FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Dont uplode image in answer

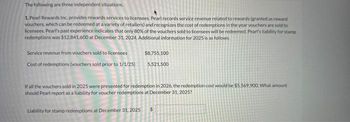

Transcribed Image Text:The following are three independent situations.

1. Pearl Rewards Inc. provides rewards services to licensees. Pearl records service revenue related to rewards (granted as reward

vouchers, which can be redeemed at a variety of retailers) and recognizes the cost of redemptions in the year vouchers are sold to

licensees. Pearl's past experience indicates that only 80% of the vouchers sold to licensees will be redeemed. Pearl's liability for stamp

redemptions was $12,841,600 at December 31, 2024. Additional information for 2025 is as follows.

Service revenue from vouchers sold to licensees

Cost of redemptions (vouchers sold prior to 1/1/25)

$8,755,100

5,521,500

If all the vouchers sold in 2025 were presented for redemption in 2026, the redemption cost would be $5.569.900. What amount

should Pearl report as a liability for voucher redemptions at December 31, 2025?

Liability for stamp redemptions at December 31, 2025 $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Repost the complete question and add sub-parts to be solarrow_forwardDuring January 2023, Nelson, Inc. acquired 40% of the outstanding common stock of Fuel Co. for $1,800,000. This investment gave Nelson the ability to exercise significant influence over Fuel. Fuel's assets on that date were recorded at $7,000,000 with liabilities of $4,000,000. Any excess of cost over book value of Nelson's investment was attributed to unrecorded patents having a remaining useful life of ten years. In 2023, Fuel reported net income of $500,000 and paid dividends of $20,000. What was the reported balance of Nelson's Investment in Fuel Co. at December 31, 2023? O a $1,968,000 Ob $3,000.000 O $2,100,000 Od $1,800,000 Oe $2.224.000arrow_forwardWhat goes in what, like what do I put on Collum a,b,c, etc I'm confused where to put the dataarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education