FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

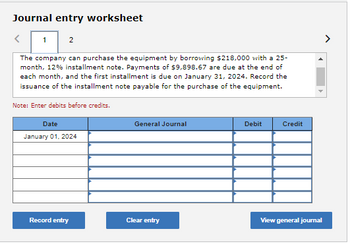

Transcribed Image Text:Journal entry worksheet

<

1 2

The company can purchase the equipment by borrowing $218,000 with a 25-

month, 12% installment note. Payments of $9,898.67 are due at the end of

each month, and the first installment is due on January 31, 2024. Record the

issuance of the installment note payable for the purchase of the equipment.

Note: Enter debits before credits.

Date

January 01, 2024

Record entry

General Journal

Clear entry

Debit

Credit

View general journal

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Sunland Company borrowed $760,000 on December 31, 2019, by issuing an $760,000, 9% mortgage note payable. The terms call for annual installment payments of $118,423 on December 31. (a) Your answer is correct. Prepare the journal entries to record the mortgage loan and the first two installment payments. (Round answers to 0 decimal places, e.g. 15,250. Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem. List all debit entries before credit entries.) Date Dec. 31, 2019 ec. 31, 2020 Account Titles and Explanation Cash Mortgage Payable Interest Expense Mortgage Payable Cash Debit 760,000 68400 50023 Credit 760,000 118423arrow_forwardLooking for answers asap. Thanks! Analyze and review the following items and determine the appropriate journal entry. Notes Payable This is a short-term note. The company borrowed money from JRT Investments on October 31, 2020 for 3 months. The principal, along with interest is to be repaid on January 31, 2021. The interest rate is 1.8%. Notes Payable = $250,000arrow_forwardSubject : Accountingarrow_forward

- On June 1, 2023 Stanfield Tileworks accepts a $50,000, five month, 9% note from a customer. On November 1, 2023, Stanfield receives full payment for the note including accrued interest. Please provide the journal entry that results from this paymentarrow_forwardHow to journalize the issuance of the note on january 1 2024arrow_forwardOn the first day of the fiscal year, Shiller Company borrowed $32,000 by giving a 5-year, 11% installment note to Soros Bank. The note requires annual payments of $8,783, with the first payment occurring on the last day of the fiscal year. The first payment consists of interest of $3,520 and principal repayment of $5,263. Journalize the entries to record the following: Question Content Area a1. Issued the installment note for cash on the first day of the fiscal year. If an amount box does not require an entry, leave it blank. blank Account Debit Credit blank Question Content Area a2. Paid the first annual payment on the note. If an amount box does not require an entry, leave it blank. blank Account Debit Credit blankarrow_forward

- eBook Show Me How Proceeds from Notes Payable On January 26, Vibrant Co. borrowed cash from Conrad Bank by issuing a 60-day note with a face amount of $39,600. Assume a 360-day year. a. Determine the proceeds of the note, assuming the note carries an interest rate of 6%. b. Determine the proceeds of the note, assuming the note is discounted at 6%. Check My Work Email Instructor Save and Exit Previous Submit Assignmearrow_forwardThe transaction below pertains to Boyer Coe Company, whose fiscal year ends December 31. On November 1, 2019 Coe borrowed $25,000 at 6 percent for 6 months. The entry to record the November 1 borrowing transaction would include a: A. Credit to notes payable for $750 B. Credit to notes payable for $24,250 C. Debit to cash for $24,250 D. Debit to cash for $25,000arrow_forward1. Record journal entries for the following transactions of Hansen Bakery Company. Jan. 1, 2020 Dec. 31, 2020 Dec. 31, 2021 Dec. 31, 2022 Issued a $265,500 note to customer Jack Bullock as terms of a merchandise sale. The merchandise's cost to Hansen Bakery Company is $89,750. Note contract terms included a 36-month maturity date, and a 4.3% annual interest rate. Hansen Bakery Company records interest accumulated for 2020. Hansen Bakery Company records interest accumulated for 2021. Jack Bullock honors the note and pays in full with cash.arrow_forward

- Problem: ABC Company issued a promissory note to RCBC Bank. Details from the promissory note are as follows: Date of note: November 1, 2020 Term of note: 180 days Principal: P120,000 Interest rate: 12% Determine the following: 1. What is the account to be credited on the adjusting entry on December 31, 2020? 2. How much is the amount to be credited on December 31, 2020? 3. How much is the total interest expense for the full term of the note.arrow_forwardDate Transaction description Obtained a loan of $41,000 from Earth Bank at a simple interest rate of 6% per year. The first interest payment is due at the end of August 2021 and the principal of the loan is to be repaid on June 1, 2024. Paid the full amount owing to Sport Borders, Check No. 603. Payment fell within discount period. Paid the full amount owing to J. J. Spud, Check No. 604. Payment fell within discount period. Made cash sales of $4,184 during the first 3 days of the month. 2 3 Purchased 6 Downhill Snowboards from Good Sports for $180 each, terms 2/10, n/30. Sold 6 Tony Eagle Mark 3 Freestyle Skateboards to Balls 'n All for $204 each, Invoice No. 501. Purchased 5 Freestyle Snowboards with cash for $170 each, Check No. 605. Purchased 5 Pipe Dream surfboards from Sports 'R Us for $150 each, terms net 30. 4 4. 7 After completing this practice set page, you should know how to record basic transactions in the journals provided below and understand the posting process in the…arrow_forwardEntries for notes payable Bennett Enterprises issues a $504,000, 30-day, 8 %, note to Spectrum Industries for merchandise inventory. Assume a 360-day year. If required, round your answers to the nearest dollar. If an amount box does not require an entry, leave it blank. Question Content Area a. Journalize Bennett Enterprises' entries to record: the issuance of the note. the payment of the note at maturity. 1. 2. Question Content Area b. Journalize Spectrum Industries' entries to record: the receipt of the note. the receipt of the payment of the note at maturity. 1. 2.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education