ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

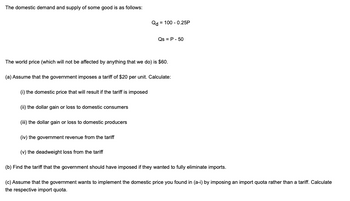

Transcribed Image Text:The domestic demand and supply of some good is as follows:

Qd = 100 -0.25P

Qs = P - 50

The world price (which will not be affected by anything that we do) is $60.

(a) Assume that the government imposes a tariff of $20 per unit. Calculate:

(i) the domestic price that will result if the tariff is imposed

(ii) the dollar gain or loss to domestic consumers

(iii) the dollar gain or loss to domestic producers

(iv) the government revenue from the tariff

(v) the deadweight loss from the tariff

(b) Find the tariff that the government should have imposed if they wanted to fully eliminate imports.

(c) Assume that the government wants to implement the domestic price you found in (a-i) by imposing an import quota rather than a tariff. Calculate

the respective import quota.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 8 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- If Indonesia (which is a small country) imposes an import tariff on textile imports, we can conclude that:(a) The world price of textile rises, and Indonesia imports less.(b) The world price of textile stays constant, and Indonesia imports less.(c) The world price of textile falls, and Indonesia imports less.(d) The world price of textile stays constant, and Indonesia imports the same as before. Explain why.arrow_forward1. a) An import tariff will government revenue, and producer surplus, overall domestic national welfare. A) increase; decrease; increase; have an ambiguous effect on B) increase; decrease; decrease; decrease b) An export subsidy will government revenue, and C) increase; decrease; have no effect on; have an ambiguous effect on D) increase; decrease; have no effect on; decrease E) increase; increase; decrease; have an ambiguous effect on consumer surplus,, producer surplus, overall domestic national welfare. A) increase; decrease; increase; have an ambiguous effect on B) increase; decrease; decrease; decrease consumer surplus, C) increase; decrease; have no effect on; have an ambiguous effect on D) increase; decrease; have no effect on; decrease E) increase; increase; decrease; have an ambiguous effect on c) An import quota will government revenue, and A) increase; decrease; increase; have an ambiguous effect on B) increase; decrease; decrease; decrease C) increase; decrease; have no…arrow_forwardPlease explain/show steps as to how you arrived at your answer. Thank you.arrow_forward

- A country decides to impose higher tariffs on imported goods to encourage domestic production. This policy change impacts the circular flow of income and expenditure by altering the dynamics of international trade. In this scenario, the imposition of tariffs on imports primarily:A) Acts as a leakage in the circular flowB) Functions as an injection into the circular flowC) Has no significant impact on the circular flowD) Reduces government expenditure in the circular flow Note:- Please avoid using ChatGPT and refrain from providing handwritten solutions; otherwise, I will definitely give a downvote. Also, be mindful of plagiarism.Answer completely and accurate answer.Rest assured, you will receive an upvote if the answer is accurate.arrow_forwardThe demand and supply functions for a product in a large country are given as Qd = 130 – 3P and Qs = -30 + 2P respectively. The world price is 20$ and the large country imposes an ad valorem tariff of %50. After the imposition of tariff world price decreases to 16$. Calculate the change in consumer surplus, producer surplus, government revenue and social welfare after the imposition of tariff.arrow_forwardWhen a country opens its markets to international trade, if the world price is ________(lower/higher) than the domestic equilibrium price, quantity supplied from foreign producers will rise.arrow_forward

- Price per Saddle Domeslic Supply P2 Tariff World Price P1 G Domestic Demand Q1 Q2 Q3 Q4 Quantity of Saddles With the tariff in place, the total tax revenue equals O (1/2)x(Q2-Q1)x(P2-P1) + (1/2)x(Q4-Q3)x(P2-P1) O P2 x Q3 (P2 - P1) x (Q3 - Q2) O (P2 - P1) x (Q4 - Q1)arrow_forwardPrice P1 D 01 Quantity The graph above shows domestic supply and demand with trade in a SMALL country. With trade, this country can purchase at the world price, Pw. Suppose that this country imposes a $5 per unit tariff on this good. Which of the following is true? O There will not be deadweight losses due to this tariff, since it is a small country. The domestic price will rise by $5. O Consumers will be better off. Producers will not increase domestic production.arrow_forwardConsider the market for coffee in the small, isolated country of Krakozhia. Within Krakozhia, the domestic demand for coffee is: Q = 500-2p and the domestic supply of coffee is: Q* = -150+ 3parrow_forward

- All of the following statements about import tariffs are true except Group of answer choices they result in countries selling the product at a lower price to domestic consumers they reduce the volume of trade and the gains from trade they limit specialization and the division of labor they yield revenue for the government that levies tariffsarrow_forward(a) Draw an offer curve for Guatemala that shows its offer of coffee for wheat. Include both an elastic and inelastic range in Guatemala’s offer curve. (b) Draw an offer curve for the United States that shows its offer of wheat for coffee. Show this US curve intersecting the Guatemalan offer curve in the inelastic range of the Guatemalan curve. Note the equilibrium terms of trade established. (c) Compare the equilibrium international price you found in question (b) to the autarky prices in Guatemala and in the United States. (You can find a country’s autarky price by drawing a line tangent to the offer curve at the origin.) Explain which country benefits the most from a more favorable movement in its terms of trade when it abandons its autarky position. (d) “The Guatemalan offer curve is likely to be less elastic than the US offer curve.” Justify this claim by explaining what factors determine the elasticity of an offer curve.arrow_forwardConsider the market for coffee in the small, isolated country of Krakozhia. Within Krakozhia, the domestic demand for coffee is: Q = 500-2p and the domestic supply of coffee is: Q* = -150+ 3parrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education