Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

The last one I posted only a few parts were correct. Please help me out and answer all correctly.

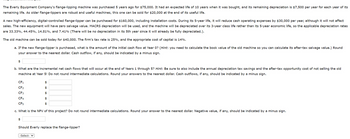

Transcribed Image Text:The Everly Equipment Company's flange-lipping machine was purchased 5 years ago for $75,000. It had an expected life of 10 years when it was bought, and its remaining depreciation is $7,500 per year for each year of its

remaining life. As older flange-lippers are robust and useful machines, this one can be sold for $20,000 at the end of its useful life.

A new high-efficiency, digital-controlled flange-lipper can be purchased for $160,000, including installation costs. During its 5-year life, it will reduce cash operating expenses by $30,000 per year, although it will not affect

sales. The new equipment will have zero salvage value. MACRS depreciation will be used, and the machine will be depreciated over its 3-year class life rather than its 5-year economic life, so the applicable depreciation rates

are 33.33%, 44.45%, 14.81%, and 7.41% (There will be no depreciation in its 5th year since it will already be fully depreciated.).

The old machine can be sold today for $40,000. The firm's tax rate is 25%, and the appropriate cost of capital is 14%.

a. If the new flange-lipper is purchased, what is the amount of the initial cash flow at Year 0? (Hint: you need to calculate the book value of the old machine so you can calculate its after-tax salvage value.) Round

your answer to the nearest dollar. Cash outflow, if any, should be indicated by a minus sign.

$

b. What are the incremental net cash flows that will occur at the end of Years 1 through 5? Hint: Be sure to also include the annual depreciation tax savings and the after-tax opportunity cost of not selling the old

machine at Year 5! Do not round intermediate calculations. Round your answers to the nearest dollar. Cash outflows, if any, should be indicated by a minus sign.

CF₁

CF₂

CF3

$

$

$

CF4

$

CF5

$

c. What is the NPV of this project? Do not round intermediate calculations. Round your answer to the nearest dollar. Negative value, if any, should be indicated by a minus sign.

$

Should Everly replace the flange-lipper?

-Select- ✓

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- In what format can you distribute T4, T4A, T5, or T4FHSA slips by email or electronic portal without obtaining consent? * 1 point > A) Always B) Only when requested by the recipient Only when the recipient is on extended leave D) Neverarrow_forwardsolve all of them. I mentioned in my question to solve all the partsarrow_forwardIt is showing the above response of 0.98 as incorrect, and showing this message (See attached image). Can you please recheck?arrow_forward

- I really need help with this item below. I have tried a few different ways to do this problem, but the top box keeps coming back as incorrect. I know that the amounts are correct, but the first box is wrong for some reason. Please read the feedback boxes and include the appropriate formulas and cell references for this item. This is done through Excel. PLEASE HELP!!!!!! Note that the pictures are the same exact problem, but I used two separate formulas to try and solve this problem.arrow_forwardAnswer the following questions by writing down the correct letter next to the relevant number:arrow_forwardAll blanks need to be filled please and thank you, it's incomplete as of now.arrow_forward

- The answer 417,974.94 was correct. Can you please help me solve without technology? Formulas used, etc. Thank you!arrow_forwardYou guys provided me an expert answer? Cuz the table for the part 1 of the p missing as well on volum PR what do i enter? and the part 2 has a table but c utilized.arrow_forwardTrue or false? In a manual system, it is proper to splits journal entry at the bottom page.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education