Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

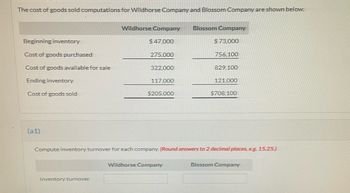

Transcribed Image Text:The cost of goods sold computations for Wildhorse Company and Blossom Company areshown below.

Wildhorse Company

Blossom Company

Beginning inventory

$47.000

$73.000

Cost of goods purchased

275.000

756.100

Cost of goods available for sale

322.000

829.100

Ending inventory

117.000

121.000

Cost of goods sold

$205.000

$708.100

(a1)

Compute inventory turnover for each company. (Round answers to 2 decimal places, eg. 15.25)

Wildhorse Company

Blossom Company

Inventory turnover

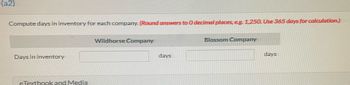

Transcribed Image Text:(a2)

Compute days in inventory for each company. (Round answers to0 decimal places, eg. 1,25O. Use 365 days for calculation.)

Wildhorse Company

Blossom Company

Days in inventory

days

days

eTextbook and Media

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Cont of pictures: Calculate gross profit rate under each of the following methods 1. LIFO 2. FIFO 3. Average-cost (Round answers to 1 decimal place, e.g. 51.2%)arrow_forward* Old Oak Winery sold inventory for $260,000, terms 5/10, n/30. Cost of goods sold was $151,000. How much sales revenue will Old Oak Winery report from the sale? (Assume the company records sales at the net amount.) OA. $109,000 OB. $260,000 OC. $247,000 OD. $151,000arrow_forwardAt December 31, 2014, the following information was available for A. Kamble Company: ending inventory $40,200, beginning inventory $57,470, cost of goods sold $276,700, and sales revenue $396,000. Calculate inventory turnover for A. Kamble Company. (Round answer to 1 decimal place, e.g. 1.5.)arrow_forward

- Bramble Inc. had beginning inventory of $11,395 at cost and $21,500 at retail. Net purchases were $122,915 at cost and $186,600 at retail. Net markups were $9,100, net markdowns were $6,600, and sales revenue was $159,100. Compute ending inventory at cost using the LIFO retail method. (Round ratios for computational purposes to 1 decimal place, e.g. 78.7% and final answer to O decimal places, e.g. 28,987.) Ending inventory using LIFO retail method $arrow_forwardThe following data are available for SQM - Sociedad Quimica y Minera S.A. Calculate Inventory Turnover (1 Decimal Place): Revenue 1850 Beg. Inventory 610 End Inventory 670 Credit Sales 1480 COGS 1110 1.8 2.9 1.8 2.3 1.9 O 1.7arrow_forward76 Company, considering the following transactions under three different cost allocation methods and using perpetual inventory updating. Number of Units Unit Cost Sales Beginning Inventory 260 $100 Sold 160 $140 Purchased 500 103 Sold 400 142 Purchased 420 110 Sold 370 174 Ending Inventory 250 Cost of Goods Sold FIFO $111,100 LIFO 97,900 AVG 96,805 Compare the ealculations for gross margin for A76 Company, based on the results of the perpetual inventory calculations using FIFO, LIFO, and AVG. Round intermediate calculation to 2 decimal places and final answer to nearest whole dollar. Comparison of FIFO, LIFO, AVG; Perpetual FIFO LIFO AVG Sales Revenue 24 Cost of Goods Sold Gross Marginarrow_forward

- James's Televisions produces television sets in three categories: portable, midsize, and flat-screen. On January 1, 2025, James adopted dollar-value LIFO and decided to use a single inventory pool. The company's January 1 inventory consists of: Category Portable Midsize Flat-screen Category Portable Midsize Quantity Cost per Unit $100 Flat-screen 3,000 4,000 1,500 8,500 Quantity Purchased 7,500 During 2025, the company had the following purchases and sales. 10,000 5,000 250 22,500 400 Cost per Unit $110 300 Total Cost 500 $300,000 1,000,000 600,000 $1,900,000 Quantity Sold 7,000 12,000 3,000 22,000 Selling Price per Unit $150 400 600arrow_forwardCalculate the goods available for sale for Atlantis Company, in units and in dollar amounts, giventhe following facts about their inventory for the period:arrow_forwardThe following data represent the beginning inventory and, in order of occurrence, the purchases and sales of Galantine, Inc., for an operating period. Unit Cost Beginning Inventory Sale No. 1 Purchase No. 1 Sale No. 2 Purchase No. 2 Totals Select one: O O O O Units 30 A. $840 B. $1,200 C. $1,110 D. $1,320 50 20 100 $21 30 33 Total Cost $630 - 1,500 Units Sold 660 $2,790 20 40 Assuming Galantine, Inc. uses LIFO perpetual inventory procedures, sale no. 2 is recorded as an entry to Cost of Goods Sold for: 60arrow_forward

- The following inventory information is gathered from the accounting records of Tucker Enterprises: # of Units x Unit Cost = Total Beginning Inventory 4000 x 5 Purchases 6000 x 7 Sales 9000 x 10 Ending Inventory 1000 a. Calculate Ending Inventory # of Units Unit Cost Ending Inventory 1.FIFO 0 $- 2.LIFO 0 $- 3.Weighted Average Cost 0 $- $- $- $- b. Cost of Goods Sold # of Units # of Units Unit cost Unit cost Cost of Goods Sold 1.FIFO $- 2.LIFO $- 3.Weighted Average Cost $- $- 0 $- c.Gross profit using each of the following methods: Sales Cost of Goods Sold Gross Profit 1.FIFO $- $- $- 2.LIFO $- $- $- 3.Weighted Average Cost $- $- $-arrow_forwardBelow are some of the account balances of FDN Company. Purchases P 1,269,500 Purchase returns and allowances 59,725 Freight in 33,800 Freight out 28,950 Beginning inventory 289,150 Cost of goods sold 1,232,825 How much is the total cost of goods available for sale?arrow_forwardSelected data for three companies are given below. All inventory amounts are ending balances. Description Amount Subcategory, Accounts Receivable 16,100 Administrative Expenses 15,300 Cash 26,500 Cost of Goods Sold 46,500 Equipment 53,000 Merchandise Inventory 7,300 Sales Revenue 92,000 Sellilng Expenses 20,500 Description Amount Subcategory, Accounts Receivable 10,800 Cash 7,800 Equipment 47,400 Rent Expense 5,200 Service Revenue 34,100 Utilities Expense 2,200 Wages Expense 10,500 Description Amount Subcategory, Accounts Receivable 25,400 Administrative Expenses 42,900 Cash 27,700 Cost of Goods Manufactured 112,900 Cost of Goods Sold 98,000 Equipment 259,000 Finished Goods Invetory 10,800 Raw Materials Inventory 8,800 Sales Revenue 223,900 Selling Expenses 49,500 Work-in-Process Inventory 5,200 Using the data above, indentify each company as a Service Company, Merchandising Company, or…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education