FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Domestic

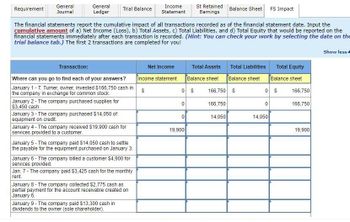

Transcribed Image Text:Requirement

General

Journal

General

Ledger

Transaction:

Where can you go to find each of your answers?

January 1 - T. Turner, owner, invested $166,750 cash in

the company in exchange for common stock.

January 2- The company purchased supplies for

$3,450 cash.

Trial Balance

January 3 - The company purchased $14,050 of

equipment on credit.

The financial statements report the cumulative impact of all transactions recorded as of the financial statement date. Input the

cumulative amount of a) Net Income (Loss), b) Total Assets, c) Total Liabilities, and d) Total Equity that would be reported on the

financial statements immediately after each transaction is recorded. (Hint: You can check your work by selecting the date on the

trial balance tab.) The first 2 transactions are completed for you!

Show less

January 4- The company received $19,900 cash for

services provided to a customer.

January 5 - The company paid $14,050 cash to settle

the payable for the equipment purchased on January 3.

January 6- The company billed a customer $4,900 for

services provided.

Jan. 7- The company paid $3,425 cash for the monthly

rent.

January 8- The company collected $2,775 cash as

partial payment for the account receivable created on

January 6.

January 9 - The company paid $13,300 cash in

dividends to the owner (sole shareholder).

Income

Statement

Net Income

Income statement

S

0

St Retained

Earnings

Total Assets

Balance sheet

0 S 166,750 S

166,750

14,050

0

Balance Sheet

19,900

Total Liabilities

Balance sheet

Total Equity

Balance sheet

0 $

FS Impact

0

14,050

166,750

166,750

19,900

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education