FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

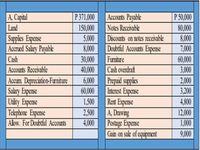

The following are accounts taken from the books of accounts of A Store. then, using the template below, identify the accounts if they are debits or credits.

Transcribed Image Text:A, Capital

P 371,000

Accounts Payable

Notes Receivable

5,000

P 50,000

Land

150,000

80,000

Supples Expense

Accrued Salary Payable

Cash

8,000

Furniture

Discounts on notes receivable

Doubtful Accounts Expense

8,000

7,000

30,000

60,000

3,000

Accounts Receivable

40,000

Cash overdraft

Prepaid supples

Accum Depreciation-Furniture

Sakary Experse

|Utlity Expense

Tekephone Expense

Allow. For Doubtful Accounts

2,000

3,200

6,000

Interest Expense

Rent Expense

A, Drawing

60,000

1,500

4,800

2,500

Postage Expense

Gain on sak of equipment

12,000

1,000

9,000

4,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Listed below are the transactions of Joseph Moore, D.D.S., for the month of September. Sept. 1 2 4 4 5 8 10 14 18 19 20 25 30 30 Moore begins practice as a dentist, invests $20,030 cash and issues 2,003 shares of $10 par stock. Purchases dental equipment on account from Green Jacket Co. for $17,820. Pays rent for office space, $690 for the month. Employs a receptionist, Michael Bradley. Purchases dental supplies for cash, $900. Receives cash of $1,770 from patients for services performed. Pays miscellaneous office expenses, $420. Bills patients $5,950 for services performed. Pays Green Jacket Co. on account, $3,760. Pays a dividend of $3,090 cash. Receives $1,060 from patients on account. Bills patients $1,980 for services performed. Pays the following expenses in cash: Salaries and wages $1,700; miscellaneous office expenses $83. Dental supplies used during September, $320. Record depreciation using a 5-year life on the equipment, the straight-line method, and no salvage value.arrow_forwardPlease help with the following question COMPLETION STATEMENTS 1.Notes and accounts receivable that result from sales transactions are often called______________ receivables. 2.Two accounting problems associated with accounts receivable are (1) ______________ and (2) ______________ accounts receivable. 3.The net amount expected to be collected in cash from receivables is the _____________. 4.When credit sales are made, _________________ Expense is considered a normal and necessary risk of doing business on a credit basis. 5.The two methods used in accounting for uncollectible accounts are the ____________ method and the ______________ method. 6.Allowance for Doubtful Accounts is a_____________ account which is ______________ from Accounts Receivable on the balance sheet. 7.When the allowance method is used to account for uncollectible accounts, ____________ is debited when an account is determined to be uncollectible. 8.The _________________ basis of…arrow_forwardPlease use the templates Thank you very much!arrow_forward

- If a credit is issued to a customer, how will this affect the General Ledger Account?arrow_forwardMatch each of the numbered descriptions with the term, title, or phrase that it best reflects. Indicate your answer by entering the letter A through J in the blank provided. A. General journal B. Special journal C. Subsidiary ledger D. Accounts receivable ledger E. Accounts payable ledger F. Controlling account G. Sales journal H. Cash receipts journal I. Purchases journal J. Cash payments journal 1. Used to record all cash payments. 2. Used to record all credit purchases. 3. Used to record all receipts of cash. 4. Used to record sales of inventory on credit. 5. Stores transaction data of individual customers. 6. Stores transaction data of individual suppliers. 7. Account that is said to control a specific subsidiary ledger. 8. Contains detailed information on a specific account from the general ledger. 9. Used to record and post transactions of similar type. 10. All-purpose journal in which any transaction can be recorded.arrow_forwardThe journal entry to record the sale of services on credit should include: a debit to Cash and a credit to Accounts Receivable. a debit to Accounts Receivable and a credit to Capital. a debit to Fees Income and a credit to Accounts Receivable. a debit to Accounts Receivable and a credit to Fees Income.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education