FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

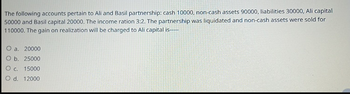

Transcribed Image Text:The following accounts pertain to Ali and Basil partnership: cash 10000, non-cash assets 90000, liabilities 30000, Ali capital

50000 and Basil capital 20000. The income ration 3:2. The partnership was liquidated and non-cash assets were sold for

110000. The gain on realization will be charged to Ali capital is-----

O a. 20000

O b. 25000

O c. 15000

O d.

12000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following accounts pertain to Ali and Basil partnership: cash 10000, non-cash assets 90000, liabilities 30000, Ali capital 50000 and Basil capital 20000. The income ration 3:2. The partnership was liquidated and non-cash assets were sold for 110000. The balance of cash after sales on non-cash assets will be - O a. 120000 O b. 140000 O c. 130000 Od 150000arrow_forwardThe condensed balance sheet and profit – sharing ratio of the partnership of Wenda, Wendy, and Wilma are presented below: Cash P 22,500.00 Liabilities P52,500.00 Due from Wanda 7,500.00 Due to Wilma 10,000.00 Other assets 205,000.00 Wanda, cap’l (4) 75,000.00 Wendy, cap’l (3) 50,000.00 Wilma, cap’l (3) 47,500.00 Total assets P235,000.00 Total equities P235,000.00 21. The partners agreed to liquidate and they sold all the Other assets for P150,000.00. How much of the available cash should go to Wanda? a. P45,500.00 b. P75,000.00 c. P42,500.00 d. P53,000.00 22. Refer to No. 21 above, how much will be received by Wendy in the partnership liquidation a. P41,000.00 b. P74,000.00 c. P33,500.00 d. P66,600.00arrow_forwardEarrow_forward

- Presented below is the condensed balance sheet of the partnership of A, B, and C who share profits and losses in the ratio of 2:3:5. respectively: Cash 100,000 Liabilities 50,000 Other assets 350,000 A, Capital 110,000 В, Сapital 120,000 C, Capital 170,000 Total 450,000 Total 450,000 The partners agree to sell to D 10% of their respective capital and profit and loss interests for a total payment of P50,000. The payment by D is to be made directly to the individual partners using the book value approach. The capital balances of A,B, and C, respectively after admission of D are:arrow_forwardThe partnership of Hendrick, Mitchum, and Redding has the following account balances: Cash Noncash assets a Maximum amount b Distributed $ 51,000 136,000 This partnership is being liquidated. Hendrick and Mitchum are each entitled to 30 percent of all profits and losses with the remaining 40 percent going to Redding. Hendrick Mitchum Liabilities Hendrick, capital Mitchum, capital Redding, capital a. What is the maximum amount that Redding might have to contribute to this partnership because of the deficit capital balance? b. How should the $10,000 cash that is presently available in excess of liabilities be distributed? c. If the noncash assets are sold for a total of $51,000, what is the minimum amount of cash that Hendrick could receive? (Do not round intermediate calculations.) Redding C Minimum amount $ 41,000 91,000 71,000 (16,000)arrow_forwardThe equal DEF partnership has the following balance sheet:Cash and other assets $400,000Recourse liabilities $100,000Capital – D $100,000Capital – E $100,000Capital – F $100,000The profits and losses are allocated 40% to D, and 30% each to E and F. Under thepartnership agreement there is a capital account deficit restoration provision. Howshould the liability be allocated?arrow_forward

- please answer do not image formatarrow_forwardThe following condensed balance sheet is for the partnership of Hardwick, Saunders, and Ferris, who share profits and losses in the ratio of 4:3:3, respectively: Cash Other assets Hardwick, loan Total assets $ 93,000 815,000 44,000 Beginning balances Sold assets $952,000 Accounts payable Ferris, loan Hardwick, capital Saunders, capital Ferris, capital Adjusted balances Max loss on remaining noncash assets Paid liabilities Safe payments Total liabilities and capital The partners decide to liquidate the partnership. Forty percent of the other assets are sold for $125,000. Prepare a proposed schedule of liquidation at this point in time. (Amounts to be deducted should be entered with a minus sign.) HARDWICK, SAUNDERS, AND FERRIS Proposed Schedule of Liquidation Cash Other Assets $ 48,000 54,000 380,000 240,000 230,000 $952,000 Accounts Payable Hardwick, Loan and Capital Saunders, Capital Ferris, Loan & Capitalarrow_forwardAlpha and Beta are partners who share income in the ratio of 1:2 and have capital balances of $41,700 and $79,200, respectively, at the time they decide to terminate the partnership. Noncash assets with a book value of $120,900 are sold for $75,000. What amount of loss on realization should be allocated to Alpha? a.$75,000 b.$41,700 c.$25,000 d.$15,300arrow_forward

- developed in part a(3). etd 189fc64d53a0a6a71 PROBLEM C.11 Dividing Partnership Profit and LossLOC-10 Rothchild Furnishings, Inc., has three partners-Axle, Brandt, and Conrad. At the beginning of the current year their capital balances were: Axle, $180,000; Brandt, $140,000; and Conrad, $80,000. The partnership agreement provides that partners shall receive salary allowances as follows: Axle, $10,000; Brandt, $50,000; and Conrad, $28,000. The partners shall also be allowed 12 percent interest annually on their capital balances. Residual profit or loss is to be divided: Axle, one-half; Brandt, one-third; and Conrad, one-sixth. Instructions Prepare separate schedules showing how income will be divided among the three partners in each of the following cases. The figure given in each case is the annual partnership net income or loss to be allocated among the partners. Round calculations to the nearest dollar. a. Income of $526,000. b. Income of $95,000. c. Loss of $32,000. PROBLEM C.12 Who…arrow_forward5.1 Al and Tantay are partners sharing profits equally. The condensedbalance sheet of their partnership prior to liquidation is shownbelow: Assets Liabilities and EquityCash P1,900 Accounts Payable P 27,200Accounts Receivable 7,200 Al Capital 15,000Merchandise Inventory 16,400 Tantay Capital 5,000Equipment 21,700 P 47,200 P 47,200They decided to liquidate and the assets realized the followingamounts in cash:Accounts Receivable P 4,200Merchandise 11,200Equipment 16,000REQUIRED: Prepare working paper for the Statement of Liquidation using the lump sum liquidation method and give all the corresponding…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education