FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

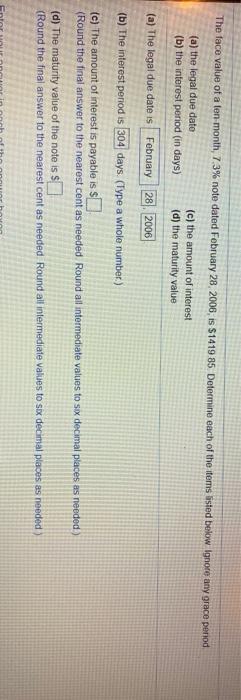

Transcribed Image Text:The face value of a ten month, 7.3% note dated February 28, 2006, is $1419 85 Determine each of the tems isted below Ignore any grace period

(a) the legal due dato

(b) the interest period (in days)

(c) the amount of interest

(d) the maturity value

(a) The legal due date is February 28 2006

(b) The interest period is 304 days. (Type a whole number.)

(e) The amount of interest is payable is S

(Round the final answer to the nearest cent as needed. Round al intermediate values to sox decimal places as needed)

(d) The maturity value of the note is

(Round the final answer to the nearest cent as needed Round all intermediate values to sox decimal places as needed)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Complete the following, using exact interest. (Use Days in a year table.) Note: Do not round intermediate calculations.Round the "Interest" and "Maturity value" to the nearest cent. Principal $ 2,100 Interest rate 5% Date borrowed May 9 Date repaid August 14 Exact time Interest Maturity valuearrow_forwardThe face value of a nine-month, 6.1% note dated April 30, 2006, is $589.09. Determine each of the items listed below. Ignore any grace period. (a) the legal due date (c) the amount of interest (b) the interest period (in days) (d) the maturity value (a) The legal due date isarrow_forwardHow do I find the maturity value and maturity date of an interest-bearing promissory note that has a face value of $1,270? Interest rate percent of 7.1 and term of note 130 days?arrow_forward

- The loan below was paid in full before its due date. (a) Obtain the value of h from the annual percentage rate table. Then (b) use the actuarial method to find the amount of unearned interest, and (c) find the payoff amount. Regular Monthly Payment $445.22 Remaining Number of Scheduled Payments after Payoff 6 APR 11.0% Click the icon to view the annual percentage rate table. (a) h=$ (b) The unearned interest is $ (c) The payoff amount is $ (Round to the nearest cent as needed.) (Round to the nearest cent as needed.)arrow_forwardData table Valley Source Foods Income Statement (Partial) Year Ended December 31, 2025 $ Net Sales Revenue Cost of Goods Sold Gross Profit $ 116,000 53,000 63,000 - Xarrow_forwardAssuming a 360-day year, when a $11,392, 90-day, 10% interest-bearing note payable matures, total payment will be a. $11,677 Ob. $12,531 Oc. $1,139 Od. $285 That's Built PlueAarrow_forward

- KE A non interest bearing promissory note for $1484 00 was discounted at 3% pa. compounded monthly. If the proceeds of the note were $1365.00, how long before the due date was the note discounted? State your answer in years and months (from 0 to 11 months) The note was discounted year(s) and month(s) before the due datearrow_forwardThe loan below was paid in full before its due date: (a). Obtain the value of h from the annual percentage rate table. Then (b) use the actuarial method to find the amount of unearned interest, and (c) find the payoff amount. Regular Monthly Payment $494.14 APR 4.0% Remaining Number of Scheduled Payments after Payo!! 12 Click the icon to view the annual percentage rate table. (b) The unearned interest is (Round to the nearest cent as needed) (c) The payoff amount is $(Round to the nearest cent as needed)arrow_forward6) A company receives a 5%, 90-day note for $5,400. The total interest due on the maturity date is: (Use 360 days a year.) A) $67.50. B) $270.00. C) $157.50. D) $135.00. E) $90.00.arrow_forward

- Complete the following, using exact interest. (Use Days in a year table.) Note: Do not round intermediate calculations. Round the "Interest" and "Maturity value" to the nearest cent. Principal Interest rate 5% 590 Date borrowed Date repaid Exact time June 10 December 12 Interest Maturity valuearrow_forwardAm. 327.arrow_forwardPresented below are data on three promissory notes. Determine the missing amounts. (Use 360 days for calculation. Do not round intermediate calculations.) Date of Note Terms Maturity Date Principal Annual Interest Rate 60 April 1 $810,000 6 % tA $ days 30 July 2 70,800 % days 6 March 7 128,000 10 % $ months Total Interest $590arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education