ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

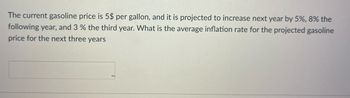

Transcribed Image Text:The current gasoline price is 5$ per gallon, and it is projected to increase next year by 5%, 8% the

following year, and 3 % the third year. What is the average inflation rate for the projected gasoline

price for the next three years

Expert Solution

arrow_forward

Step 1

Given:

Current gasoline price = $5

It is expected to increase next year by 5%, 8% the following year, and 3% the third year.

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Suppose that you borrow $20,000 at 12%, compounded monthly, over 5 years. Knowing that the 12% represents the market interest rate, the monthly payment in actual dollars will be $444.90. If the average monthly general inflation rate is expected to be 0.5%, what is the equivalent equal monthly payment series in constant dollars? A. $386 B. $486 C. $345 D. $445arrow_forwardIf the average college graduate makes $33,000 more every year than the average high school graduate, what is the cumulative marginal benefit of a college education if the average college graduate works for 40 years, assuming a 3% inflation rate? Options: a) $762,797.48 b) $1,320,000 c) $1,100,000 d) $2,488,241.57 e) $358,824.57 Which formula would you use to solve this equation? Options: a) PVA b) FVA c) PVP d) PV e) No formula neededarrow_forwardIf the inflation rate is 6% per year and you want to earn a real return of 10% per year, how many future dollars must you receive 10 years from now for an investment of $10,000 today?.arrow_forward

- The purchase of a car requires a $30, 000 loan to be repaid in monthly installments for four years at 18% interest compounded monthly. If the general inflation rate is 6% compounded monthly, find the actual and constant dollar value of the 20th payment of this loan. Include both a CFD in actual dollars and a CFD in constant dollars.arrow_forwardRequired information In wisely planning for your retirement, you invest $18,000 per year for 20 years into a 401K tax-deferred account. Assume you make a real return of 10% per year when the inflation rate averages 2.8% per year. How many future dollars will you have in the account immediately after your last deposit? You will have $ |future dollars in your account immediately after your last deposit.arrow_forwardRequired information For many years, college costs (including tuition, fees, and room and board) increases have been higher than the inflation rate, averaging 5% to 8% per year. According to the College Board's Trends in College Pricing, the average total costs at present in dollars is $22,000 for students attending in-state four-year public colleges and universities and $41,500 for students at four-year private colleges and universities. Assume an additional $4,300 per year for textbooks, supplies, transportation, and other expenses. Using a 7% per year inflation rate, how much can a sophomore high-school student expect to spend on in-state tuition, fees, and room and board for the freshman year (3 years from now) at a four-year public university? (Round the final answer to three decimal places.) A sophomore high-school student is expected to spend $ for the freshman year.arrow_forward

- A man desires to have a preplanned amount in a savings account when he retires in 20 years. This amount is to be equivalent to $30,000 in today’s purchasing power. If the expected average inflation rate is 7% per year and the savings account earns 5% interest, what lump sum of money should the man deposit now in his savings account?arrow_forwardAn engineer who is now 65 years old began planning for retirement 40 years ago. At thattime, he thought that if he had $1 million when he retired, he wouldhave more than enoughmoney to live his remaining life in luxury. Assume the inflation rate over the 40-year timeperiod averaged a constant 3.7% per year.a) What is the CV purchasing power of his $1million at age 65? (Hint: Use the day he started 40 years ago as the base year.)b) How manyfuture dollars should he have accumulated over the 40 years to have a CV purchasing powerequal to $1.3 million at his current age of 65?arrow_forwardRequired information In wisely planning for your retirement, you invest $34,000 per year for 20 years into a 401K tax-deferred account. Assume you make a real return of 10% per year when the inflation rate averages 3.3% per year. How many future dollars will you have in the account immediately after your last deposit? You will have $ | future dollars in your account immediately after your last deposit.arrow_forward

- A father wants to save in advance for his eight-year-old daughter's collegeexpenses. The daughter will enter the college 10 years from now. An annualamount of $20,000 in today's dollars (constant dollars) will be required to support her college expenses for four years. Assume that these college payments will be made at the beginning of each school year. (The first payment occurs at the end of 10 years.) The future general inflation rate is estimated to be 5% per year, and the interest rate on the savings account will be 8% compounded quarterly (market interest rate) during this period. If the father has decided to save only $500 (actual dollars) each quarter, how much will the daughter have to borrow to cover her freshman expenses?(a) $1,920(b)$2,114(c) $2,210(d)$2,377arrow_forwardQuestion 7 The price of a product was $0.88 in the year 2008 and $1.28 in the year 2018. What is the average annual inflation rate for this product? 3.82 % 3.68% 3.42 % 3.98 % Question 8 If the CPI for January 2008 is 208.837 and the CPI for December 2018 is 255.539, what is the average annual inflation rate (per year) from Jan 2008 to Dec 2018? (Hint: Calculate monthly inflation rate and then use annual effective interest rate) O 1.65 % ☐ 1.75% O 1.95 % O 1.85 %arrow_forwardIf a 2-percent increase in the price of corn flakes causes a 10-percent decline in the quantity demanded, what is the elasticity of demand?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education