FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Please explain

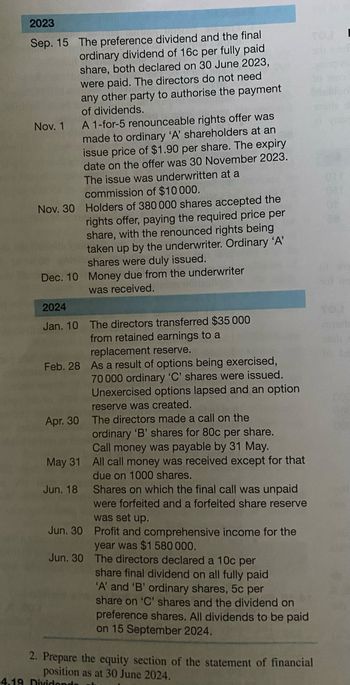

Transcribed Image Text:2023

Sep. 15

Nov. 1

The preference dividend and the final

ordinary dividend of 16c per fully paid

share, both declared on 30 June 2023,

were paid. The directors do not need

any other party to authorise the payment

of dividends.

2024

Jan. 10

A 1-for-5 renounceable rights offer was

made to ordinary 'A' shareholders at an

issue price of $1.90 per share. The expiry

date on the offer was 30 November 2023.

The issue was underwritten at a

commission of $10 000.

Nov. 30 Holders of 380 000 shares accepted the

rights offer, paying the required price per

share, with the renounced rights being

taken up by the underwriter. Ordinary 'A'

shares were duly issued.

Dec. 10 Money due from the underwriter

was received.

The directors transferred $35 000

from retained earnings to a

replacement reserve.

Feb. 28 As a result of options being exercised,

70 000 ordinary 'C' shares were issued.

Unexercised options lapsed and an option

reserve was created.

Apr. 30 The directors made a call on the

ordinary 'B' shares for 80c per share.

Call money was payable by 31 May.

May 31 All call money was received except for that

due on 1000 shares.

Jun. 18

Jun. 30

Jun. 30

Shares on which the final call was unpaid

were forfeited and a forfeited share reserve

was set up.

Profit and comprehensive income for the

year was $1 580 000.

The directors declared a 10c per

share final dividend on all fully paid

'A' and 'B' ordinary shares, 5c per

share on 'C' shares and the dividend on

preference shares. All dividends to be paid

on 15 September 2024.

MOSQUE

2. Prepare the equity section of the statement of financial

position as at 30 June 2024.

4.19 Dividends

OF

Tou

POTER

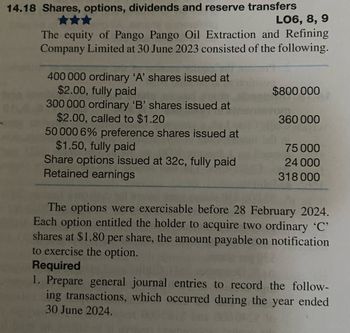

Transcribed Image Text:14.18 Shares, options, dividends and reserve transfers

LO6, 8, 9

The equity of Pango Pango Oil Extraction and Refining

Company Limited at 30 June 2023 consisted of the following.

400 000 ordinary 'A' shares issued at

$2.00, fully paid

300 000 ordinary 'B' shares issued at

$2.00, called to $1.20

50 000 6% preference shares issued at

$1.50, fully paid

Share options issued at 32c, fully paid

Retained earnings

$800 000

360 000

75 000

24 000

318 000

The options were exercisable before 28 February 2024.

Each option entitled the holder to acquire two ordinary 'C'

shares at $1.80 per share, the amount payable on notification

to exercise the option.

Required

1. Prepare general journal entries to record the follow-

ing transactions, which occurred during the year ended

30 June 2024.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 8 images

Knowledge Booster

Similar questions

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education