Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

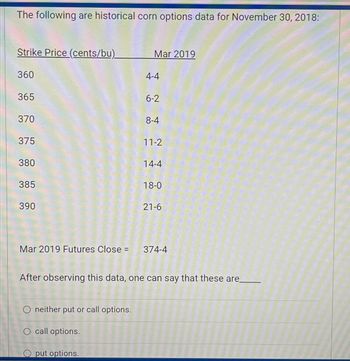

Transcribed Image Text:The following are historical corn options data for November 30, 2018:

Strike Price (cents/bu)_

360

365

370

375

380

385

390

Mar 2019

O neither put or call options.

O call options.

4-4

Oput options.

6-2

8-4

11-2

14-4

18-0

Mar 2019 Futures Close = 374-4

21-6

After observing this data, one can say that these are

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- M4arrow_forwardA farm that produces corn is looking to hedge their exposure to price fluctuations in the future. It is now May 15th and they expect their crop to be ready for harvest September 30th. You have gathered the following information: Bushels of corn they expect to produce 44,000 May 15th price per bushel $3.08 Sept 30 futures contract per bushel $3.22 Actual market price Sept 30 $3.37 Required (round to the nearest dollar): Calculate the gain or loss on the futures contract and net proceeds on the sale of the corn. Net gain or loss on future $Answer Sell the corn $Answer Net $Answerarrow_forwardCan you please help with the question in the picture attached? The answer should be only one and I’m quite confused. Thank you!arrow_forward

- Using the forward price approach to finish the following blanks. The expected closing basis was -$.15. And the actual closing basis was -$0.25. Date 1-Oct Cash Cash Price $6.30 Futures May Futures $6.75 Cost of holding from Oct 1 to May 1 (including interest) = $0.21 What is the forward price? What is the break-even price? What is the expected profit margin? = 1-Oct 1-May Sell Cash @ $6.40 Sell May Futures @ $6.75 Buy May Futures @ ? What is the futures price on May 1? What is the gain or loss on futures market result? = What is the gain or loss on cash market result? = What is the realized price (or net selling price)? = What is the overall profit? = What is the break-even price?arrow_forwardHedge May 20th: Producer plans to sell corn in early November. Currently the December corn futures are trading at $4.33. The expected basis is -$0.36. • Does the producer have a long or short cash position? long • To hedge: The producer will sell (buy/sell) Dec corn futures at $4.33/bu. • What is the expected price? $3.97 per bushel Nov. 10th: • The producer must sell (buy/sell) corn locally in the cash market at • . $4.18/bu. To offset their future position, they must buy $4.67/bu. What is the actual basis? -se.49 per bushel · (buy/sell) Dec futures at I What is the realized price for the producer? $3.84 per bushel о Method 1: o Method 2: о The hedge resulted in a realized price ofarrow_forwardThe following table shows the options quotation in U.S. dollars for Big Walnut Nut Company for June 30 of this year. Option Closing Price Strike Price Calls–Last Quote September Puts–Last Quote September 1 $43.00 $47.00 $2.00 $2.20 2 $43.00 $41.00 $3.00 $1.20 3 $43.00 $49.00 $1.60 $2.60 If you could exercise the options listed only on the expiration date (the third Friday of September), then these options would be ____ options. Assuming that the options listed are American options, on June 30, which of the call options for Big Walnut Nut Company listed in the table is in-the-money? Option 2 Option 1 Option 3arrow_forward

- The following table lists prices of Amazon options in January 2018 when Amazon stock was selling for $1,200. Exercise Price Expiration Date April 2018 Call Price Put Price $ 31.10 $1,200 1,300 1,400 $1,200 1,300 1,400 $1,200 1,300 1,400 $132.70 73.20 70.10 134.20 $ 53.55 96.00 33.00 July 2018 $161.70 104.00 62.55 156.05 January 2019 $210.00 $ 88.05 155.35 133.25 112.00 190.00 Suppose that by January 2019, the price of Amazon could either rise from its January 2018 level to $1,200 × 1.25 = $1,500.00 or fall to $1,200/1.25 = $960.00. a. What would be your percentage return on a January expiration call option with an exercise price of $1,200 if the stock price rose? (Round your answer to 2 decimal places.) b. What would be your percentage return if the stock price fell? (Negative value should be indicated by a minus sign.) c. Which is riskier: the stock or the option? a. Percentage return b. Percentage return Which is riskier: the stock or the option? % (100) % Option C.arrow_forwardThe below table shows the list of prices for puts expiring in 30 days (T = 1/12). Using the put option with a strike price of $236, estimate the level of the VIX index. K p 230 2.14 231 2.37 232 2.62 233 2.91 234 3.23 235 3.60 236 4.01 237 4.47 238 4.95 Other parameters you'll need: s0 = $234.35r = 0.74%T = 1/12 years (required precision 0.01 +/- 0.01)arrow_forwardThe answers should be found on the following website; cmegroup . Find the recent quotes for soybean futures. What is the longest maturity for this contract? Is there more trading in the nearer or more distant contracts? Does it cost more to buy soybeans for delivery in the next few months or for later delivery? ( give deeply step wise explaination with type the answer.)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education