FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

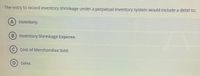

Transcribed Image Text:The entry to record inventory shrinkage under a perpetual inventory system would include a debit to:

A) Inventory.

B) Inventory Shrinkage Expense.

(C) Cost of Merchandise Sold.

Sales.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Which of the following is a true statement about inventory systems? A perpetual system determines cost of goods sold only at the end of the accounting period. Periodic inventory systems require more detailed inventory records. A periodic system requires cost of goods sold be determined after each sale. Perpetual inventory systems require more detailed inventory records.arrow_forward(True or false) Under the perpetual inventory system, on a work sheet, cost of sales will be shown in the trial balance (Dr), adjusted trial balance (Dr) and income statement (Dr) columns.arrow_forwardAssume that a perpetual inventory system using the NET METHOD is in use. Which of the following statements regarding the journal entries prepared is correct? A) When a customer returns inventory, the seller debits Customer Refunds Payable. B) Shipping costs associated with sales with terms FOB, destination should be included in Cost of Merchandise Inventory. C) When a company receives payment from a customer for a sale, Cash is debited and Accounts Payable is credited. D) When a company sells merchandise with terms 2/10, n 30, the company will credit Merchandise Inventory for the amount of the discount of 2 percent of sales. Why is the answer A and not D?arrow_forward

- Which of the following is incorrect about the perpetual inventory method? a. purchases are recorded as debit to inventory accountb. the entry to record a sale includes a debit to cost of goods sold and a credit to inventoryc. after a physical inventory count, inventory is credited for any missing inventory.d. purchase returns are recorded by debiting accounts payable and crediting purchase returns and allowancesarrow_forwardWhen a company that uses the periodic inventory system wants to remove beginning estimated returns inventory, which of the following accounts is debited? a.Estimated Returns Inventory b.Cost of Goods Sold c.Customer Refunds Payable d.Income Summaryarrow_forwardWhich of the following entries would be made to record the purchase of inventory on account, if a company uses the perpetual inventory system? A. a debit to Purchases and a credit to Accounts Payable B. a debit to Accounts Payable and a credit to Merchandise Inventory C. a debit to Merchandise Inventory and a credit to Accounts Payable D. a debit to Accounts Payable and a credit to Purchasesarrow_forward

- Define the term inventory shrinkage. How is the amount of inventory shrinkage determined in a business using a per-petual inventory system, and how is this shrinkage recorded in the accounting records?arrow_forwardExplain the types of inventory and the differences between a perpetual inventory system and a periodic inventory system.arrow_forwardAssuming a periodic inventory system is used, the entry to record a purchase of merchandise on credit includes: Multiple Choice a debit to Purchases and a credit to Accounts Receivable. a debit to Purchases and a credit to Accounts Payable. a debit to Accounts Payable and a credit to Purchases. a credit to Purchases and a credit to Accounts Payable.arrow_forward

- Under the perpetual inventory system, which of the following accounts is credited in the adjusting entry to reflect the expected amount of merchandise that will be returned? a. Merchandise Inventory b. Cost of Goods Sold c. Sales Returns and Allowances d. Estimated Returns Inventoryarrow_forwardConcord Corporation's accounting records reflect the following inventories: Raw materials inventory Work in process inventory Finished goods inventory. Dec. 31, 2020 O $2190700 O $2110700 Ⓒ$2260700. O $2010700 $310000 300000 190000 Dec. 31, 2019. $260000 160000 150000 During 2020, $920000 of raw materials were purchased, direct labor costs amounted to $684700, and manufacturing overhead incurred was $736000. If Concord Corporation's cost of goods manufactured for 2020 amounted to $2150700, its cost of goods sold for the year isarrow_forwardDescribe the journal entry(ies) when recording a sale of inventory using the periodic inventory system.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education