Question

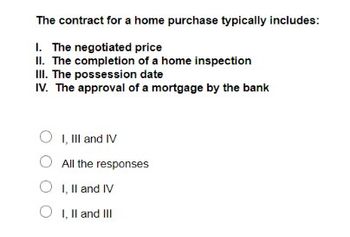

Transcribed Image Text:The contract for a home purchase typically includes:

I. The negotiated price

II. The completion of a home inspection

III. The possession date

IV. The approval of a mortgage by the bank

I, III and IV

All the responses

OI, II and IV

O I, II and III

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Loan interest income ▸ D7/84 O 。 The sequence in determining the taxability of interest income of an Fl: о . Consider s.14(1) first If not chargeable under s.14(1), then consider s.15(1)(i) Interpretation on s.15(1)(i): . (a) if the place where the funds are made available is a factor in determining source under s.14; and (b) if under s.14 it is decided that the interest is not subject to Hong Kong tax Then the matter must be viewed again under s.15(1)(i) but this time the place where the funds were provided is to be disregarded as a factor in determining the source of the interest 77arrow_forwardBuyer Bert can't believe that Seller Sam has had a last-second change of heart about entering into an agreement to sell his home to Bert. Sam has offered to refund Bert's earnest money and even pay him something in acknowledgment of Bert's inconvenience and disappointment, but Bert's not having it. He wants Sam's house. Choose the remedy for breach of trust that Bert will most likely take. demand specific performance initiate rescission accept compensatory damages settle for liquidated damagesarrow_forwardThe buyer and seller are scheduled to close the sales transaction on Wednesday, June 14. The taxes for the year were $3,500 and were paid in arrears. How would this appear on a closing statement? O A credit and debit to the seller. O A credit to the buyer and a debit to the seller. O A credit to the seller and a debit to the buver. • A credit and debit to the buyer.arrow_forward

- A $27.0 million mortgage loan from Bank of America fully amortizing over twenty five years at a fixed annual interest rate 6.75% with equal monthly payments and a 1% prepayment penalty has been seasoned for seven years. What will be the balloon payment due on the contract maturity date if the monthly mortgage payments continue to be paid on time? a. $24,512,618 b. $23,290,179 c. $27,000,000 d. $0arrow_forward37. Reduce the required provision if some or all of the expenditure required to settle a provision is expected to be reimbursed by another party, when, and only when, it is probable that reimbursement will be received if the enterprise settles the obligation. Select one: True or Falsearrow_forward- QUESTION 1 Green Tea 4 Life Ltd has requested your help in preparing their financial statements as they are unsure of the requirements of NZ IFRS 16 Leases for lessees. You are provided with the following lease details: Green Tea 4 Life Ltd is the Commencement date Lease term Economic life of asset Interest expense SCF classification IDC incurred by the lessee Upfront payment due on the commencement date Fixed payments per annum at year end Ownership transfer at end of lease Lessee's incremental borrowing rate The depreciation method used by the lessee The relevant present value discount factors are: Present value of $1 in n periods Present value of an annuity -5 1-8% Lessee 1 April 2019 5 years 10 years CFOA $10000 $30 000 $200 000 No 8% Straight line 0.6806 3.9927 (i) Prepare the journal entry to initially recognise the ROU asset and lease liability, at the commencement date. (ii) Complete the lessee's table in the space provided. Determine the total interest expense that would be…arrow_forward

- If the delivery term in the parties’ contract for the sale of goods is FOB the place at what the goods originated, absent any other agreement, the buyer is responsible for making reasonable arrangements for the goods to be shipped. true or falsearrow_forwardMichael Jordan specially orders a 10 foot mattress from Sleepy's without a written agreement. This contract is not enforceable. 3. Explain your answer to question 2.arrow_forward13. Sam Fraser, 24 years of age and single, possesses a two-year-old vehicle which he drives to work (a distance of 7(1/2) miles, full circle). He keeps the vehicle in 03 region, and has had one auto crash during the previous three years. What amount would Sam save money on a mix of $100-deductible impact and thorough inclusion on the off chance that he drove a vehicle delegated image 1 instead of as image 5? We don't know whether Sam has had driver preparing.arrow_forward

- 14. If a buyer defaults on a contract for sale after paying $7,000 in earnest money as a deposit, what happens to the earnest money? O The seller keeps the $7,000. O The buyer gets the money back. ○ The seller and the listing broker split the money between them O The broker keeps the $7,000arrow_forwardWhat was the correct interpretation of condition 4 in DTR Nominees Pty Ltd v Mona Homes Pty Ltd (1978) 138 CLR 423? Choose one of the following. A plan containing the 9 lots being sold should have already been lodged for registration at the time of contract. The plan attached to the contract containing 35 lots could be registered in 2 stages, so long as the plan already lodged at the time of contract contained the 9 lots being sold. The plan attached to the contract containing 35 lots should have already been lodged for registration at the time of contract. The plan attached to the contract containing 35 lots could be lodged within 14 days of the contract being signed.arrow_forwardA seller paid $1,200 in HOA fees at the beginning of the year. The buyer closed on the property and took possession on June 1st. Using the 360-day calendar, how much would the buyer owe the seller in prorated HOA fees? $200 $700 $600 $1,200arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios