FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:The data shown were obtained from the financial records of Italian Exports, Inc., for March:

Estimated Sales

$550,000

Sales

567,933

Purchases

294,814

Ending Inventory*

10%

Administrative Salaries

50,340

Marketing Expense**

5%

Sales Commissions

2%

Rent Expense

7,400

Depreciation Expense

1,100

Utilities

2,600

Taxes***

15%

*of next month's sales

**of estimated sales

***of income before taxes

Sales are expected to increase each month by 10%.

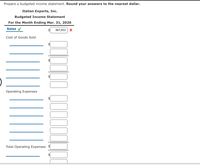

Transcribed Image Text:Prepare a budgeted income statement. Round your answers to the nearest dollar.

Italian Exports, Inc.

Budgeted Income Statement

For the Month Ending Mar. 31, 2020

Sales v

567,933

X

Cost of Goods Sold

Operating Expenses

Total Operating Expenses

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A company reported the following data for the year ending 2018: Description Amount Sales $400,000 Sales discount $16,000 Sales returns and allowances $13.000 Cost of goods sold $117,000 Operating expense $153,000 Income tax expense $23,750 Compute the amount of net sales to be reported on the Income statement. $371,000 $397000 $384.000 $387.000arrow_forwardThe financial data for Crane's Fresh Fruits Incorporated and Cullumber's Supermarket Ltd. for the current year are as follows: Crane's Fresh Fruits Cullumber's Supermarket (a) Annual Cost of Goods Sold $9,724,440 Inventory turnover 53,026,340 Inventory Jan. 1 $64 100 4,512,200 Crane's Fresh Fruits Inventory Dec. 31 Calculate the inventory turnover for each company. (Round answers to 1 decimal place, e.g. 18.4.) times $756,100 1,128,900 Cullumber's Supermarket timesarrow_forwardThe data shown were obtained from the financial records of Italian Exports, Inc., for March: Estimated Sales $580,000 Sales 567,930 Purchases 294,832 Ending Inventory* 10% Administrative Salaries 50,280 Marketing Expense** 5% Sales Commissions 2% Rent Expense 7,700 Depreciation Expense 1,200 Utilities 2,500 Taxes*** 15% *of next month's sales **of estimated sales ***of income before taxes Sales are expected to increase each month by 10%. Prepare a budgeted income statement. Round your answers to the nearest dollar. Italian Exports, Inc.Budgeted Income StatementFor the Month Ending Mar. 31, 2020 $Sales Cost of Goods Sold $Beginning Inventory Purchases $Cost of Goods Available for Sale Ending Inventory $Cost of Goods Sold Gross Profit Operating Expenses $Administrative Salaries Marketing Expenses Sales Commissions Rent Expense Depreciation Expense Utilities Total…arrow_forward

- Our company is a manufacturer and has the following data available for the current year: sales, $550,000; sales discounts, $20,000; sales returns and allowances, $15,000; and cost of goods sold, $200,000. What is the amount reported on the income statement for net sales? $530,000 $515,000 $500,000 $330,000arrow_forwardThe following income statements were drawn from the annual reports of the Atlanta Company and the Boston Company. Atlanta* $ 32,400 (15,500) 16,900 Boston* $ 87,500 (64,030) 23,470 Net sales Cost of goods sold Gross margin Less: Operating expenses Selling and administrative expenses Net income *All figures are reported in thousands of dollars. Required a-1. Compute the gross margin percentages and return-on-sales ratios of Atlanta and Boston. a-2. Ascertain which of the companies is a high-end retailer based on ratios computed. b. If Atlanta and Boston have equity of $17,800 and $20,200, respectively, which company is in the more profitable business? Complete this question by entering your answers in the tabs below. Req A1 Req A2 (12,740) (19,026) $ 4,160 $ 4,444 Req B Gross margin percentages Return-on-sales ratios Compute the gross margin percentages and return-on-sales ratios of Atlanta and Boston. (Round your answers to the nearest whole number.) Atlanta % % Bostonarrow_forwardCalculating the Times-Interest-Earned Ratio Beech Company provided the following income statement for last year: Sales $24,350,735 Cost of goods sold 15,300,000 Gross margin $9,050,735 Operating expenses 4,910,685 Operating income $4,140,050 Interest expense 470,015 Income before taxes $3,670,035 Income taxes 1,461,214 Net income $2,208,821 Required: Calculate the times-interest-earned ratio. Round the answer to one decimal place.timesarrow_forward

- Use the following to answer questions 6 – 7 MC, Inc., reported the following amounts at the end of the year: Total sales $888,000 Accounts receivable Sales allowances 60,000 3,500 Allowance for Uncollectible accounts 1,400 Sales discounts 18,000 9,000 Sales returns Determine total contra revenues for $ the company 6. 7. $ Determine net sales for the companyarrow_forwardA comparative income statement follows for Martine Ltd. of Montreal: MARTINE LTD. Comparative Income Statement For the Years Ended October 31, Year 1 and Year 2 Year 2 Year 1 Sales $ 8,050,000 $ 6,050,000 Less: Cost of goods sold 5,095,650 3,605,800 Gross margin 2,954,350 2,444,200 Less: Operating expenses: Selling expenses 1,529,500 1,131,350 Administrative expenses 756,700 726,000 Total expenses 2,286,200 1,857,350 Net operating income 668,150 586,850 Less: Interest expense 136,850 114,950 Net income before taxes $ 531,300 $ 471,900 Members of the company's board of directors are surprised to see that net income increased by only $59,400 when sales increased by $2,000,000. Required: 1. Express each year’s income statement in common-size percentages. (Round your answers to 1 decimal place.)arrow_forwardRequired information [The following information applies to the questions displayed below.] The following data were provided by Mystery Incorporated for the year ended December 31: $ 175,000 20,700 260,000 46,000 20,000 7,650 44, Cost of Goods Sold Income Tax Expense Merchandise Sales (gross revenue) for Cash Merchandise Sales (gross revenue) on Credit Office Expense Sales Returns and Allowances Salaries and Wages Expense Required: 1. Prepare a multistep income statement for external reporting purposes.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education