ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

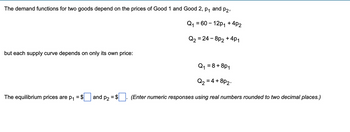

Transcribed Image Text:The demand functions for two goods depend on the prices of Good 1 and Good 2, p₁ and p2,

Q₁ = 60-12p₁ +4P2

-4P1

Q₂ = 24 - 8p₂ +

but each supply curve depends on only its own price:

The equilibrium

are p₁ = $ and p₂ = $

= 8 + 8P1

Q₁:

Q₂ = 4 +

8p2.

(Enter numeric responses using real numbers rounded to two decimal places.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 7 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- The demand and supply functions for three (03) goods are given as follows: Dx = 100-3Px+Py+3Pz Dy = 80+Px-2Py-Pz Dz = 120+3Px-Py-4Pz Sx = -10+Px Sy = -20+3Py Sz = -30+2Pz The equilibrium prices and quantities of all three goods are. The government decides to: a) Impose a 25% Tax on X b) Impose a 5 Rs /unit Tax on Y c) Give a 10% subsidy on good z Analyze the impact of each of these policies separately on equilibrium prices and quantities. Analyze the impact of each of these policies separately on equilibrium prices and quantities. Provide theoretical justification (using diagrams) of all results obtainedarrow_forwardSuppose the demand schedule in a market can be represented by the equation QD=500-10P, where QD is the quantity demanded and P is the price. Also, suppose the supply schedule can be represented by the equation Q8=200+ 10P, where QS is the quantity supplied. Refer to Scenario 4-1. Suppose the price is currently equal to 10 in this market. Is there a shortage or surplus in this market, and how large is the shortage/surplus?arrow_forwardYou own Earthworm Excavators. Your company is the sole manufacturer of super-sized excavators that are used in the world’s largest mining operations. The U.S. has recently lifted export restrictions on the product you sell, so you can now sell your equipment in the world market along with sales in the domestic market. You hire an economist to estimate the following (inverse) demand curves per year for these distinct markets: Domestic market : Pd = $1200 - $10QdForeign market : Pf = $600 - $5Qf where P refers to prices charged in each market in thousands of dollars and Q refers to the annual quantities demanded in each market. The total costs (in thousands of dollars) of your annual operation are given by: TC = 900 + 200Q a. If you decide to offer you machines at a single price to all potential buyers, at what price will the foreign buyers be priced out of the market?b. What is the market demand function if you decide to offer the machines to all potential buyers at a single…arrow_forward

- Consider the market for pork illustrated in the graph. Suppose initial demand (D') is Q = 290 – 20p and supply (S') is Q = 80 + 40p and that a $3.00 tax is charged to consumers, shifting the demand curve to D. Using the original and after-tax pork demand functions and the supply function, derive the initial equilibrium price and quantity and the after-tax equilibrium price and quantity. %24 (Enter all responses using real numbers rounded to two decimal places) The equilibrium price is initially $ per kg. P1 ey P2 D2 D1 Q2 Q, Q. Million kg of pork per year SEP 24 30 tv Help Me Solve This Text Paces HAT More Hein ear All MacBook Air 80 DII esc F10 F11 F3 F4 F5 F6 F7 F8 F9 F1 F2 @ # $ & * 1 3 4 5 6. 7 8. P P. S per kg >arrow_forwardConsider a hypothetical market for copper (q), where q is measured in 1000 tons. Suppose the supply of virgin copper is Sv = 10+5q. Suppose that the supply for recycled copper is Sr = 15+2.5q. Demand for copper is P = 65 - 1.5q. Note, buyers don't distinguish between recycled and virgin copper. The equilibrium price and output for copper is (hint: draw a graph) q=8.46, p = $52.31. q=0, p = $65. q=12.50, p = $46.25. O q=4.44, p = $58.33.arrow_forwardFind the producers' surplus at a price level of p = $90 for the price-supply equation below. %3D p= S(x) = 20 + 0.4x + 0.003x? ... The quantity supplied at the price p is x = (Round to the nearest whole number as needed.)arrow_forward

- The demand and supply functions for three (03) goods are given as follows: Dx = 100-3Px+Py+3Pz Dy = 80+Px-2Py-Pz Dz = 120+3Px-Py-4Pz Sx = -10+Px Sy = -20+3Py Sz = -30+2Pz The equilibrium prices and quantities of all three goods are? The government decides to: a) Impose a 25% Tax on X? b) Impose a 5 Rs /unit Tax on Y? c) Give a 10% subsidy on good z? Analyze the impact of each of these policies separately on equilibrium prices and quantities? Analyze the impact of each of these policies separately on equilibrium prices and quantities? Provide theoretical justification (using diagrams) of all results obtained?arrow_forward= D(x) = 23 Espacio en Blanco 1: Espacio en Blanco 2: Espacio en Blanco 3: P = 1 X 20 and the price-supply equation = S(x) P = Given the price-demand equation (A) Find the equilibrium price. Answer: The equilibrium price is $ (use 2 decimal places) (B) The total gain to producers who are willing to supply units at a lower price is $ (C) The total savings to consumers who are willing to pay a higher price for the product is $ = 8+ 1 8000 (round to 2 decimal places) (use 2 decimal places)arrow_forwardThe demand and supply functions for two independent goods are given by: QD1 = 400 - 5P₁ - 3P₂ and QD2 = 300 - 2P₁ - 3P₂ Qs2 = -100 + 2P₂ Qs1 = -60 +3P₁ and Show that in equilibrium the prices satisfy [23] [²²] = [461] Using Cramer's rule find the equilibrium price of Good 1.arrow_forward

- The coconut oil demand function (Bushena and Perloff, 1991) is Q=1,200-9.5p+16.2pp +0.2Y, where Q is the quantity of coconut oil demanded in thousands of metric tons per year, p is the price of coconut oil in cents per pound, pp is the price of palm oil in cents per pound, and Y is the income of consumers. Assume that p is initially 50 cents per pound, pp is 29 cents per pound, and Q is 1,325 thousand metric tons per year. Calculate the price elasticity of demand for coconut oil and the cross-price elasticity of demand (with respect to the price of palm oil). The price elasticity of demand is e= (Enter your response rounded to three decimal places and include a minus sign.)arrow_forwardThe demand and supply functions for two independent goods are given by: QD₁ = 502P₁ + P₂ and QD2 = 10 + P₁ - 4P₂ Qs1 = -21 + P₁ and Qs2 = -10 + 5P₂ Show that in equilibrium: R=2 Find the equilibrium prices.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education