ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

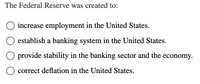

Transcribed Image Text:The Federal Reserve was created to:

- ○ increase employment in the United States.

- ○ establish a banking system in the United States.

- ○ provide stability in the banking sector and the economy.

- ○ correct deflation in the United States.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- I need help with this hwarrow_forwardQUESTION 5 Which of the following can the Federal Reserve do to reduce money supply O A. lower reserve requirements O B. issue more currency C. sell government bonds D. buy government bondsarrow_forwardIn 2007-08, the financial crisis led money multiplier to and the money supply to which would cause the excess reserves ratio to and depositors are likely to their holdings of currency. O decrease; decrease: increase; increase O increase; increase; decrease; decrease: decrease; increase; decrease: increase; O increase; decrease; increase; decrease; « Previous Next Quiz saved at 9:26am Submit Quizarrow_forward

- 19... Acquiring information on a bank's activities in order to determine a bank's risk is difficult for depositors and is another argument for government Question 19 options: a) ownership. b) forbearance. c) regulation. d) recall.arrow_forwardBefore October 2008, if the Fed were to increase the discount rate so that it was much higher than the federal funds rate, eventually reserves would have decreased and the money supply would have decreased. O reserves would have increased and the money supply would have increased. reserves would have decreased and the money supply would have increased. O reserves would have increased and the money supply would have decreased.arrow_forwardThe federal funds rate A. equals the discount rate. B. only matters to banks and has very little impact on individual consumers. C. is set by the Federal Reserve Bank. D. is the rate that banks charge each other for short-term loans of excess reserves.arrow_forward

- The federal funds rate is: Select an answer and submit. For keyboard navigation, use the up/down arrow keys to select an answer. a the interest rate that the Federal Reserve charges banks when banks borrow reserves from the Federal Reserve. b the market interest rate that banks pay each other when they borrow reserves from each other. c the interest rate the the Federal Reserve pays on banks' required reserves. d the interest rate that the Federal Reserve pays on banks' excess reserves.arrow_forwardThe Federal Reserve a. was created in 1896. b. is part of the executive branch of government. c. is the central bank of the United States. d. is only responsible for controlling the money supply.arrow_forwardPage 4 5. Use the following T-account information and the fact that the required reserve ratio in this economy is 0.10 (i.c., 10 %) to answer the questions below (Show your work) Treasury dd T 20 Bonds 600 Bonds Loans to Fed 300 dd 190 B dd 100 T 20 Banks FRN 200 Public 1500 Loans from Banks 850 Banks Cash 60 dd p 1500 dd p P dd B 190 Other Cash 150 Loans to Deposits 100 Bonds 100 Public 850 Loans from Other Bonds 100 Fed 100 Deposits 100 a. What are the Bank Reserves? b. What are the Bank Required Reserves? c. What are the Bank Excess Reserves? d. What is the current Money Supply (MI)? e. If Banks maximized their Loans to the Public, using up all their excess reserves, what will be the new Money Supply? f. The Fed did not like the new Money Supply and sold 40 in Bonds to Banks. After the banks bought the bonds, they have to call in loans from the public. What will be the new Money Supply end up being after the banks made the required changes? g. If the Banks refused the buy the 40 in…arrow_forward

- If a society chooses fiat money as its money form, it __________.Group of answer choices A. will need to make sure the currency is convertible into gold B. must make sure there is an illiquid money supply C. should estimate any central bank D. must be particularly vigilant about controlling the quantity of moneyarrow_forwardThe table shows the commercial banks' balance sheet (aggregated over all the banks). The commercial banks' desired reserve ratio on all deposits is 10 percent and there is no currency drain. Calculate the bank's excess reserves. >>> Answer to 2 decimal places. Assets Reserves at the Fed Cash in vault Securities Loans The banks' excess reserves are $☐ million. Liabilities (millions of dollars) 2535 20 Checkable deposits 15 Savings deposits 40 95arrow_forwardQuestion 3 If the Federal Reserve wants to increase the money supply, it can O increase the reserve ratio, allowing banks to loan more money to customers. O reduce the reserve ratio, allowing banks to loan more money to customers. sell bonds on the open market to banks, allowing them to loan less money to customers. O increase the reserve ratio, making it harder for banks to loan money to customers. Question 4 DELL Carrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education