FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

16. The chief accountant for Grandview Corporation provides you with the company’s 2021 statement of

| GRANDVIEW CORPORATION Statement of Cash Flows For the Year Ended December 31, 2021 |

|||||||

| Cash Flows from Operating Activities: | |||||||

| Collections from customers | $ | 134 | |||||

| Payment to suppliers | (44 | ) | |||||

| Payment of general & administrative expenses | (34 | ) | |||||

| Payment of income taxes | (25 | ) | |||||

| Net cash flows from operating activities | $ | 31 | |||||

| Cash Flows from Investing Activities: | |||||||

| Sale of investments | 81 | ||||||

| Cash Flows from Financing Activities: | |||||||

| Issuance of common stock | 15 | ||||||

| Payment of dividends | (6 | ) | |||||

| Net cash flows from financing activities | 9 | ||||||

| Net increase in cash | $ | 121 | |||||

| GRANDVIEW CORPORATION Income Statement For the Year Ended December 31, 2021 |

||||||

| Sales revenue | $ | 144 | ||||

| Cost of goods sold | 48 | |||||

| Gross profit | 96 | |||||

| Operating expenses: | ||||||

| General and administrative expense | $ | 34 | ||||

| 26 | ||||||

| Total operating expenses | 60 | |||||

| Operating income | 36 | |||||

| Other income: | ||||||

| Gain on sale of investments | 20 | |||||

| Income before income taxes | 56 | |||||

| Income tax expense | 13 | |||||

| Net income | $ | 43 | ||||

Required:

1. Calculate the missing amounts.

2. Prepare the operating activities section of Grandview’s 2021 statement of cash flows using the indirect method.

Transcribed Image Text:Prepare the operating activities section of Grandview's 2021 statement of cash flows using the indirect method. (Amounts to

be deducted should be indicated with a minus sign. Enter your answers in millions (i.e., 10,000,000 should be entered as

10).)

GRANDVIEW CORPORATION

Statement of Cash Flows

For the Year Ended December 31, 2021

($ in millions)

Cash flows from operating activities:

Adjustments for noncash effects:

Changes in operating assets and liabilities:

Net cash flows from operating activities

< Required 1

Required 2

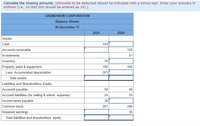

Transcribed Image Text:Calculate the missing amounts. (Amounts to be deducted should be indicated with a minus sign. Enter your answers in

millions (i.e., 10,000,000 should be entered as 10).)

GRANDVIEW CORPORATION

Balance Sheets

At December 31

2021

2020

Assets:

Cash

194

Accounts receivable

100

Investments

61

Inventory

76

Property, plant & equipment

166

166

Less: Accumulated depreciation

(97)

Total assets

Liabilities and Shareholders' Equity:

Accounts payable

Accrued liabilities (for selling & admin. expense)

Income taxes payable

Common stock

58

46

25

25

38

261

246

Retained earnings

30

Total liabilities and shareholders' equity

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- ssarrow_forwardGrier & Associates maintains its records on the cash basis. You have been engaged to convert its cash basis income statement to the accrual basis. The cash basis income statement, along with additional information, follows: Grier & Associates Income Statement (Cash Basis) For the Year Ended December 31, 2025 Cash receipts from customers $425,000 Cash payments: Salaries and wages $170,000 Income taxes 65,000 Insurance 40,000 Interest…arrow_forwardhe chief accountant for Julius Company provides you with the company's most recent income statement and comparative balance sheets below. The accountant has asked for your help in preparing part of the company's 2024 statement of cash flows. 2024 Income Statement ($ in thousands) Sales revenue $ 5,000 Depreciation expense $ 280 Selling & administrative expense 3,720 4,000 Income before taxes 1,000 Income tax expense 300 Net income $ 700 Balance Sheet (all $ in thousands) 12/31/2024 12/31/2023 Cash $ 800 $ 750 Accounts receivable 450 365 Property, plant & equipment 1,900 1,450 Less: Accumulated depreciation (800) (520) $ 2,350 $ 2,045 Accrued liabilities for selling & administration expense $ 300 $ 325 Income taxes payable 180 130 Common stock 700 700 Retained earnings 1,170 890 $ 2,350 $ 2,045 Required: Determine the cash flow from operating activities for Julius Company, using the direct method. Note: Enter…arrow_forward

- Your examination of the records of a company that follows the cash basis of accounting tells you that the company’s reported cash-basis earnings in 2022 are $37,007. If this firm had followed accrual-basis accounting practices, it would have reported the following year-end balances. 2022 2021 Accounts receivable $3,740 $3,080 Supplies on hand 1,430 1,603 Unpaid wages owed 2,200 2,640 Other unpaid expenses 1,540 1,210 Determine the company’s net earnings on an accrual basis for 2022. Net earnings on an accrual basis for 2022arrow_forwardRequired information [The following information applies to the questions displayed below.] Portions of the financial statements for Parnell Company are provided below. For the Revenues and gains: Sales Cost of goods sold Gain on sale of building Expenses and loss: Salaries Insurance Depreciation PARNELL COMPANY Income Statement Income tax expense Year Ended December 31, 2021 ($ in thousands) Interest expense Loss on sale of equipment Income before tax Net income $ 820 10 $310 122 42 125 52 13 $830 664 166 83 $ 83arrow_forwardi did most part, not sure if its correct. how do i find the cash at the begining of the year? i got $ -5500 as net decraese in casharrow_forward

- Audio City, Incorporated, is developing its annual financial statements at December 31. The statements are complete except for the statement of cash flows. The completed comparative balance sheets and income statement are summarized below: Balance Sheet at December 31 Cash Accounts Receivable Inventory Equipment Accumulated Depreciation-Equipment Total Assets Accounts Payable Salaries and Wages Payable Notes Payable (long-term) Common Stock Retained Earnings Total Liabilities and Stockholders' Equity Income Statement Sales Revenue Cost of Goods Sold Other Expenses Net Income Additional Data: a. Bought equipment for cash, $67,000. b. Paid $12,000 on the long-term notes payable. c. Issued new shares of stock for $24,000 cash. Current Year $ 45,100 12,600 18,400 211,000 (51,000) $ 236,100 JA OPOFF00 $ 7,400 2,100 57,000 88,000 81,600 $ 236,100 $ 182,000 84,000 51,000 $ 47,000 Previous Year $ 51,800 17,000 17,000 144,000 (39,000) $ 190,800 $ 17,800 1,000 69,000 64,000 39,000 $ 190,800 d.…arrow_forwardSelected Information taken from the financial statements of Verbeke Co. for the year ended December 31, 2019, follows: Gross profit General and administrative expenses Net cash used by investing activities Dividends paid Interest expense Net sales Advertising expense Accounts payable Income tax expense Other selling expenses $414,000 83,000 105,000 50,000 63,000 745,000 75,000 103,000 81,000 41,000 Required: a. Calculate Income from operations (operating Income) for the year ended December 31, 2019. Income from operations Net income b. Calculate net income for the year ended December 31, 2019.arrow_forwardP4-4A. Preparing the Financial Statements Listed below are items reported on the financial statements of the Huntington Company as of June 30: Prepare a classified balance sheet as of June 30 and statement of cash fows for the current year.arrow_forward

- During Year 1, Chung Corporation earned $4,800 of cash revenue and accrued $2,500 of salaries expense. Required Based on this information alone: a. Prepare the December 31, Year 1, balance sheet. b. Determine the amount of net income that Chung would report on the Year 1 income statement. c. Determine the amount of net cash flow from operating activities that Chung would report on the Year 1 statement of cash flows. Complete this question by entering your answers in the tabs below. Accounting Equation Based on this information alone: (Not all cells require input. Enter any decreases to account balances with a minus sign.) CHUNG CORPORATION Accounting Equation - Year 1 Assets = Liabilities + Salaries Payable Cash Event Earned revenue Accrued salaries Ending balance Req A Req B and C = = 0 = 0 + + + Stockholders' Equity Retained Earnings Common Stock + + + 0 + 0arrow_forwardThe following is selected information from L corporation for the fiscal year ending October 21, 2022: Cash received from customers Revenue recognized Cash paid for expenses Cash paid for computers on Nov. 1, 2021 that will be used for 3 years Expenses incurred including any depreciation Proceeds from a bank loan, part of which was used to pay for the computers O $224,000 $254,000 Based on the accrual basis of accounting, what is L corporation's net in some for the year ending October 31, 2022? $208,000 $300,000 440,000 170,000 $270,000 48,000 216,000 100,000arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education