Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Calculate the NPV of this investment

NPV = $

Please make sure your answer is correct tutor. Out of my questions in Bartleby, 90% are wrong all the time. Please don't get the question if you are not sure.

Thank you

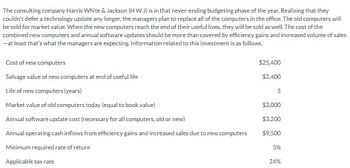

Transcribed Image Text:The consulting company Harris White & Jackson (HWJ) is in that never-ending budgeting phase of the year. Realizing that they

couldn't defer a technology update any longer, the managers plan to replace all of the computers in the office. The old computers will

be sold for market value. When the new computers reach the end of their useful lives, they will be sold as well. The cost of the

combined new computers and annual software updates should be more than covered by efficiency gains and increased volume of sales

- at least that's what the managers are expecting. Information related to this investment is as follows.

Cost of new computers

Salvage value of new computers at end of useful life

Life of new computers (years)

Market value of old computers today (equal to book value)

Annual software update cost (necessary for all computers, old or new)

Annual operating cash inflows from efficiency gains and increased sales due to new computers

Minimum required rate of return

Applicable tax rate

$25,400

$2,400

5

$2,000

$3,200

$9,500

5%

24%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardcan you describe detailed steps (all the keys to press) to calculate this in a ba -ii plus Texas instrument financial calculator? the answer will be 39.28 only I want to know which keys to press to get that answer as I have never used a financial calculator.arrow_forwardNonearrow_forward

- Please complete this practice problem by using the 2 images below. Please write cleary and everything in order. Thank youarrow_forwardIn this part of the project, you will be purchasing the home you chose in the Budget Project. You will need to obtain a loan from a financial institution since you cannot pay cash for your home. You will be researching three different loan scenarios and determining which loan option best fits your situation and needs. Purchase price of the home you chose from the Budget Project: ________$431,873______ Part 1: Financing your home Loan Scenario 1: In this scenario, your financial institution is offering you a 30-year fixed mortgage with a 20% down payment at a 3.43% fixed rate. Determine the following: Calculate the down payment for this loan. How much will you need to finance from the bank for this loan? What is your monthly payment? Use technology or the monthly payment formula in your text to get the monthly payment for this loan. What is the total cost of the loan over 30 years? How much of this cost is interest? What is the total you will expect to pay at closing for this loan…arrow_forwardQuestion A .Full explain this question and text typing work only We should answer our question within 2 hours takes more time then we will reduce Rating Dont ignore this linearrow_forward

- Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardCool Math Games... Vanilla Sauce Reci... F. Easiest Bread Pud.... gle Chrome updates, you'll need macOS 10.13 or later. This computer is using OS X 10.11. 5 Homework Year 0 1 2 3 Consider the following cash flows on two mutually exclusive projects for the Bahamas Recreation Corporation (BRC). Both projects require an annual return of 14 percent. Check my work mode: This shows what is correct or incorrect for the work Deepwater Fishing -$ 875,000 330,000 480,000 440,000 Deepwater Fishing Submarine Ride New Submarine Ride -$1,650,000 a-1. Compute the IRR for both projects. (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g.. 32.16.) Deenwater Fishin 890,000 730,000 590,000 % % Seved a-2. Based on the IRR, which project should you choose? < Prev Creams 10 of 11 MacBook Proarrow_forwardI need this question completed in 5 minutesarrow_forward

- Question A .Full explain this question and text typing work only We should answer our question within 2 hours takes more time then we will reduce Rating Dont ignore this linearrow_forwardAbswer with detailed steps. Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education