ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

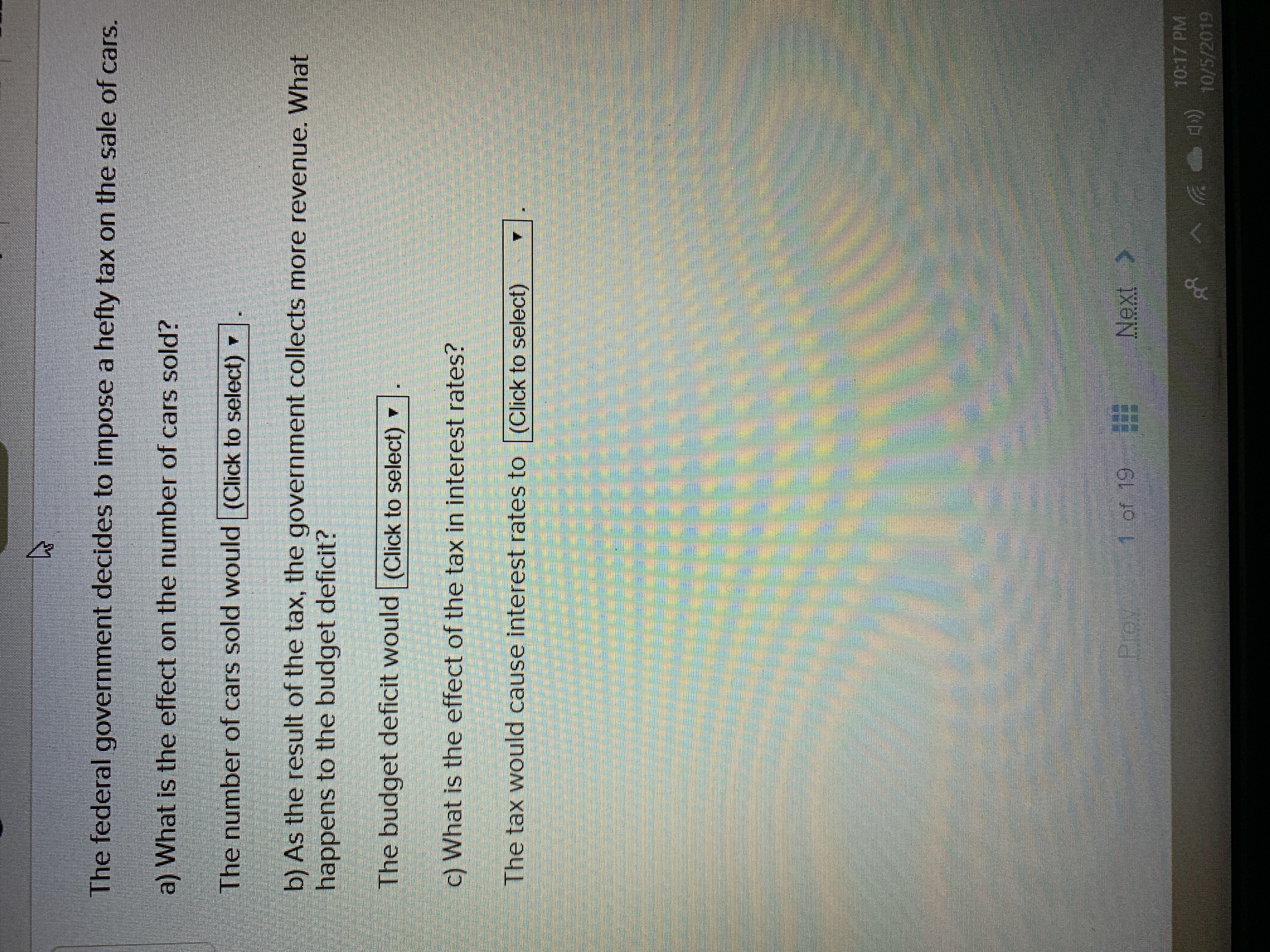

Transcribed Image Text:The federal government decides to impose a hefty tax on the sale of cars.

a) What is the effect on the number of cars sold?

The number of cars sold would (Click to select)

b) As the result of the tax, the government collects more revenue. What

happens to the budget deficit?

The budget deficit would (Click to select)

c) What is the effect of the tax in interest rates?

The tax would cause interest rates to (Click to select)

1 of 19

Next

Prey

10:17 PM

10/5/2019

ర

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- How and why would the line-item veto influence budget reforms and reduce deficits?arrow_forwardWhat items are part of mandatory spending in the federal government?arrow_forwardWhat would happen to the budget deficit if the:a) GDP growth rate jumped from 1 percent to 3 percent?b) inflation increased by 2 percentage points?arrow_forward

- In recent economic history, the U.S. federal budget was in surplus from 2001 through 2005. 1998 through 2001. 1990 through 1997. 1980 through 1989.arrow_forwardThe federal budget usually shows a surplus. True or False?arrow_forward←05 Survey Junkie 17 Gmail C https:/Assign W 2 https://highschools.foolproofonline.info/modules/taxes/board13.php YouTube Maps Dashboard - HMH Ed Okay, more Practice Questions: This is: Identify the type of tax for each example. Example 1: You are charged this tax by the federal government on your yearly pay. O Income Tax. O Sales Tax. O Property Tax. O Excise Tax. This is: Example 2: You own a piece of property and receive a tax bill from the state each year. O Income Tax. O Sales Tax. O Property Tax. O Excise Tax. EN Anglais (ats-Unis) E $ 4 0.6.76 Edmen w foolpro Cc X R 5 T Y & 7 F9 8arrow_forward

- Question 1 There is a recession gap of $150 billion in the economy. The MPS is 20%. What is the MPC [Select] and the Government Spending Multiplier [Select] Government need to [Select] much [Select] change taxes, would they [Select] the Tax multiplier [Select] [Select] ? Would the spending? By how ? If the Government decided to taxes? What is and by how mucharrow_forwardNow assume the government raises the tax from $1.00 to $1.50. This causes sale to decline from 10,000 units to 5,000 units. a) calculate the price(tax) elasticity of demand. b) is it elastic, inelastic, or unit elastic? c) what happens to total tax revenue?arrow_forwardIf you voted for your committees to increase overall spending under your jurisdiction, resulting in a budget deficit for the overall federal budget, what would you expect to see happen to the national debt?arrow_forward

- The budget function for the economy of Sunsville is T - G = -400 + 0.25Y.a) Suppose income is $4,000. What is the value of the budget surplus or deficit?b) What range of income will give Sunsville a budget surplus?c) What range of income will give Sunsville a budget deficit?d) At what level of income will there be a balanced budget?arrow_forwardOregon Hikes Cigarette Tax by $2 Last November Oregon voters overwhelmingly approved higher taxes on cigarettes and a new tax on e-cigarettes. Effective January 1, 2021, the state tax on a pack of cigarettes jumped from $1.33 to $3.33, the sixth-highest state tax in the nation. That will bring the average retail price up to $8.33 a pack, almost a 32 percent increase. State officials are expecting a tax windfall of $135 million in 2021 from the higher taxes. That assumes Oregonians continue to buy cigarettes at the same rate. Economists warn, however, that smokers reduce cigarette purchases when prices go up. Typically, unit sales decline by 4 percent when cigarette prices go up by 10 percent. The drop in unit sales may be larger in Oregon, as residents will have the option of purchasing smokes from other states, Indian reservations, and online. Source: Media reports of November 2020–February 2021. According to the News Wire, Instructions: Round your responses to one decimal…arrow_forwardThe federal government ran a budget surplus in the late 1990 and in the year 2000, but has since returned to running a budget deficit. Explain why reducing the budget deficit can cause short-term pain in the form of lower employment, higher unemployment, and a recession. (Use diagram and analysis)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education