FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

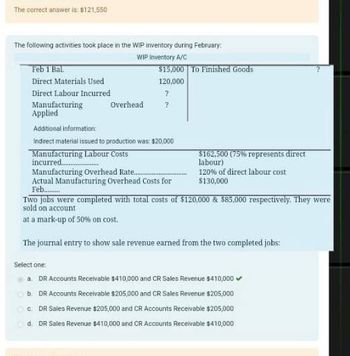

Transcribed Image Text:The correct answer is: $121,550

The following activities took place in the WIP inventory during February:

WIP Inventory A/C

$15,000 To Finished Goods

Feb 1 Bal

Direct Materials Used

120,000

Direct Labour Incurred

?

Manufacturing

Overhead

?

Applied

Additional information:

Indirect material issued to production was: $20,000

Manufacturing Labour Costs

incurred..

Manufacturing Overhead Rate...

Actual Manufacturing Overhead Costs for

Feb............

$162,500 (75% represents direct

labour)

120% of direct labour cost

$130,000

Two jobs were completed with total costs of $120,000 & $85,000 respectively. They were

sold on account

at a mark-up of 50% on cost.

The journal entry to show sale revenue earned from the two completed jobs:

Select one:

a. DR Accounts Receivable $410,000 and CR Sales Revenue $410,000✔

b. DR Accounts Receivable $205,000 and CR Sales Revenue $205,000

C. DR Sales Revenue $205,000 and CR Accounts Receivable $205,000

d. DR Sales Revenue $410,000 and CR Accounts Receivable $410,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- 5 a. Determine the number of units in progress inventory at December 31. _______ units b. Determine the equivalent units of production for direct materials and conversion costs in December. If an amount is zero, enter in "0".arrow_forwardNonearrow_forwardSterling's records show the work in process inventory had a beginning balance of $4,000 and an ending balance of $3,000. The records also showed the following data for the month: Materials used Overhead applied Cost of goods manufactured $1,500 50 7,500 Entry labels available for this problem: Beginning inventory Manufacturing costs incurred Materials available for use Overhead applied Ending inventory Materials used in production Cost of goods manufactured Direct labor Purchases Using the entry labels listed above, complete the following T-account to determine how much direct labor was incurred during the month? PLEASE NOTE: You must enter the entry labels exactly as written above and all entry amounts will be rounded to whole dollar amounts with "$" and commas as needed (i.e. $12,345). If no entry label is needed, please use "None" and if no entry amount is needed, please use "$0" - no quotation marks for either. You are to fill in cells beginning at the top of the T-account with any…arrow_forward

- The journal entry to record $1,500 of direct labor and $250 of indirect labor incurred will include debit(s) to the ________. A. Work−in−Process Inventory account for $1,500 and Manufacturing Overhead account for $250 B. Manufacturing Overhead account for $1,750 C. Finished Goods Inventory account for $1,750 D. Work−in−Process Inventory account for $1,500 and Finished Goods Inventory account forarrow_forwardThe following information pertains to Acme Manufacturing Company for June. Assume actual overhead equaled applied overhead. June 1 June 30 Inventory Balances Raw Materials $100,000 $60,000 Work in Process 120,000 145,000 Finished Goods 78,000 80,000 Activity during June: Raw materials purchased $120,000 Direct labor costs 100,000 Manufactured overhead 63,000 Complete the following Schedule of Cost of Goods Manufactured and Soldarrow_forwardSterling's records show the work in process inventory had a beginning balance of $5,000 and an ending balance of $4,000. How much direct labor was incurred if the records also show: Materials used $1,600 Overhead applied 400 Cost of goods manufactured 7,700 $fill in the blank 1arrow_forward

- Cost of Goods Sold, Cost of Goods Manifactured Glenville Company has the following information for April; Cost of direct materials used in production $41,000 Direct labor 55,000 Factory overhead 30, 000 Work in process inventory, April 1, 25,000 Work in process inventory, April 30, 41, 000 Finished goods mventory, April 1, 21,000 Finished goods inventory, Apnt 30, 17, 000 a. For April, determine the cost of goods manufactured. Using the data given, prepare a statement of Cost of Goods Manufactured. Glenville Company Statement of Cost of Goods Manufactured Total manufacturing costs incurred in April Total manufacturing costsarrow_forwardHarrow_forwardProblem 3: Lederman Inc. has provided the following data for the month of April: Beginning $12,000 $27,000 Inventories Work in process... Finished goods.... Additional Information: Direct materials.. Direct labor costs.. Manufacturing overhead cost incurred...... Manufacturing overhead cost applied to WIP Required: a. Determine costs of goods manufactured for april b. Was the overhead underapplied or overapplied? By how much? $51,000 $91,000 Ending $16,000 $25,000 $60,000 $59,000arrow_forward

- Given the following information, determine the cost of goods manufactured. Direct Labor Incurred $64,000 180,000 Manufacturing Overhead Incurred Direct Materials Used 155,000 197,000 98,000 220,500 110,000 Finished Goods Inventory, Jan. 1 Finished Goods Inventory, Dec. 31 Work-in - Process Inventory, Jan. 1 Work-in - Process Inventory, Dec. 31 O A. $185,000 B. $509,500 OC. $289,000 O D. $399,000arrow_forwardSV f: Job 222 started on June 1 and finished on July 15. Total cost on July 1 was $12,400, and the costs added in July were $188,500. The entry for the sale at a price of $310,000 would be: O A. Finished goods inv. OB. Sales Revenue C. Work in process inventory OD. Accounts receivable C C ar sti Ccour Cost of goods sold Accounts receivable Cost of goods sold Sales Revenue 200,900 310,000 200,900 310,000 200,900 310,000 200,900 310,000 asedarrow_forward< Zoe Corporation has the following information for the month of March: Cost of direct materials used in production Direct labor Factory overhead Work in process inventory, March 1 Work in process inventory, March 31 Finished goods inventory, March 1 Finished goods inventory, March 31 a. Determine the cost of goods manufactured. $ b. Determine the cost of goods sold. $16,971 25,726 36,875 18,297 18,757 21,733 25,034arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education