Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

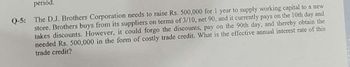

Transcribed Image Text:period.

Q-5: The D.J. Brothers Corporation needs to raise Rs. 500,000 for 1 year to supply working capital to a new

store. Brothers buys from its suppliers on terms of 3/10, net 90, and it currently pays on the 10th day and

takes discounts. However, it could forgo the discounts, pay on the 90th day, and thereby obtain the

needed Rs. 500,000 in the form of costly trade credit. What is the effective annual interest rate of this

trade credit?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- es Little Kimi Clothiers can borrow from its bank at 20 percent to take a cash discount. The terms of the cash discount are 3/25 net 85. a. Compute the cost of not taking the cash discount. (Use 365 days in a year. Do not round the intermediate calculations. Round the final answer to 2 decimal places.) Cost of not taking a cash discount b. Should the firm borrow the funds? % 00 Yes O Noarrow_forwardRed Lizard Construction just borrowed $53,600.00. The terms of the loan require the company to make equal monthly payments forever. The first monthly payment is due in 1 month. If the regular monthly loan payment is $600.00, then what is the EAR of the loan? A rate less than 10.44% or a rate greater than 14.72% A rate equal to or greater than 12.43% but less than 13.86% A rate equal to or greater than 10.44% but less than 11.06% A rate equal to or greater than 11.06% but less than 12.43% A rate equal to or greater than 13.86% but less than 14.72% 100arrow_forwardThe Second National Bank of Fullerton advertises an APR of 15%, but it indicates in the “small print” that compounding occurs on a monthly basis for personal loans with no collateral required. This is a multi-part question. Once an answer is submitted, you will be unable to return to this part. Determine the APY you would pay using an equation. The APY paid would be % per year.arrow_forward

- please quickluy , thanks 27. Caterpillar purchased merchandise from Alpha echnologies as follows: Invoice date: March 12th Invoice Amount: $4,000 Terms: 2/10, n/30 If we assume an annual interest rage of 6% and a 360-day year. And Caterpillar has to borrow money for the remaining 20 days of the credit period. How much are the savings from taking the discount? A.19.6 B.66.93 C.13.07 D.6.67arrow_forward(Related to Checkpoint 18.2) (Evaluating trade credit discounts) If a firm buys on trade credit terms of 5/15, net 90 and decides to forgo the trade credit discount and pay on the net day, what is the annualized cost of forgoing the discount (assume a 365-day year)? The annualized cost of the trade credit terms of 5/15, net 90 is %. (Round to two decimal places.)arrow_forwardThe Patel Company has several financial issues to solve. As the company’s Financial Analyst you have been asked to answer the following 2 questions: Their bank will lend them $100,000 for 90 days at a cost of $1,200 interest. What is the company’s effective annual rate? A major supplier has granted credit terms of 1/10 N120. Assuming the company can borrow any amount of money at the rate you have calculated above (in part 1), should the company take the discount? (Your answer must be supported with a calculation of the cost of not taking the discount – using either simple or effective annual rate)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education