Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

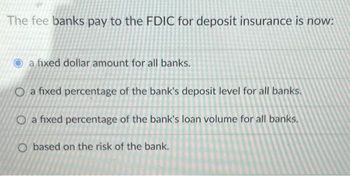

Transcribed Image Text:The fee banks pay to the FDIC for deposit insurance is now:

a fixed dollar amount for all banks.

O a fixed percentage of the bank's deposit level for all banks.

O a fixed percentage of the bank's loan volume for all banks.

O based on the risk of the bank.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- 17. Assume that a bank obtains most of its funds from long-term borrowed funds such as Federal Home Loan Bank borrowings. The bank's assets are in the form of loans with rates that adjust affected if interest rates every three months. In the next three months, the bank would be increase. A. negatively. B. favorably. C. unaffected.arrow_forwardAssume that all banks are loaned up and that the reserve requirement is 2%. If you deposit $10,000 in currency into your checking account, what is the change in the MONEY SUPPLY? (Round answers to the nearest whole number, and be careful about signs.)arrow_forwardPLEASE SOLVEarrow_forward

- The T-account below represents assets and liabilities for a bank. Use the T-account to calculate the bank's loans Loans Bonds Reserves Provide your answer below: million Assets ? $18 million $5 million Liabilities + Net Worth Deposits Net Worth $12 million $13 millionarrow_forwardAssume that banks holds no excess reserves and the public holds no currency: A. If a bank receives a deposit inflow of $100,000 explain (using t-accounts) what happens to this bank and one additional round in the deposit creation process assuming the reserve requirement is 8%. B. How much do deposits and loans change for the banking system when the process is completed? Show computation and the entire banking system's final T-account. C. Suppose the Central Bank sells $5 billion to ABC Bank. Determine what happens to checkable deposits of the entire banking system after the sale and completion of the multiple deposit creation process. Determine the change in checkable deposit in the banking system and show the T-account of the banking system.arrow_forwardIts full one question please help ill definitely likearrow_forward

- How do you calculate the rate on an Adjustable Rate Mortgage? Survey the cost of funds an local banks. O Use the amortization formula. With a financial calculator. O Index + Marginarrow_forwardFractional reserve banking refers to a banking system in which bank loans are less than bank reserves. bank deposits are less than bank reserves. bank reserves are less than total deposits. bank reserves are only a fraction of required reserves.arrow_forward2.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education