FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

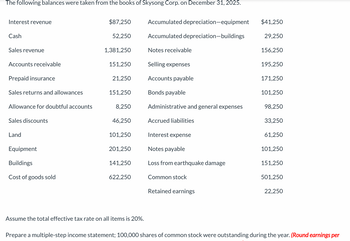

Transcribed Image Text:The following balances were taken from the books of Skysong Corp. on December 31, 2025.

Interest revenue

Cash

Sales revenue

Accounts receivable

Prepaid insurance

Sales returns and allowances

Allowance for doubtful accounts

Sales discounts

Land

Equipment

Buildings

Cost of goods sold

$87,250

52,250

1,381,250

151,250

21,250

151,250

8,250

46,250

101,250

201,250

141,250

622,250

Assume the total effective tax rate on all items is 20%.

Accumulated depreciation-equipment

Accumulated depreciation-buildings

Notes receivable

Selling expenses

Accounts payable

Bonds payable

Administrative and general expenses

Accrued liabilities

Interest expense

Notes payable

Loss from earthquake damage

Common stock

Retained earnings

$41,250

29,250

156,250

195,250

171,250

101,250

98,250

33,250

61,250

101,250

151,250

501,250

22,250

Prepare a multiple-step income statement; 100,000 shares of common stock were outstanding during the year. (Round earnings per

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Romie Ltd is preparing accounts for the year ended 31 December 20X5. The company has an estimated tax charge of $35,000 for the year ended December 20X5. The trial balance includes an entry of $2,000 relating to an over provision of tax in the previous financial year. What is the charge for tax in the statement of profit or loss for the year ended December 20X5?arrow_forwardAt the beginning of 2021, Pitman Co. had pretax financial income of $1,200,000. Additionally, there was a timing difference of $300,000 due to an accounts receivable that will not be collected until the following year. The tax rate us 30%. A. Calculate the total taxable income for 2021. B. Calculate Income tax expense, income tax payable, and the deferred amount for 2021, and create the journal entry.arrow_forwardRecording Income Tax Expense Rangee Rover Inc. had taxable income of $218,500 for the year. The GAAP basis of accounts receivable (net) is $13,800 less than the tax basis of accounts receivable. Assuming a tax rate of 25%, record the income tax journal entry on December 31. Assume zero beginning balances in deferred tax accounts. • Note: If a line in a journal entry isn't required for the transaction, select "N/A" as the account names and leave the Dr. and Cr. answers blank (zero). Date Account Name Cr. Dec. 31 Income Tax Expense Deferred Tax Liability Income Tax Payable N/A To record income tax expense. > > Dr. 54,625 0 0 O 0x 13,800 * 40,825 * 0arrow_forward

- Attached is the question and information for question 1a and 2a part 2barrow_forwardThe totals from the first payroll of the year are shown below. TotalEarnings FICAOASDI FICAHI FITW/H StateTax UnionDues NetPay $36,195.10 $2,244.10 $524.83 $6,515.00 $361.95 $500.00 $26,049.22 Journalize the entry to deposit the FICA and FIT taxes. For a compound transaction, if an amount box does not require an entry, leave it blank. Round your answers to two decimal places.arrow_forwardThe totals from the first payroll of the year are shown below. TotalEarnings FICAOASDI FICAHI FITW/H StateTax UnionDues NetPay $36,195.10 $2,244.10 $524.83 $6,515.00 $361.95 $500.00 $26,049.22 Journalize the entry to deposit the FICA and FIT taxes. For a compound transaction, if an amount box does not require an entry, leave it blank. Round your answers to two decimal places.arrow_forward

- With the following data, compute the NET FUTA Tax. Gross FUTA Tax DUE $ 6,750 Credit against FUTA (assume applicable) $3,100 Group of answer choices $3,100 $7,000 $3,650 $6,750arrow_forward3. Loudoun Trucking purchases 4,750 truck tires. The federal excise tax is $0.13 per tire. Find the amount (in $) of the excise tax for this transaction. $arrow_forwardPlease answer it in good accounting formarrow_forward

- In the following problem I am asked to compute Net Income. I am having a difficult time . Net Income is computed after Income Tax Expense. I am not sure of which amount the 20% tax rate is supposed to be taken from Presented below are selected ledger accounts of Waterway Corporation as of December 31, 2020. Cash $58,000Administrative expenses 116,000Selling expenses 92,800Net sales 626,400Cost of goods sold 243,600Cash dividends declared (2020) 23,200Cash dividends paid (2020) 17,400Discontinued operations (loss before income taxes) 46,400Depreciation expense, not recorded in 2019 34,800Retained earnings, December 31, 2019 104,400Effective tax rate 20% Compute Net Income for 2020arrow_forward7. Consider the following excerpts from the income statement and tax returns of Rashford Inc. Amounts in $ Income before taxes Taxable income a. 22.4% b. 19.6% Income statement Depreciation 200 Warranty expenses* 120 Fine 100 *Warranty expenditures are tax deductible when payments are made to fulfil the warranty. C. 23.38% d. 17.92% e. None of the above 1,500 ANSWER: A Tax returns The statutory tax rate is 21%. There are no temporary or permanent differences other than the ones listed in the table. The effective tax rate of Rashford Inc. is: ? 250 0 0arrow_forwardVishanoarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education