ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

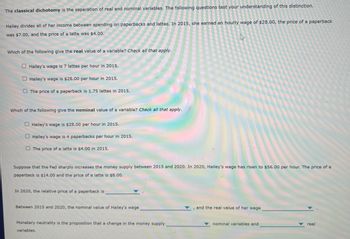

Transcribed Image Text:The classical dichotomy is the separation of real and nominal variables. The following questions test your understanding of this distinction.

Hailey divides all of her income between spending on paperbacks and lattes. In 2015, she earned an hourly wage of $28.00, the price of a paperback

was $7.00, and the price of a latte was $4.00.

Which of the following give the real value of a variable? Check all that apply.

Hailey's wage is 7 lattes per hour in 2015.

Hailey's wage is $28.00 per hour in 2015.

The price of a paperback is 1.75 lattes in 2015.

Which of the following give the nominal value of a variable? Check all that apply.

Hailey's wage is $28.00 per hour in 2015.

Hailey's wage is 4 paperbacks per hour in 2015.

The price of a latte is $4.00 in 2015.

Suppose that the Fed sharply increases the money supply between 2015 and 2020. In 2020, Hailey's wage has risen to $56.00 per hour. The price of a

paperback is $14.00 and the price of a latte is $8.00.

In 2020, the relative price of a paperback is,

Between 2015 and 2020, the nominal value of Hailey's wage

Monetary neutrality is the proposition that a change in the money supply

variables.

, and the real value of her wage

nominal variables and

real

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- On January 1, 2012, Albert invested $2,000 at 5 percent interest per year for three years. The CPI (times 100) on January 1, 2012, stood at 100. On January 1, 2013, the CPI was 106; on January 1, 2014, it was 112; and on January 1, 2015, the day Albert's investment matured, the CPI was 117. Find the real rate of interest earned by Albert in each of the three years and his total real return over the three-year period. Assume that interest earnings are reinvested each year and themselves earn interest. Hint: Calculate inflation and real interest for each year and then calculate it for the three years as a whole. Instructions: Enter your responses rounded to one decimal place. If you are entering any negative numbers be sure to include a negative sign (-) in front of those numbers. Year 2012 2013 2014 Real rate of interest Total real rate of return: -1% % % %.arrow_forwardConsider a fictional price index, the College Student Price Index (CSPI), based on a typical college student’s annual purchases. Suppose the following table shows information on the market basket for the CSPI and the prices of each of the goods in 2017, 2018, and 2019. The cost of each item in the basket and the total cost of the basket are shown for 2017. Perform these same calculations for 2018 and 2019, and enter the results in the following table. **THE TABLE IS ATTACHED** Suppose the base year for this price index is 2017. In the last row of the table, calculate and enter the value of the CSPI for the remaining years. Between 2017 and 2018, the CSPI increased by_________%. Between 2018 and 2019, the CSPI increased by_________%. Which of the following, if true, would illustrate why price indexes such as the CSPI might overstate inflation in the cost of going to college? Check all that apply. As the price of textbooks increased, more and more students…arrow_forwardConsider a fictional price index, the College Student Price Index (CSPI), based on a typical college student’s annual purchases. Suppose the following table shows information on the market basket for the CSPI and the prices of each of the goods in 2017, 2018, and 2019. The cost of each item in the basket and the total cost of the basket are shown for 2017. Perform these same calculations for 2018 and 2019, and enter the results in the following table.arrow_forward

- What is the effect of the sources of bias on the CPI calculation? A. Changes in relative prices lead consumers to change the items they buy, and the CPI reflects this substitution. B. The new goods bias injects a downward bias into the CPI. C. When faced with higher prices, people use discount stores more frequently and convenience stores less frequently, but the CPI doesn't include this outlet substitution. D. When the quality of a good improves over time, the CPI doesn't include the portion of the price rise attributable to the higher quality in its calculation.arrow_forwardTamika is lending Juan $1,000 for one year. The CPI is 1.60 at the time the loan is made, and they both expect it to be 1.68 in one year. If Tamika and Juan agree that Tamika should earn a 3 percent real return for the year, the nominal interest rate on this loan should be percent.arrow_forwardWhat is the difference between nominal and real variables? Give two examples of each.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education