Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Need help on both

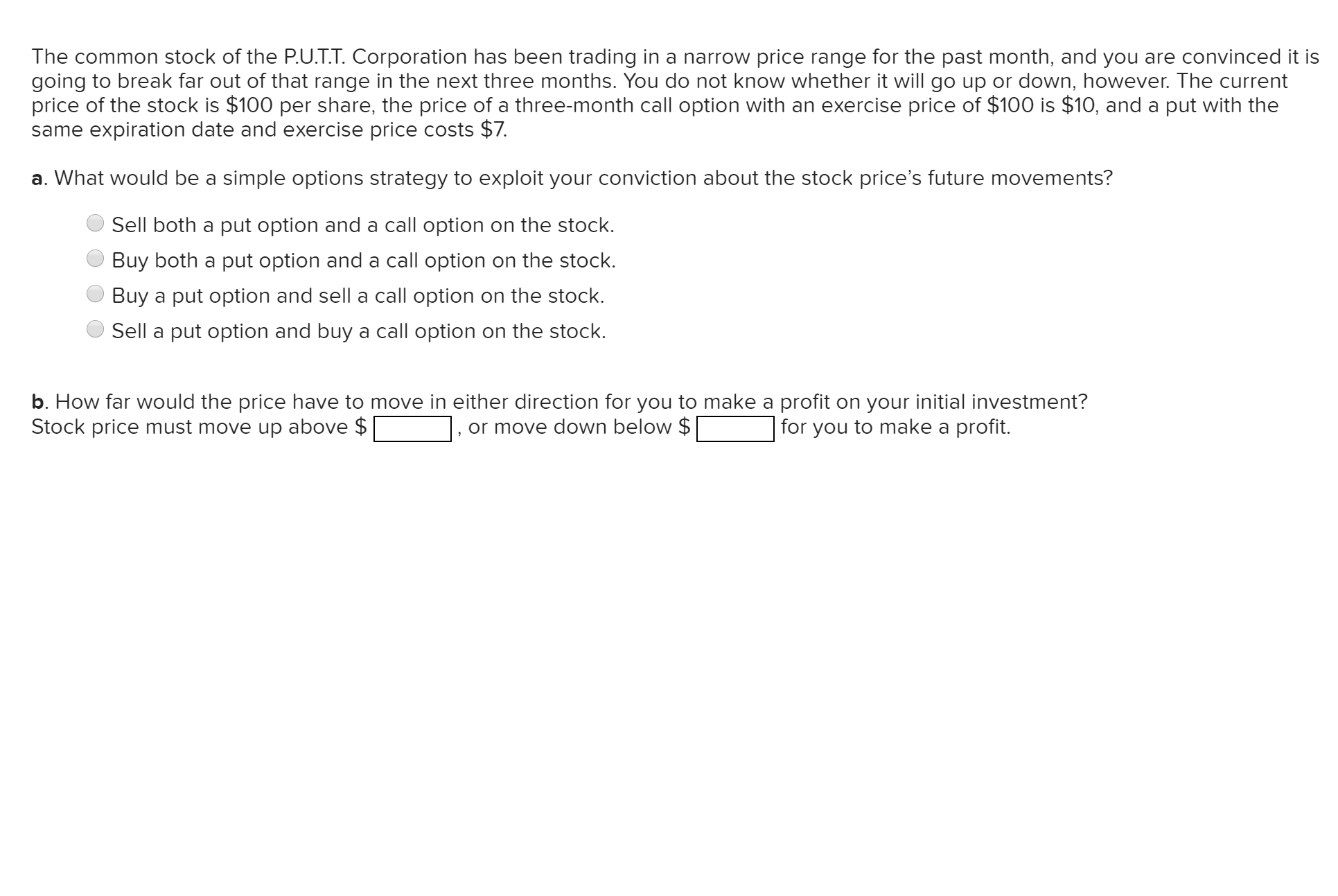

Transcribed Image Text:The common stock of the P.U.T.T. Corporation has been trading in a narrow price range for the past month, and you are convinced it is

going to break far out of that range in the next three months. You do not know whether it will go up or down, however. The current

price of the stock is $100 per share, the price of a three-month call option with an exercise price of $100 is $10, and a put with the

same expiration date and exercise price costs $7.

a. What would be a simple options strategy to exploit your conviction about the stock price's future movements?

Sell both a put option and a call option on the stock.

Buy both a put option and a call option on the stock.

Buy a put option and sell a call option on the stock.

Sell a put option and buy a call option on the stock.

b. How far would the price have to move in either direction for you to make a profit on your initial investment?

Stock price must move up above $

| for you to make a profit.

or move down below $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The common stock of the P.U.T.T. Corporation has been trading in a narrow price range for the past month, but you are convinced it is going to break far out of that range in the next 6 months. You do not know whether it will go up or down, however. The current price of the stock is $125 per share, and the price of a 6 month call option at an exercise price of $125 is $6.93. Required: If the semiannual risk-free interest rate is 5%, what must be the price of a 6-month put option on P.U.T.T. stock at an exercise price of $125? (The stock pays no dividends.) What would be a simple options strategy to exploit your conviction about the stock price's future movements? How far would it have to move in either direction for you to make a profit on your initial investment?arrow_forwardThe common stock of the P.U.T.T. Corporation has been trading in a narrow price range for the past month, but you are convinced it is going to break far out of that range in the next 6 months. You do not know whether it will go up or down, however. The current price of the stock is $130 per share, and the price of a 6 month call option at an exercise price of $130 is $10.85. Required: a. If the semiannual risk-free interest rate is 5%, what must be the price of a 6-month put option on P.U.T.T. stock at an exercise price of $130? (The stock pays no dividends.) b. What would be a simple options strategy to exploit your conviction about the stock price's future movements? How far would it have to move in either direction for you to make a profit on your initial investment? Complete this question by entering your answers in the tabs below. Required A Required B If the semiannual risk-free interest rate is 5%, what must be the price of a 6-month put option on P.U.T.T. stock at an exercise…arrow_forwardThe common stock of the P.U.T.T. Corporation has been trading in a narrow price range for the past month, but you are convinced it is going to break far out of that range in the next 6 months. You do not know whether it will go up or down, however. The current price of the stock is $120 per share, and the price of a 6 month call option at an exercise price of $120 is $8.89. Required: a. If the semiannual risk-free interest rate is 4%, what must be the price of a 6-month put option on P.U.T.T. stock at an exercise price of $120? (The stock pays no dividends.) b. What would be a simple options strategy to exploit your conviction about the stock price's future movements? How far would it have to move in either direction for you to make a profit on your initial investment? Complete this question by entering your answers in the tabs below. Required A Required B If the semiannual risk-free interest rate is 4%, what must be the price of a 6-month put option on P.U.T.T. stock at an exercise…arrow_forward

- The common stock of the P.U.T.T. Corporation has been trading in a narrow price range for the past month, but you are convinced it is going to break far out of that range in the next 6 months. You do not know whether it will go up or down, however. The current price of the stock is $85 per share, and the price of a 6 month call option at an exercise price of $85 is $8.00. Required: a. If the semiannual risk-free interest rate is 4%, what must be the price of a 6-month put option on P.U.T.T. stock at an exercise price of $85? (The stock pays no dividends.) b. What would be a simple options strategy to exploit your conviction about the stock price's future movements? How far would it have to move in either direction for you to make a profit on your initial investment? Complete this question by entering your answers in the tabs below. Required A Required B If the semiannual risk-free interest rate is 4%, what must be the price of a 6-month put option on P.U.T.T. stock at an exercise price…arrow_forwardA.K. Scott’s stock is selling for $37 a share. A 3-month call on this stock with a strike price of $38 is priced at $2. Risk-free assets are currently returning 0.28 percent per month. a) What should be the price of a 3-month put option on this stock with a strike price of $38? b) Which of the two options is currently in the money and does that accord with your conclusions about their relative prices?arrow_forwardThe common stock of the XYZ Co. has been trading in a narrow range around $40 per share for months, and you believe it is going to stay in that range for the next 3 months. The price of a 3-month put option with an exercise price of $40 is $3, and a call with the same expiration date and exercise price sells for $4. How can you create a position involving a put, a call, and riskless lending that would have the same payoff structure as the stock at expiration? O Buy the call, sell the put; lend the present value of $40. O Sell the call, buy the put; lend the present value of $40. O Buy the call, sell the put; borrow the present value of $40. O Sell the call, buy the put; borrow the present value of $40.arrow_forward

- Nikilarrow_forwardRadubhaiarrow_forwardStanton Company stock is trading for 50 in a two‑time period environment, so that each relevant time period is 6 months. The stock might increase by exactly 20% in just one period or perhaps in both periods. Of course, the stock might not increase in either period. If the stock price does not increase in a given period, it will decline by 16.67 percent in that particular period. One-year options with an exercise price equal to 60 are trading on this stock. The annual riskless rate of return equals 0. a. What is the value of a put in this environment? b. What is the probability (risk-neutral probability) implied in this framework that the Stanton Company stock price will exceed 40 when options expire?arrow_forward

- Now suppose the stock price of Oceanic Industries throughout the four quarters in 2019 actually looks as follows: 100 90 80 70 60 50 40 30 20 10 0 Oceanic Industries Stock Price (2019) ?arrow_forwardA share of stock with a beta of 0.70 now sells for $45. Investors expect the stock to pay a year-end dividend of $4. The T-bill rate is 5%, and the market risk premium is 8%. If the stock is perceived to be fairly priced today, what must be investors’ expectation of the price of the stock at the end of the year? (Do not round intermediate calculations. Round your answer to 2 decimal places.)arrow_forwardMomo, a fast-growing company, will make an earnings announcement three months from now. But you do not know whether it will be positive or negative (i.e., the stock price will go up or down). The current price of the stock is $30 per share. A three-month call with an exercise price of $30 costs $5. A put with the same exercise price and expiration date costs $5. a. What would be a simple options strategy to bet on the stock price volatility?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education