57,500 13 2 217 1,059 62,200 14 2 132 942 54,900 15 4 300 1,299 71,530 16 4 315 1,283 64,800 Totals 30 3,650 15,945 $ 959,950 In…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education