FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

The comparative

Additional data obtained from an examination of the accounts in the ledger for 2020 are as follows:

- The investments were sold for $875 million cash.

- Equipment and land were acquired for cash.

- There were no disposals of equipment during the year.

- The common stock was bought back with cash.

- There was a $89 million credit to

Retained Earnings for net income. - There was a $564 million debit to Retained Earnings for cash dividends declared.

Prepare a statement of

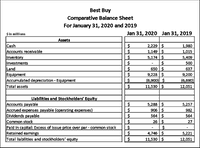

Transcribed Image Text:Best Buy

Comparative Balance Sheet

For January 31, 2020 and 2019

$in millions

Jan 31, 2020 Jan 31, 2019

Assets

Cash

Accounts receivable

Inventory

Investments

Land

Equipment

Accumulated depreciation - Equipment

2,229 $

1,149 $

5,174 $

1,980

1,015

5,409

500

637

650 $

9,228 $

(6,900) $

9,200

(6,690)

Total assets

11,530 |$

12,051

Liabilities and Stockholders' Equity

Accounts payable

Accrued expenses payable (operating expenses).

Dividends payable

Common stock

Paid in capital: Excess of Issue price over par- common stock

Retained eamings

Total liabilities and stockholders' equity

5,288 $

906 $

564 $

26$

5,257

982

564

27

4,746 $

11,530 $

5,221

12,051

haka ko

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Compute the following ratios and measurement for 2020 a. cash flow from operations to current liabilities b. inventory turnover c. rate of gross profit on salesarrow_forwardSuppose the following items were taken from the 2022 financial statements of Texas Instruments, Inc. (All dollars are in millions.) Common stock Prepaid rent Equipment Stock investments (long-term) Debt Investments (short-term) Income taxes payable Cash $2.826 164 6,705 637 1,743 128 1,182 Accumulated depreciation-equipment Accounts payable Patents Notes payable (long-term) Retained earnings Accounts receivable V Inventory TEXAS INSTRUMENTS, INC. Balance Sheet (in millions) Assets $3.547 1,459 2,210 Prepare a classified balance sheet in good form as of December 31, 2022. (List Current Assets in order of liquidity) $ 810 6,896 1,823 1,202 Liabilities and Stockholders' Equity $ $ $ $arrow_forwardSkysong, Inc. had the following transactions involving current assets and current liabilities during February 2019. Feb. 3 Collected accounts receivable of $18,900. 7 Purchased equipment for $36,800 cash. 11 Paid $3,500 for a 1-year insurance policy. 14 Paid accounts payable of $12,400. 18 Declared cash dividends, $8,500. Additional information:As of February 1, 2019, current assets were $135,000 and current liabilities were $35,400.Compute the current ratio as of the beginning of the month and after each transaction. (Round all answers to 2 decimal places, e.g. 1.83 : 1.) Current ratio as of February 1, 2019 enter current ratio :1 Feb. 3 enter the current ratio as of February 3 :1 Feb. 7 enter the current ratio as of February 7 :1 Feb. 11 enter the current ratio as of February 11 :1 Feb. 14 enter the current ratio as of February 14 :1 Feb. 18 enter the current ratio as of February 18 :1arrow_forward

- Extracts from the balance sheet of Atlantis Inc. are as follows: 2018 Assets Current Assets: Cash and Cash Equivalents 30,000 Accounts Receivable, Net 65,000 Merchandise Inventory 50,000 Total Current Assets 145,000 Long-Term Investments 150,000 Property, Plant, and Equipment, Net 250,000 Total Assets 545,000 Total Current Liabilities 150,000 Compute the acid test ratio.arrow_forwardAccording to the balance sheet of Free Inc, at the end of the 2020 fiscal year, the cash balance is $200,000, account available balance is $500,000, inventory balance is $750,000; the net fixed asset is $1,500,000. On the other side, the account payable is $250,000, the accrual $40,000, the notes payable is $300,000, long-term debt is $510,000, common stock is $1,200,000, retained earnings is $650,000. The net income is $900,000; the interest payment is $45,600; the tax rate is 25%. If the sales is $10,000,000, what is the operating margin?b. 13.26%c. 11.45%d. 10.66%arrow_forwardRefer to the following financial statements for Kodenko Inc: Prepare forecasts of its income statement, statement of financial position and statement of cash flows for 2020 under the following assumptions:a. All financial ratio remains at 2019 level.b. Kodenko will not record restructuring costs for 2020.c. Taxes payable are at the 2019 level of RM544 million.d. Depreciation expense charged to Selling, general and administrative is RM765million for 2019 and 2018 repectively.e. Gross PPE is RM 12,982 million and RM12,963 million for 2019 and 2018 respectively.f. Projected current maturities of long term debt are RM13 million for 2020.g. Capital expenditure for 2019 and 2018 are RM1,047 and RM783, respectivelyarrow_forward

- The accountant at Storm Inc. gathered the following selected accounting information: Cash Short-term investments Accounts receivable (net) Inventory Prepaid expenses Accounts payable Salaries payable Income taxes payable Bonds payable (due 2019) Sales Cost of goods sold 2022 $ 35,000 28,000 33,000 47,000 7,000 55,000 10,000 3,000 90,000 250,000 180,000 2023 $33,000 29,000 30,000 50,000 5,500 62,000 8,000 2,500 90,000 230,000 165,000 Required 1. Compute the acid-test ratio for 2022 and 2023. 2. Compute the days' sales in average receivables for 2022 and 2023. Net accounts receivable on December 31, 2021 was $27,000.arrow_forwardThe balance sheets for Planet Company showed the following information. Additional information concerning transactions and events during 2020 are presented below. Kinder Company Balance Sheet December 31 2020 2019 Cash 24 30,900 $10,200 Accounts receivable (net) 43.300 20,300 Inventory 35.000 42,000 Long-term investments 15,000 Property, plant & equipment 236,500 150,000 Accumulated depreciation (37,700) (25,000) $308,000 $212,500 Accounts payable $ 17,000 $ 26,500 Accrued liabilities 21,000 17,000 Long-term notes payable 70,000 50,000 Common stock 130,000 90,000 Retained earnings 70,000 29,000 $308,000 $212,500arrow_forwardThe 2018 balance sheet of Speith's Golf Shop, Inc., showed long-term debt of $6.2 million, and the 2019 balance sheet showed long-term debt of $6.45 million. The 2019 income statement showed an interest expense of $215,000. The 2018 balance sheet showed $610,000 in the common stock account and $2.5 million in the additional paid-in surplus account. The 2019 balance sheet showed $650,000 and $3 million in the same two accounts, respectively. The company paid out $610,000 in cash dividends during 2019. Suppose you also know that the firm's net capital spending for 2019 was $1,470,000, and that the firm reduced its net working capital investment by $89,000. What was the firm's 2019 operating cash flow, or OCF? (Do not round intermediate calculations. Enter your answer in dollars, not millions of dollars, e.g., 1,234,567.) t Operating cash flow 3 F5 F6 ences Mc Graw :0 F2 20 F3 000 F4 ◄◄ F7 ▶11arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education