FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

The following additional information is available at December 31, 2018:

- Insurance of $450,000 was paid on May 1, 2018 for the 10-months to February 2019.

- The furniture and fixtures have an estimated useful life of 10 years and is being

depreciated on the straight-line method down to a residual value of $100,000. - The computer equipment was acquired on March 1, 2018 and is being depreciated over 10 years on the double-declining method of depreciation, down to a residue of $60,000.

- Wages earned by employees NOT yet paid amounted to 15,000 at December 31, 2018.

- A physical count of inventory at December 31, reveals $180,000 worth of inventory on hand.

- At December 31, $140,000 of the previously unearned sales revenue had been earned.

- The aging of the

Accounts Receivable schedule at December 31 indicated that the estimated uncollectible on account receivable should be $45,000.

REQUIRED:

- Prepare the closing entries

- Prepare the post-closing

trial balance

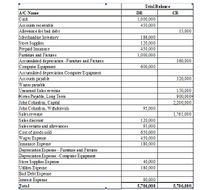

Transcribed Image Text:Trial Balance

A/C Name

DR

CR

Cash

1,000,000

Accounts receivable

Allowance for bad debt

450,000

15,000

Merchandise Inventory

Store Supplies

Prepaid Insurance

Furniture and Fix tures

Accumulated deprecia tion -Furniture and Fixtures

Computer Equipment

Accumulated deprecia tion Computer Equipment

Accounts payable

Wages payable

Unearned Sales re vemue

Notes Payable, Long Term

John Cohumbus, Capital

John Cohumbus, Withdrawals

186,000

120,000

450,000

1,000,000

360,000

600,000

320,000

150,000

900,000

2,200,000

95,000

Sales revemue

1,761,000

Sales discount

120,000

95,000

Sales returns and allowances

Cost of goods sold

Wages Expense

Insurance Expense

Depreciation Expense - Furniture and Fixtures

Depreciation Expense -Computer Equipment

Store Supplies Expense

Utlities Expense

Bad Debt Expense

Interest Expense

650,000

450,000

180,000

40,000

180,000

90,000

Total

5,706,000

5,706,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Monty Company purchases an oil tanker depot on January 1, 2020, at a cost of $ 552,300. Monty expects to operate the depot for 10 years, at which time it is legally required to dismantle the depot and remove the underground storage tanks. It is estimated that it will cost $ 81,010 to dismantle the depot and remove the tanks at the end of the depot’s useful life. Prepare the journal entries to record the depot and the asset retirement obligation for the depot on January 1, 2020. Based on an effective-interest rate of 6%, the present value of the asset retirement obligation on January 1, 2020, is $ 45,235. (If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Prepare any journal entries required for the depot and the asset retirement obligation at December 31, 2020. Monty uses straight-line depreciation; the estimated salvage value for the depot is…arrow_forwardLucky Lure Co. purchased a machine on October 1, 2018 for $125,000. It has a $15,000 residual value and a 10- year useful life. On July 1, 2020 the machine sold for $79,500. The company uses the double-declining-balance method of depreciation. The company fiscal year end is December 31. Instructions Prepare the journal entries for 2018 through 2020. Š A▾ B Iarrow_forwardFaithful Company purchased an equipment on January 2, 2021 for P3,000,000. The equipment had an estimated useful life of 5 years. It is the company's policy to use the double declining method in its first two years and then switch to the straight-line method for the remaining useful life of the asset. How much is the balance of the accumulated depreciation account pertaining to the equipment as of December 31, 2023?arrow_forward

- Coronado Company is in the process of preparing its financial statements for 2022. Assume that no entries for depreciation have been recorded in 2022. The following information related to depreciation of fixed assets is provided to you. Coronado purchased equipment on January 2, 2019, for $86,300. At that time, the equipment had an estimated useful life of 10 years with a $5,300 residual value. The equipment is depreciated on a straight-line basis. On January 2, 2022, as a result of additional information, the company determined that the equipment has a remaining useful life of 4 years with a $2,800 1. residual value. 2. During 2022, Coronado changed from the double-declining-balance method for its building to the straight-line method. The building originally cost $300,000. It had a useful life of 10 years and a residual value of $30,000. The following computations present depreciation on both bases for 2020 and 2021. 2021 2020 Straight-line $27,000 $27,000 Declining-balance 48,000…arrow_forwardSesame Company purchased a computer system for $74,000 on January 1, 2019. It was depreciated based on a 7-year life and an $18,000 salvage value. On January 1, 2021, Sesame revised these estimates to a total useful life of 4 years and a salvage value of $10,000. Prepare Sesame's entry to record 2021 depreciation expense. Sesame uses straight-line depreciation.arrow_forwardGeorge Company purchased a van on May 1, 2018 for $800,000. Estimated life of the van was five years, and its estimated residual value was $80,000. George uses the straight line method of depreication. The journal entry to record the depreciation expense for 2019 on the van would include: A) Debit Depreciation expense for $192,000 B) Credit Accumulated Depreciation for $192,000 C) Debit Depreciation expense for $96,000 D) Debit accumulated depreciation for $96,000arrow_forward

- McClain Company incurred the following expenditures during 2019: Apr. 9 The air conditioning system in the old manufacturing facility was replaced for $80,000. The old air conditioning system had a cost of $71,750 and a book value of $1,700. The old air conditioning system had no scrap value. June 29 Annual maintenance of $39,500 was performed. Sept. 12 The roof of the old manufacturing facility is replaced at a cost of $68,000. This expenditure substantially extended the life of the facility. Dec. 28 A new wing was added to the manufacturing facility at a cost of $261,000. This expenditure substantially increased the productive capacity of the plant. Required: 1. Prepare journal entries to record McClain’s expenditures for 2019. 2. Next Level What is the effect on the financial statements if management had improperly accounted for the: a. addition of the new wing to the manufacturing facility b. annual maintenance expendituresarrow_forwardWardell Company purchased a mini computer on January 1, 2019, at a cost of $40,000. The computer has been depreciated using the straight-line method over an estimated five-year useful life with an estimated residual value of $4,000. On January 1, 2021, the estimate of useful life was changed to a total of 10 years, and the estimate of residual value was changed to $900.Required:1. Prepare the appropriate adjusting entry for depreciation in 2021 to reflect the revised estimate.2. Prepare the appropriate adjusting entry for depreciation in 2021 to reflect the revised estimate, assuming that the company uses the sum-of-the-years’-digits method instead of the straight-line method.arrow_forwardWhispering Company owns equipment that cost $100,000 when purchased on January 1, 2019. It has been depreciated using the straight-line method based on an estimated salvage value of $10,000 and an estimated useful life of 5 years. Depreciation expense adjustments are recognized annually. Instructions: Prepare Whispering Company's journal entries to record the sale of the equipment in these four independent situations. Update depreciation on assets disposed of at time of sale. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) (a) (b) (c) (d) (e) (f) (a) Sold for $59,000 on January 1, 2022. Sold for $59,000 on April 1, 2022. SR. Account Titles and Explanation (b) Sold for $21,000 on January 1, 2022. Sold for $21,000 on September 1, 2022. Repeat (a), assuming Whispering uses double-declining…arrow_forward

- 1) Equipment was purchased on January 1, 2019 for $800,000. At the time of its purchase, the equipment was estimated to have a useful life of five years and a salvage value of $50,000. The equipment was depreciated using the straight- line method of depreciation through 2021. At the beginning of 2022, the estimate of useful life was revised to a total life of eight years and the expected salvage value was changed to $30,000. The amount to be recorded for depreciation for 2022 is?arrow_forwardOn July 1, 2019, Cullumber Company purchased new equipment for $90,000. Its estimated useful life was 6 years with a $12,000 salvage value. On December 31, 2022, the company estimated that the equipment’s remaining useful life was 10 years, with a revised salvage value of $5,000. Compute the revised annual depreciation on December 31, 2022.arrow_forwardMcClain Company incurred the following expenditures during 2019: Apr. 9 The air conditioning system in the old manufacturing facility was replaced for $85,500. The old air conditioning system had a cost of $73,750 and a book value of $1,900. The old air conditioning system had no scrap value. June 29 Annual maintenance of $37,000 was performed. Sept. 12 The roof of the old manufacturing facility is replaced at a cost of $64,250. This expenditure substantially extended the life of the facility. Dec. 28 A new wing was added to the manufacturing facility at a cost of $265,000. This expenditure substantially increased the productive capacity of the plant. Required: 1. Prepare journal entries to record McClain’s expenditures for 2019. 2. Next Level What is the effect on the financial statements if management had improperly accounted for the: a. addition of the new wing to the manufacturing facility b. annual maintenance expenditures CHART OF…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education