FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

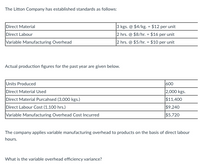

Transcribed Image Text:The Litton Company has established standards as follows:

Direct Material

Direct Labour

3 kgs. @ $4/kg. = $12 per unit

2 hrs. @ $8/hr. = $16 per unit

2 hrs. @ $5/hr. = $10 per unit

%3!

Variable Manufacturing Overhead

Actual production figures for the past year are given below.

Units Produced

Direct Material Used

Direct Material Purcahsed (3,000 kgs.)

600

2,000 kgs.

$11,400

Direct Labour Cost (1,100 hrs.)

Variable Manufacturing Overhead Cost Incurred

$9,240

$5,720

The company applies variable manufacturing overhead to products on the basis of direct labour

hours.

What is the variable overhead efficiency variance?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please explain:: What is the purpose of an overhead rate What are the steps to apply the overhead cost to a product What does it represent when the overhead cost for over-appliedarrow_forwardPlease indicate which are product costs and which are period costs. Under Absorption Costing: Direct Materials are considered a Direct Labor is considered a Variable overhead is considered a Fixed overhead is considered a Under Variable Costing: Direct Materials are considered a Direct Labor is considered a Variable overhead is considered a Fixed overhead is considered aarrow_forwardWhen used as the denominator in the calculation of an overhead rate, which of the following will cause the least amount of overhead to be applied? a. Theoretical activity level b. Expected activity level c. Practical activity level d. Normal activity levelarrow_forward

- Under variable costing, all fixed manufacturing costs are treated as a a. product cost included in the cost of goods manufactured. b. product cost included in the cost of ending inventory. c. period expense deducted from manufacturing margin. d. period expense deducted from contribution margin.arrow_forwardWhat is a key difference between variable costing and absorption costing? a. The usage of homogenous cost pools. b. The classification of fixed factory overhead. c. classification of direct materials and labor. d. The choice of allocation base.arrow_forward1. What are the three primary reasons of using a standard cost system? In a business that routinely manufactures the same products or performs the same services, why are standards helpful? 2. What are ideal standards? What are currently attainable standards? Explain which standard is usually adopted and why. 3. Some people suggest that the direct labor rate variance is never controllable. Do you agree or disagree? Give reasons to support your answer.arrow_forward

- In Traditional product costing systems, the measure of product activity is usually some volume based cost driver, like direct labor hours. True or False?arrow_forwardWhich of the following is a correct equation to calculate the fixed overhead production-volume variance? a. budgeted fixed overhead costs − fixed overhead costs allocated for actual output b. static budget amount − flexible budget amount c. actual costs incurred − fixed overhead costs allocated for actual output d. flexible budget amount − actual costs incurredarrow_forwardWhich of the following statements Is true? Multiple Choice The material quantity variance is recorded when overhead is applied to production. The material price and the material quantity variances are recorded at the same time., The materials quantity variance is recorded when materials are used in production. The materials quantity variance is recorded when materials are purchased.arrow_forward

- Which of the following is not a method of cost absorption? (a) Percentage of direct material cost (b) Machine hour rate (c) Labour hour rate (d) Repeated distribution methodarrow_forwardQuestion: In cost accounting, what is the primary purpose of calculating the predetermined overhead rate? A) To allocate indirect costs to products based on a predetermined formula.B) To determine the actual overhead costs incurred during a specific production period.C) To calculate variable costs associated with each unit of production.D) To assess fixed costs that remain constant regardless of production levels.arrow_forwardWhat are the advantages and disadvantages of Standard costing system when the labor rate us fixed?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education