FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

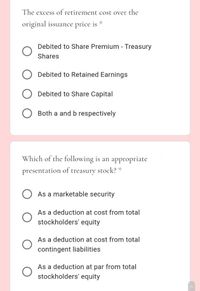

Transcribed Image Text:The excess of retirement cost over the

original issuance price is

Debited to Share Premium - Treasury

Shares

Debited to Retained Earnings

Debited to Share Capital

Both a and b respectively

Which of the following is an appropriate

presentation of treasury stock?"

As a marketable security

As a deduction at cost from total

stockholders' equity

As a deduction at cost from total

contingent liabilities

As a deduction at par from total

stockholders' equity

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- When using discounted dividend method to estimate stock price, which of the following should be used as the discount rate? - required return of debt - risk free rate - required return of the equity - WACC - Bank deposit ratearrow_forwardIn computing Earnings per share when there are preference shares, the total net income after tax is reduced by the dividend in arrears of cumulative preference shares. a. TRUE b. FALSEarrow_forwardThe Equity Method of accounting for investments: a) Requires the investment asset to increase proportionally with the affiliates net income b) Requires the investment asset to decrease proportionally with the affiliates net loss c) Requires the investment asset to decrease proportionally with dividends received d) All of the abovearrow_forward

- For fi nancial assets classifi ed as held to maturity, how are unrealized gains and losses refl ected in shareholders’ equity?B . Th ey fl ow through retained earnings.arrow_forwardDiluted earnings per share shows dilution resulting from additional shares that may be issued for stock options or bonds that may be converted to shares of common stock in the future. True Falsearrow_forwardCalculate the total cost (in $), proceeds (in $), total gain (or loss) (in $), and return on investment for the mutual fund investment. The offer price is the purchase price of the shares, and the net asset value is the price at which the shares were later sold. (Round your return on investment to one decimal place.) Shares OfferPrice TotalCost Net AssetValue Proceeds Per ShareDividends Total Gain(or Loss) Return onInvestment% 500 $10.60 $ $12.80 $ $0.65 $ %arrow_forward

- A major difference between IFRS and GAAP relates to the Revaluation surplus account. Retained earnings account. Share capital account. Share premium account.arrow_forwardWhen treasury stock is purchased for cash at more than its par value, what is the effect on total shareholders’ equity under each of the following methods?arrow_forwardThe distribution of a dividend that represents a partial return of the original investment made by the shareholders is known as a. participating dividend. b. liquidating dividend. c. property dividend.arrow_forward

- hh.3arrow_forward4. Define the following terms. Signaling hypothesis; clientele effect Residual distribution model; extra dividend Declaration date; holder-of-record date; ex-dividend date; payment date Dividend reinvestment plan (DRIP) Stock split; stock dividend; stock repurchasearrow_forwardhelparrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education