ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

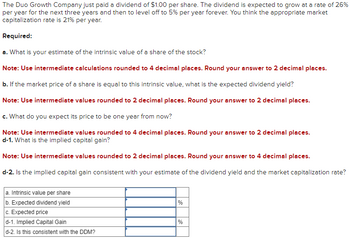

Transcribed Image Text:The Duo Growth Company just paid a dividend of $1.00 per share. The dividend is expected to grow at a rate of 26%

per year for the next three years and then to level off to 5% per year forever. You think the appropriate market

capitalization rate is 21% per year.

Required:

a. What is your estimate of the intrinsic value of a share of the stock?

Note: Use intermediate calculations rounded to 4 decimal places. Round your answer to 2 decimal places.

b. If the market price of a share is equal to this intrinsic value, what is the expected dividend yield?

Note: Use intermediate values rounded to 2 decimal places. Round your answer to 2 decimal places.

c. What do you expect its price to be one year from now?

Note: Use intermediate values rounded to 4 decimal places. Round your answer to 2 decimal places.

d-1. What is the implied capital gain?

Note: Use intermediate values rounded to 2 decimal places. Round your answer to 4 decimal places.

d-2. Is the implied capital gain consistent with your estimate of the dividend yield and the market capitalization rate?

a. Intrinsic value per share

b. Expected dividend yield

c. Expected price

%

d-1. Implied Capital Gain

%

d-2. Is this consistent with the DDM?

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- At what interest rate payable quarterly will payments of P 500 at the beginning of each 3 months for 7 years discharge a debt of P 12,500? 3.44% 4.33% 5.22% 6.11% Clear selectionarrow_forwardLast year CompanyXA paid a dividend of $2 per share. Use a growth rate of 2% per year and a discount rate of 5% to value the stock. What is the implied stock price?arrow_forwardIdentify the following as either equity or debt financing: bonds, stock sales, retained earnings, venture capital, short term loan, capital advance from friend, cash on hand, credit card, home equity loan.arrow_forward

- 4. A fixed capital investment of Php 10,000,000 is required for a proposed manufacturing plant and an estimated working capital of Php 2,000,000. Annual depreciation is estimated to be 10% of the fixed capital investment. Determine the rate of return on the total investment and the payout period if the annual profit is Php 2,500,000.arrow_forwardUse excelarrow_forwardFor each of the following problems, (a) draw the cash flow diagram; (b) present clean and clear manual solutions to the problem; (c) highlight the final answer (only the final answer as required by the problem) by enclosing it within a box. How much money should a bank be willing to loan a real estate developer who will repay the loan by selling lakefront lots at $1,000,000 10 years from now? Assume the bank’s interest rate is 10% per year.arrow_forward

- Q. 18 - Attached as a screenshotarrow_forwardWhat are the strategic and implementation issues for GSI to consider in deciding whether to enter into the joint venture?arrow_forwardXTR company is considering investing in Project Zeta or Project Omega. Project Zeta generates the following cash flows: year "zero" = 339 dollars (outflow); year 1 = 197 dollars (inflow); year 2 = 312 dollars (inflow); year 3 = 355 dollars (inflow); year 4 = 192 dollars (inflow). Project Omega generates the following cash flows: year "zero" = 230 dollars (outflow); year 1 = 120 dollars (inflow); year 2 = 100 dollars (inflow); year 3 = 200 dollars (inflow); year 4 = 120 dollars (inflow). The MARR is 10 %. Using the Annual Worth Method, calculate the annual worth of the BEST project. (note: round your answer to the nearest cent, and do not include spaces, currency signs, plus or minus signs, or commas) 105.28 156.41 margin of error +/- 20arrow_forward

- An investor has £13,000 in a fund generating a 5% return, with a 2.5% initial cost and an annual charge of 0.5%. What would that fund be worth after 5 years? Use the equation M = P (1+i)n to calculate the fund value.arrow_forwardThe following cash flows result from a potential construction project for your company: 1. Receipts of $505,000 at the start of the contract and $1,200,000 at the end of the fourth year 2. Expenditures at the end of the first year of $400,000 and at the end of the second year of $900,000 3. A net cash flow of $0 at the end of the third year. Using an appropriate rate of return method (Approximate ERR), for a MARR of 20%, should your company accept this project (Perform all calculations using 5 significant figures and round your answer to one decimal place. Also remember that text answers are case-sensitive):? Answers entered using text are case sensitive! What is the approximate ERR for this project? Number Should your company undertake this project? (Enter either 'Yes' or 'No'): %arrow_forwardIn a city by a river, flood damage to businesses and homes averages $5,000,000 per year. A proposed levee system would prevent all flood damage, at a cost of $50,000,000 to construct and $3,000,000 per year for maintenance and interest. The city proposes to finance the construction by selling bonds; these bonds would have a 20-year term and pay 6% interest on par value. The bonds will be renewed at maturity for the same term and at the same interest rate. The benefit-cost ratio for the levee system is A. less than 0.5 B. greater than 0.5 but less than 1.0 C. greater than 1.0 but less than 1.5 D. greater than 1.5arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education