Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

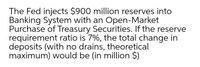

Transcribed Image Text:The Fed injects $900 million reserves into

Banking System with an Open-Market

Purchase of Treasury Securities. If the reserve

requirement ratio is 7%, the total change in

deposits (with no drains, theoretical

maximum) would be (in million $)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- If the required reserve ratio is 15%, currency in circulation is $400 Billion, checkable deposists are $8000 billion, and excess reserves total is $0.8 billion. first) calculate the M1 money multiplier second) if the monetatyr base now increases by $275 billion, how much would money supply increase by?arrow_forwardF2 Penco Supply spends £428,000 a week to pay bills and maintains a lower cash balance limit of £75,000. The standard deviation of its disbursements is £18,900. The applicable interest rate is 5 per cent and the fixed cost of transferring funds is £65. What is the firm's optimal initial cash balance based on the BAT model?arrow_forwardNonearrow_forward

- Ef 321.arrow_forwardSuppose a bank currently has $250,000 in deposits and $27,000 in reserves. The required reserve ratio is 10%. If at the end of the day, there is an unexpected withdrawal of $4,000 in reserves, what is the bank's resulting reserve ratio (expressed as a %)? Using the information from the prior problem, how much would the bank need to borrow in either the Fed Funds market or at the discount window, to be in complicance with the required reserve ratio?arrow_forward2. Government Treasury bills are yielding 4.15%. Inflation is 2.75%. What is the real rate of return on this financial asset? A. 6.90% B. 7.01% C. 1.36% D. 1.40%arrow_forward

- D1. Please redraw the balanced T-account.arrow_forwardThe Fed conducts an open market operation and increase a bank's excess reserves by $7,000. Explain the first five rounds of the money creation process if the desired reserve ratio is 20% and if people keep no currency outside of the banking system. (5 points) Rounds Deposits Reserves Loans 1 $7,000 $1,400 $5,600 2 $5,600 $1,120 $4,480 345 $4,480 $896 $3,584 $3,584 $716.8 $2,867.2 $2,867.2 $573.44 $2,293.76arrow_forwardA2-2. The Chinese central bank (PBOC) recently lowered its required reserve ratio for banks in China. If we assume that the initial balance sheet of the banking system is as shown below, and that everyone holds all their money in the banking system, and that the reserve ratio is decreased from 10% to 5%, both loans and the money supply will increase by 1000.arrow_forward

- A bank has an adjusted amount of $536 million in high-quality liquid assets, and $425 million in adjusted potential outflows, with an additional $75 million in adjusted derivative risk. What is the bank's LCR?arrow_forwardI need both a ) and b)answers i will give upvotes no chatgptarrow_forwardProvide help with this Questionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education