Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

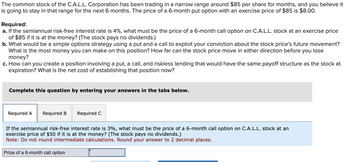

Transcribed Image Text:The common stock of the C.A.L.L. Corporation has been trading in a narrow range around $85 per share for months, and you believe it

is going to stay in that range for the next 6 months. The price of a 6-month put option with an exercise price of $85 is $8.00.

Required:

a. If the semiannual risk-free interest rate is 4%, what must be the price of a 6-month call option on C.A.L.L. stock at an exercise price

of $85 if it is at the money? (The stock pays no dividends.)

b. What would be a simple options strategy using a put and a call to exploit your conviction about the stock price's future movement?

What is the most money you can make on this position? How far can the stock price move in either direction before you lose

money?

c. How can you create a position involving a put, a call, and riskless lending that would have the same payoff structure as the stock at

expiration? What is the net cost of establishing that position now?

Complete this question by entering your answers in the tabs below.

Required A Required B

Required C

If the semiannual risk-free interest rate is 3%, what must be the price of a 6-month call option on C.A.L.L. stock at an

exercise price of $50 if it is at the money? (The stock pays no dividends.)

Note: Do not round intermediate calculations. Round your answer to 2 decimal places.

Price of a 6-month call option

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The common stock of the C.A.L.L. Corporation has been trading in a narrow range around $105 per share for months, and you believe it is going to stay in that range for the next 3 months. The price of a 3-month put option with an exercise price of $105 is $12.86. a. If the risk-free interest rate is 5% per year, what must be the price of a 3-month call option on C.A.L.L. stock at an exercise price of $105 if it is at the money? (The stock pays no dividends.) (Do not round intermediate calculations. Round your answer to 2 decimal places.) Price of a 3-month call optionarrow_forwardThe stock price is currently $30. Each month for the next two months it is expected to increase by 8% or reduce by 10%. The risk-free interest rate is 5%. Use a two-step tree to calculate the value of a derivative that pays off [max(30 — St; 0)]2, where St is the stock price in two months? If the derivative is American-style, should it be exercised early?arrow_forwardA stock price is currently $51. It is assumed that at the end of six months it will be either $30 or $74. The risk-free interest rate is 1.3% per annum with continuous compounding. The stock doesn't pay dividends. One-step binomial tree is used to value options. What is the value of a six-month European call option with a strike price of $51? Round your final result to the nearest cents and input one number only, without units or percentage sign [%], using the dot [.] to separate decimals. Your Answer: Answerarrow_forward

- There are call and put options on the shares in Nord AS with a redemption price of NOK 55 and one year to maturity. Today's share price is NOK 50. At the end of the year, the stock price will either be 30 kroner or 80 kroner. The risk-free interest rate of 3% per. year. a) What is the value of call options today? b) What is the value of the put options today if the put-buy parity holds? You have a portfolio of 2000 shares in Nord AS, but are starting to worry about that price. must fall. You therefore want to secure yourself by using options. c) Show how you can use call and put options to secure your position your. Explain.arrow_forwardIBM stock currently sells for 84 dollars per share. Over 8 months the price will either go up by 7.5 percent or down by -3.0 percent. The risk-free rate of interest is 4.5 percent continuously compounded. A call option with strike price 83 and maturity of 8 months has a delta of 0.82766. What is the value of this call option? 0.62579 O2.6708 O4.0788 2.9324 O4.3788arrow_forwardUse the binomial tree analysis to value a 6-month American put option with a $65 strike price on Crookshanks Corporation. The shares are currently trading for $60. The annualized continuously compounded risk-free rate is 3%. The volatility of the stock is 57%. You will use the Cox Ross Rubenstein method for computing the binomial tree, and use a time step of 2 months.arrow_forward

- Generic Stock Inc. (GS) is trading at $100. A call option with a strike price of $102, which expires in 6 months, costs $9.52 (assuming a risk - free rate of 5% and a volatility of 0.33). What is the Delta of this optionarrow_forwardThe price of a stock is currently $37. Over the next half year, the price is anticipated to rise to $42 or decline to $36. The upside has a 60% probability of occurring. The risk-free interest rate is 5% p.a.. What is the price of a six month call option with an exercise price of $38?arrow_forwardThe stock price of Heavy Metal (HM) changes only once a month: either it goes up by 24% or it falls by 20.7%. Its price now is $48. The interest rate is 1.2% per month. What is the value of a one-month call option with an exercise price of $48? What is the option delta? The payoffs of the call option can be replicated by buying shares of stock and borrowing. What amount should be invested in stock and what amount must be borrowed? What is the value of a two-month call option with an exercise price of $49? What is the option delta of the two-month call over the first one-month period?arrow_forward

- A non-dividend-paying stock is currently selling for $50, and the risk-free rate of interest is 8% per annum with continuous compounding for all maturities. An investor has just taken a short position in a six-month forward contract on the stock. a. What is the forward price? (sample answer: $25.45) b. What is the initial value of the forward contract? (sample answer: $25.45) c. Three months later, the price of the stock is $48 and the risk-free rate is still 8% per annum. What is the forward price now? (sample answer: $25.45) What is the value of the short position in the forward contract? (sample answer: $25.45 or -$25.45arrow_forwardThe market price of JS stock is currently $30. It is known that at the end of three months it will be either $33 or $27. The risk-free interest rate is 8% per annum with continuous compounding. (a) Use a one-step binomial tree to calculate the value of a three-month European put option on the JS stock with a strike price of $31? Use no-arbitrage arguments (you need to show how to set up the riskless portfolio). (b) Use the same one-step binomial tree and your results from (a) to determine the price of a three-month American put option on the JS stock with a strike price of $31arrow_forwardThe common stock of the CGI Inc. has been trading in a narrow range around $35 per share for months, and you believe it is going to stay in that range for the next three months. The price of a three-month put option with an exercise price of $35 is $2, and a call with the same expiration date and exercise price sells for $3. Suppose you write a strap ( = write 2 calls and write 1 put with the same strike price) and the stock price winds up to be $37 at contract expiration. What was your net profit on the strap? A. $200 B. $300 C. $400 D. $500 E. $700arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education