FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

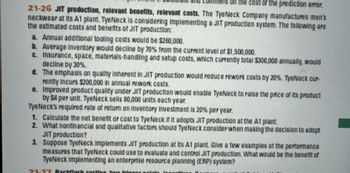

Transcribed Image Text:the cost of the prediction error.

21-26 JIT production, relevant benefits, relevant costs. The Tye Neck Company manufactures men's

neckwear at its A1 plant. TyeNeck is considering implementing a JIT production system. The following are

the estimated costs and benefits of JIT production:

a. Annual additional tooling costs would be $280,000.

b. Average Inventory would decline by 70% from the current level of $1,500,000.

c. Insurance, space, materials-handling and setup costs, which currently total $300,000 annually, would

decline by 30%.

d. The emphasis on quality inherent in JIT production would reduce rework costs by 20%. TyeNeck cur-

rently incurs $200,000 in annual rework costs.

e. Improved product quality under JIT production would enable TyeNeck to raise the price of its product

by $4 per unit. TyeNeck sells 80,000 units each year.

TyeNeck's required rate of return on inventory Investment is 20% per year.

1. Calculate the net benent or cost to Tye Neck if it adopts JIT production at the A1 plant

2. What nonfinancial and qualitative factors should TyeNeck consider when making the decision to adopt

JIT production?

3. Suppose TyeNeck implements JIT production at its A1 plant. Give a few examples of the performance

measures that TyeNeck could use to evaluate and control JIT production. What would be the benefit of

TyeNeck implementing an enterprise resource planning (ERP) system?

21-27 Backflush coction have trigger malte Innsethve

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Ore Company produces bookcases. Sales were good in 2019. However, with the slowdown in the economy, the Chief Financial Officer is concerned about the sales for 2020. The income statement for 2020 is as follows: Sales revenue $600,000 Less: Variable costs $360,000 Contribution margin $240,000 Less: Fixed costs $140,000 Net profit $100,000 The company expects to sell 60,000 units in 2020. Compare different types of cost behaviours to do the following: (a) Use cost-volume-profit analysis to determine the breakeven point in units and in dollars. (b) Use cost-volume-profit analysis to determine the margin of safety in units and in dollars. (c) Assuming that cost behaviour pattern remains unchanged, compute the decrease in net income if sales revenue dropped by $200,000 in 2020.arrow_forwardSammamish Brick, Inc., manufactures bricks using clay deposits on the company's property. Raw clays are blended and then extruded into molds to form unfired bricks. The unfired bricks are then stacked onto movable metal platforms and rolled into the kiln where they are fired until dry. The dried bricks are then packaged and shipped to retail outlets and contractors. The bottleneck in the production process is the kiln, which is available for 2,200 hours per year. Data concerning the company's four main products appear below. Products are sold by the pallet. Gross revenue per pallet Contribution margin per pallet Annual demand (pallets) Hours required in the kiln per pallet Traditional Brick $769 $480 75 10 Textured Facing $1,331 $ 620 Cinder Block $608 $388 85 4 Roman Brick $886 $455 95 10 150 No fixed costs could be avoided by modifying how much is produced of any product. Required: 1a. Calculate the total hours required in the kiln to satisfy demand for all products. Traditional…arrow_forwardProvide Answer Without Fail And provide With Definitionarrow_forward

- 117. es Woodland Wearables produces two models of a smart watch, the Basic and the Flash. The watches have the following characteristics: Selling price per watch Variable cost per watch Expected sales (watches) per year The total fixed costs per year for the company are $1,545,600. Basic Required A Required B $360 $ 280 48,000 Required: a. What is the anticipated level of profits for the expected sales volumes? b. Assuming that the product mix is the same at the break-even point, compute the break-even point in units. c. If the product sales mix were to change to nine Basic watches for each Flash watch, what would be the new break-even volume for Woodland Wearables? Required C Flash Complete this question by entering your answers in the tabs below. $ 505 $265 16,000 What is the anticipated level of profits for the expected sales volumes? Anticipated profitarrow_forwardThe Gargus Company, which manufactures projection equipment, is ready to introduce a new line of portable projectors. The following data are available for a proposed model: Variable manufacturing costs Applied fixed manufacturing overhead Variable selling and administrative costs Applied fixed selling and administrative costs $ 380 190 145 160 What price will the company charge if the firm uses cost-plus pricing based on total variable cost and a markup percentage of 205%?arrow_forwardLaser Cast Inc. manufactures color laser printers. Model J20 presently sells for $325 and has a product cost of $260, as follows: Line Item Description Amount Direct materials $190 Direct labor 50 Factory overhead 20 Total $260 It is estimated that the competitive selling price for color laser printers of this type will drop to $310 next year. Laser Cast has established a target cost to maintain its historical markup percentage on product cost. Engineers have provided the following cost-reduction ideas: 1. Purchase a plastic printer cover with snap-on assembly, rather than with screws. This will reduce the amount of direct labor by 9 minutes per unit.2. Add an inspection step that will add six minutes per unit of direct labor but reduce the materials cost by $7 per unit.3. Decrease the cycle time of the injection molding machine from four minutes to three minutes per part. Thirty percent of the direct labor and 45% of the factory overhead are related to running injection…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education