MATLAB: An Introduction with Applications

6th Edition

ISBN: 9781119256830

Author: Amos Gilat

Publisher: John Wiley & Sons Inc

expand_more

expand_more

format_list_bulleted

Question

only do part of b

and then c and d only

thanks, the data is shown above in the image

Transcribed Image Text:Rate of Return

Month

Apr-18

May-18

Jun-18

Jul-18

Aug-18

Sept-18

Oct-18

Nov-18

Dec-18

Jan-19

Feb-19

H₁ P₁0

OD. H₂ P-D

H₁ B₁ 0

Rates of return of

the index, x

4.23

3.25

1.78

3.20

1.29

3.58

1.48

4.40

-0.86

6.12

-3.48

-

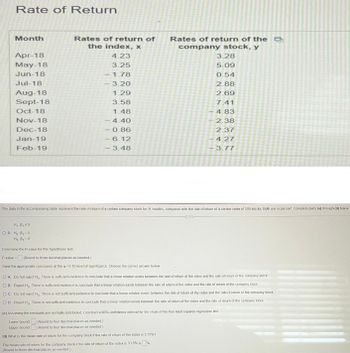

The data in the accompanying table represent the rate of return of a certain company stock for 11 months, compared with the rate of return of a certain index of 500 stocks. Both are in percent. Complete parts (a) through (d) below

Determine the P-value for this hypothesis test

P-value= (Round to three decimal places as needed.)

State the appropriate conclusion at the a=0.10 level of significance Choose the correct answer below

Lower bound

Upper bound

Rates of return of the D

company stock, y

3.28

5.09

0.54

2.88

2.69

7.41

4.83

2.38

2.37

4.27

3.77

OA. Do not reject Ho. There is sufficient evidence to conclude that a linear relation exists between the rate of return of the index and the rate of return of the company stock

OB. Reject Ho There is sufficient evidence to conclude that a linear relation exists between the rate of return of the index and the rate of return of the company stock

OC. Do not reject H, There is not sufficient evidence to conclude that a Inear relation exists between the rate of return of the index and the rule of return of the company stock

OD. Reject H, There is not sufficient evidence to conclude that a linear relation exists between the rate of return of the index and the rate of return of the company stock

(c) Assuming the residuals are normally distributed, construct a 90% confidence interval for the slope of the true least squares regression line

(Round to four decimal places as needed.)

(Round to four decimal places as needed)

(d) What is the mean rate of return for the company stock if the rate of return of the index is 3.15%?

The mean rate of return for the company stock if the rate of return of the index is 3 15% is

(Round to three decimal places as needed)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps with 14 images

Knowledge Booster

Similar questions

- Window Below are two snapshots of data taken from the covid19.nj.gov website on January 8, 2021. What information can you take away from these graphs? Can the graphs be compared? What might be confusing or misleading about the information? What could you do to better present the information?arrow_forwardThe owner of a radio station wants to determine how much airtime songs take up. The owner collects the song length in seconds of 10 popular songs. The data are reproduced in the table below. Calculate the mode(s) using a TI-83. TI-83 plus, or TI-84 graphing calculator. Length of Songs in Seconds 279 219 298 134 206 293 165 227 230 212arrow_forwardMrs. Alexander had her chemistry classes analyze the amount of time it takes for water to evaporate out of different-sized containers. The graph below shows a line of best fit for the data collected by all of her students.arrow_forward

- Derive the linear interpolant through the two data points (1.0, 2.0) and (1.1, 2.5).Then, derive the quadratic interpolant through these two points and the point (1.2, 1.5). Show a graphdepicting this situation.arrow_forwarda and b are two points in the third dimension. Write an equation that describes the set of points that are equidistant to a and b. Draw a picture of this set in the case where a = i and b = j.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

MATLAB: An Introduction with ApplicationsStatisticsISBN:9781119256830Author:Amos GilatPublisher:John Wiley & Sons Inc

MATLAB: An Introduction with ApplicationsStatisticsISBN:9781119256830Author:Amos GilatPublisher:John Wiley & Sons Inc Probability and Statistics for Engineering and th...StatisticsISBN:9781305251809Author:Jay L. DevorePublisher:Cengage Learning

Probability and Statistics for Engineering and th...StatisticsISBN:9781305251809Author:Jay L. DevorePublisher:Cengage Learning Statistics for The Behavioral Sciences (MindTap C...StatisticsISBN:9781305504912Author:Frederick J Gravetter, Larry B. WallnauPublisher:Cengage Learning

Statistics for The Behavioral Sciences (MindTap C...StatisticsISBN:9781305504912Author:Frederick J Gravetter, Larry B. WallnauPublisher:Cengage Learning Elementary Statistics: Picturing the World (7th E...StatisticsISBN:9780134683416Author:Ron Larson, Betsy FarberPublisher:PEARSON

Elementary Statistics: Picturing the World (7th E...StatisticsISBN:9780134683416Author:Ron Larson, Betsy FarberPublisher:PEARSON The Basic Practice of StatisticsStatisticsISBN:9781319042578Author:David S. Moore, William I. Notz, Michael A. FlignerPublisher:W. H. Freeman

The Basic Practice of StatisticsStatisticsISBN:9781319042578Author:David S. Moore, William I. Notz, Michael A. FlignerPublisher:W. H. Freeman Introduction to the Practice of StatisticsStatisticsISBN:9781319013387Author:David S. Moore, George P. McCabe, Bruce A. CraigPublisher:W. H. Freeman

Introduction to the Practice of StatisticsStatisticsISBN:9781319013387Author:David S. Moore, George P. McCabe, Bruce A. CraigPublisher:W. H. Freeman

MATLAB: An Introduction with Applications

Statistics

ISBN:9781119256830

Author:Amos Gilat

Publisher:John Wiley & Sons Inc

Probability and Statistics for Engineering and th...

Statistics

ISBN:9781305251809

Author:Jay L. Devore

Publisher:Cengage Learning

Statistics for The Behavioral Sciences (MindTap C...

Statistics

ISBN:9781305504912

Author:Frederick J Gravetter, Larry B. Wallnau

Publisher:Cengage Learning

Elementary Statistics: Picturing the World (7th E...

Statistics

ISBN:9780134683416

Author:Ron Larson, Betsy Farber

Publisher:PEARSON

The Basic Practice of Statistics

Statistics

ISBN:9781319042578

Author:David S. Moore, William I. Notz, Michael A. Fligner

Publisher:W. H. Freeman

Introduction to the Practice of Statistics

Statistics

ISBN:9781319013387

Author:David S. Moore, George P. McCabe, Bruce A. Craig

Publisher:W. H. Freeman